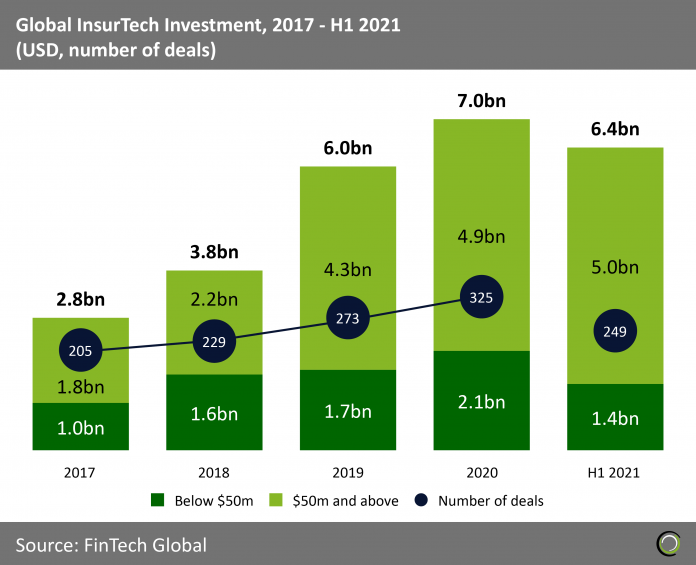

Funding in 2021 is on pace for a new record driven by large deals over $50m

- Global InsurTech investment between 2017 and 2020 increased at a CAGR of 35.7%. The strong growth trend is set to continue in 2021 as companies in the sector raised $6.4bn across 249 transactions. Assuming H2 continues the trajectory deal activity and funding will have increased in each year since 2017, displaying a healthy growth in the InsurTech sector.

- InsurTech investment saw a $2.2bn jump in total funding from 2018 to 2019, the largest in the five-year span. Even prior Covid-19’s impact on digital adoption, investors were keeping a close eye on the disruption of InsurTech companies in the traditional insurance space. InsurTech firms have streamlined the insurance process, using modern technology that is easily understandable for millennials, and are taking advantage of big data to better manage claims, even using unstructured data such as audio and video to assist in the process.

- Average funding per deal has increased at a CAGR of 19.7% from year to year from 2017 to 2021. This increase can be attributed to the increased deal activity among deals over $50m. Funding coming from deals in this size bracket already hit $5bn this year surpassing the total recorded in the whole of last year.

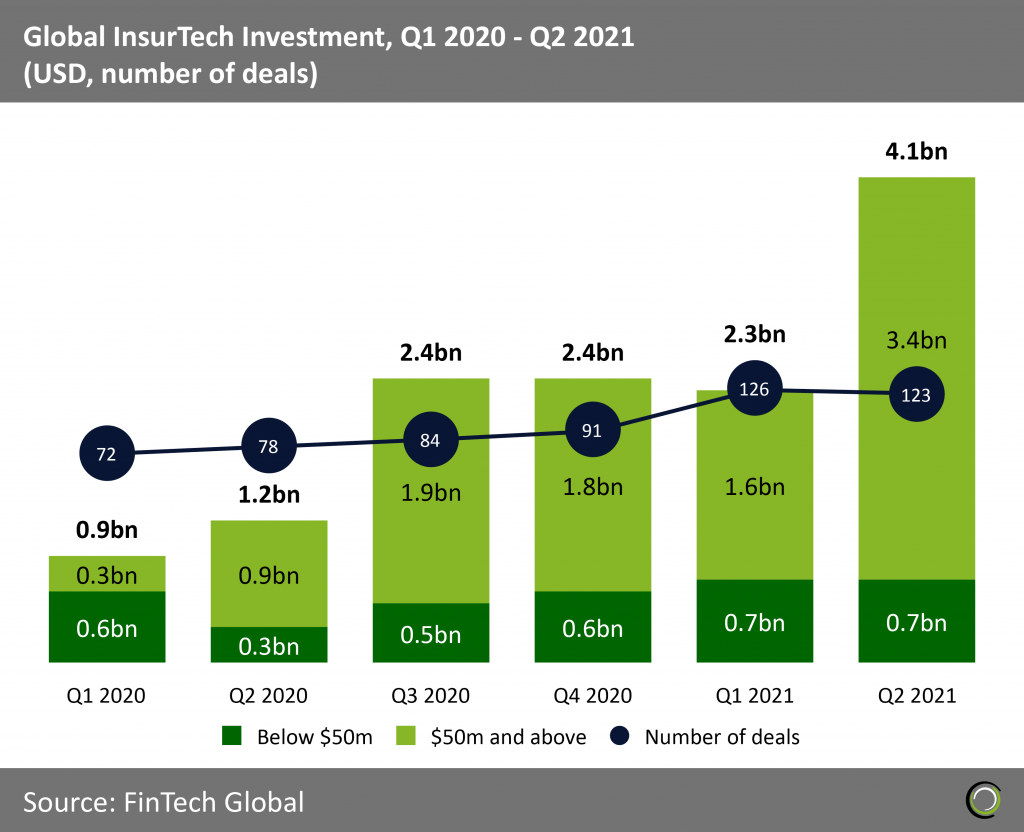

InsurTech funding in Q2 surged by 78% compared to the opening quarter of 2021 to set a new record

- The funding of $4.1bn recorded in Q2 was the largest over the past six quarters, mainly driven by $3.4bn invested capital in deals $50m and above. As Covid-19 forced businesses to become more reliant on technology to perform normal operations, the market and future prospects for InsurTech companies has grown.

- Given the current state of the market, KPMG insights quotes that “Carriers are emboldened to move well beyond pilots, proofs of concept and small-scale rollouts. Now, their intent is to move these innovations into the mainstream of their business — they want to ‘go big,’ fast.†Hence, investors have been drawn towards funding larger InsurTech deals, as evidenced by average funding per deal jumping from $18.3m in Q1 2021 to $33.3m in Q2 2021. InsurTech companies see the accelerated digital transformation facilitated by Covid-19 as a prime opportunity to sway investors more towards larger deals, as the current market becomes more conducive to big InsurTech carriers.

- Deal activity has increased by 26% from Q1 2020 to Q4 2020, followed by a drastic increase from 91 to 126 deals which reflects on the economy’s strong overall recovery during the first quarter of this year. Additionally, the impact of technology has become clearer in 2020, increasing prospects for InsurTech and FinTech companies in general leading to more capital being invested overall.

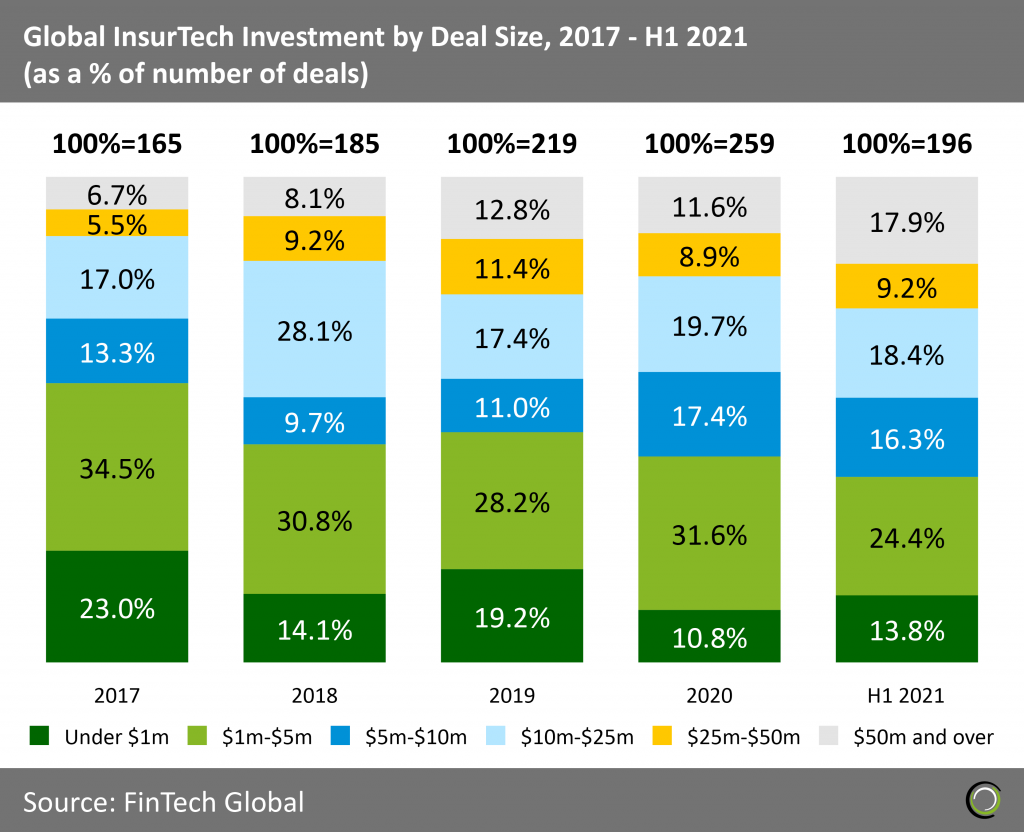

Share of deals $50m and above up by 6.3pp in H1 2021 as companies raise large rounds to capitalise on post Covid opportunities

- H1 2021 has the largest share of deals $50m and above over the past five years with 17.9%. As alluded to earlier, the current landscape of InsurTech is positioned in favor of mature companies wanting to become premier insurance or B2B firms. Many of these firms were likely funded back in 2017 and 2019 when the share of deal activity under $1m was 23% and 19.2%, respectively. Covid-19 has accelerated companies among all industries into the technological age, even including insurance which has always been viewed as an archaic industry. Companies seeking investment recognize this opportunity and are taking full advantage of readily available late-stage funding to do so.

- The share of deals under $5m reached a five-year low in H1 2021, totaling 38.2%. As the economy recovers from the pandemic and gears towards more permanent technology solutions to incorporate into their practices, larger deals from late-stage companies are getting more attention. Many different areas within insurance were reshaped by Covid-19, allowing InsurTech companies to take full advantage of the opportunity to market themselves.

- Covid-19 completely altered the auto insurance sector, as lockdowns significantly reduced the number of drivers on the road, thus drastically diminishing the need for premium auto insurance policies. Several InsurTech companies, such as Clearcover, recognized this trend and began to promote modern policies that were more catered to one’s personal driving habits, offering lower rates in the process. As stay-at-home mandates prolonged, the demand for these services rose.

- The health insurance component of InsurTech will also evolve in a post-pandemic world. The demand Covid-19 related services such as testing and possibly vaccine booster shots could become a deciding factor when one is choosing their insurance policy. Furthermore, prospective customers who had contracted the virus may face challenges getting coverage at all, if not for an extremely high sum. Modern InsurTech companies like Alan, a digital health insurance provider focusing on providing a seamless user experience coupled with value priced plans, will have to take these difficulties into account in order to provide optimal customer experience.

- Additionally, the shift towards remote work and reliance on the security of company databases also fueled demand for cyber insurance. Companies such as Coalition have solidified themselves in the market as top-quality providers of cyber protection amidst a world heavily rooted in online practices.

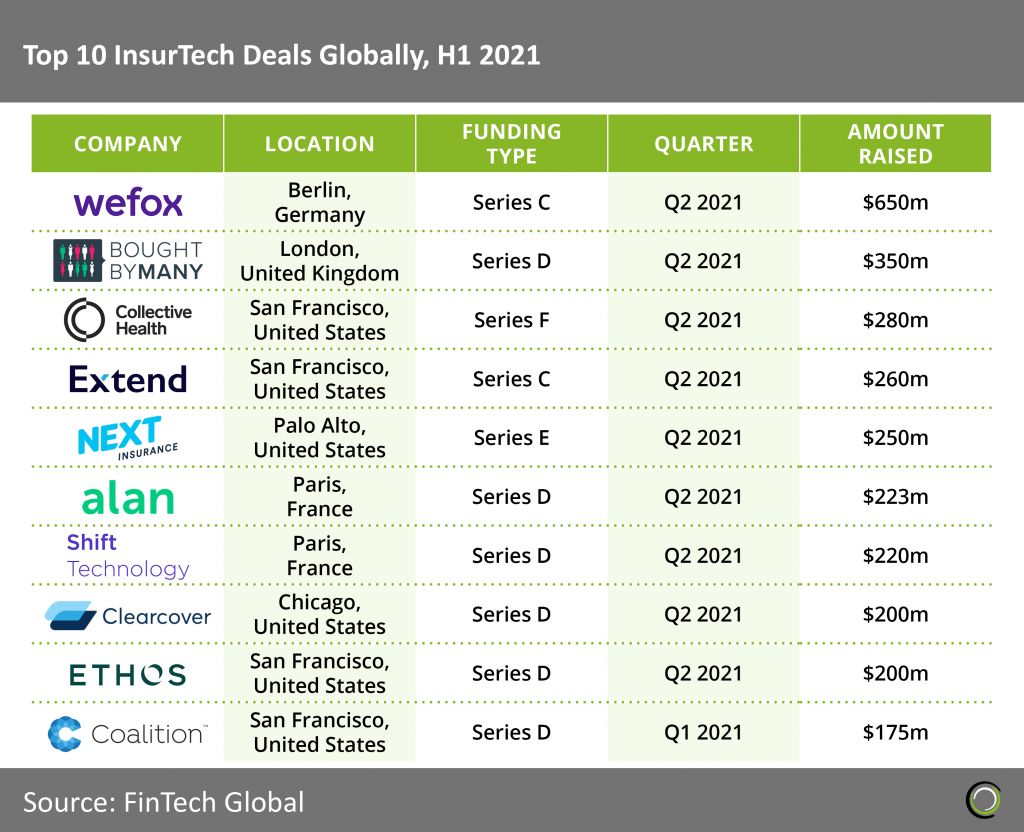

Nine out of the top ten deals in H1 2021 took place in the second quarter

- Transactions completed in Q2 2021 made up nine of the top ten largest deals so far this year, totaling $2.8bn in funding. This sizeable jump in funding is likely a result of Covid-19’s effect on accelerating digital adoption, especially as it pertains to InsurTech. As businesses began adopting technology based InsurTechs as an alternative to traditional carriers early on in the pandemic, these InsurTech companies are demanding more capital through later funding rounds in order to continue expansion and launch new product offerings.

- All ten deals listed obtained their funding through venture rounds, six of which being through series D. The shift towards heavily incorporating technology into regular business operations coupled with the rise in demand for such InsurTech companies’ services presents an opportunity for InsurTech companies to raise more funding late in the process prior to an IPO or SPAC arrangement. Shift Technologies has already gone public in June since its $220m funding round while Bought By Many CEO Steven Mendel said that an IPO could come in the future.

- The top ten InsurTech deals in H1 2021 all came from companies based either in North America or Europe, performing 116 and 68 deals in this time period, respectively. London, San Francisco, and New York were the top three cities globally by deal activity, attracting 21, 19, and 18 deals, respectively. London and San Francisco, specifically, contained five of the ten largest deals in H1 2021, each by a different company. The two cities are world leaders in the FinTech space as a whole, and their InsurTech record also follows suit.

- Wefox, a digital InsurTech start-up offering personal insurance products, raised $650m as H1 2021’s top deal performed. The Berlin based company’s post money valuation current sits at $3bn, thus classifying it as unicorn. The company intends to use the funding to further increase its scale and generate more revenue.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global