A total of $710m was raised across the 25 FinTech funding rounds this week, with just two deals accounting to $498m of this.

This was a big week for small deals. The ten biggest deals raised a collective $670.9m and the remaining 15 saw just $39.15m raised. The total funding this week reached $710m.

The two biggest deals of the week were India-based PayTech giant PhonePe and UK-based LendInvest, which aims to simplify the mortgage process.

PhonePe secured $350m in its funding round, which is part of a larger funding round that could secure an additional $650m. The investment more than doubled PhonePe’s valuation, putting it at $12bn.

This sharp rise in valuation comes against the general trend in the market. Last year, BNPL giant Klarna suffered an 85% dip in its valuation after it secured an $800m investment. The valuation went from its peak of $45.6bn to $6.7bn.

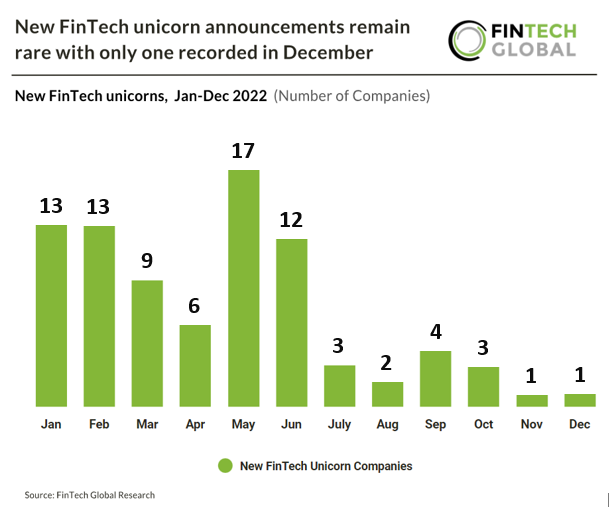

FinTech Global released a piece of research last week that showed the FinTech market is not seeing as many new unicorns. In December, there was just one new FinTech unicorn. Between July and December, there were just 14 companies to earn the unicorn status, which is a huge drop from the first six months where 70.

PhonePe was not the only big FinTech story to come from India this week. Chinese e-commerce giant Alibaba has reportedly sold half of its position in India-based payments company Paytm. Alibaba sold its 3.1% stake in Paytm for $125m, splitting its 6.26% stake in half.

Following this sale, Morgan Stanley Asia was reported to have acquired 5.4 million shares in Paytm at $6.55 apiece.

The second biggest funding round of this week was secured by LendInvest. The FinTech company received £120m ($148m) in additional funding from Lloyds Bank, which has now committed a total of £300m into LendInvest.

It was quite a globally diverse week for funding rounds. Of the top ten, just the USA was the homebase for more than one company. These were CyberTech platform SpiderOak, RegTech startup Seek AI and InsurTech company Liberate Innovations.

Other countries represented in the top ten deals were UAE (Tabby), Sweden (Anyfin), PeopleFund (South Korea), Israel (nsKnox) and Singapore (BlackPanda).

As for the verticals, marketplace lending took the top spot, with three of the ten biggest deals. This was followed by PayTech, RegTech and CyberTech, which each recorded two deals. The other vertical represented in the top ten was InsurTech.

Moving away from funding shortly, it is important to note tehre were major developments in the cryptocurrency space this week. Genesis Global Holdco (GGH), the parent company of struggling crypto brokerage Genesis, has filed for bankruptcy protection. This move was taken as part of a strategic action to help maximise value for all clients and stakeholders, as well strengthen the business for the future.

This announcement came just days after it was reported Genesis owes $3bn to creditors. To tackle this, DCG is looking to sell assets in its venture portfolio to raise money. Genesis has also recently cut 40% of its workforce and shut its wealth management business to reduce costs.

Adding even more to the bad news, the US Securities and Exchange Commission charged Generis, as well as crypto exchange Gemini, for the unregistered offer and sale of securities to retail investors through the Gemini Earn crypto asset lending program. The SEC claims this unregistered offering enabled the duo to raise billions of dollars’ worth of crypto assets from hundreds of thousands of investors.

Late last year, Genesis secured $140m in equity from Digital Currency Group to help support its balance sheet. This came as a reaction to the fall of FTX, which filed for bankruptcy protection. Genesis stated its derivatives business had $175m locked in a trading account of FTX.

FTX sent shockwaves across the industry when it filed for bankruptcy protection. The founder Sam Bankman-Fried is currently being charged for fraud. Last week, Bankman-Fried pleaded not guilty to the charges. He faces eight criminal counts, including wire fraud and money laundering conspiracy.

Without further ado, here are this week’s 25 FinTech deals.

Digital payments app PhonePe joins FinTech decacorn club

Digital payments app PhonePe becomes a decacorn following the closing of a $350m funding round, which doubles its valuation to $12bn.

The PayTech company has not finished there, with plans to raise another $650m as part of the round, according to a report from TechCrunch. General Atlantic served as the lead investor to the round.

It is not clear who else invested in the round, but PhonePe majority investor Walmart is expected to join the round.

With the equity injection, PhonePe hopes to make investments into infrastructure, including the development of data centres and to build more financial services. Capital will also be used to enter new business verticals, including insurance, wealth management and lending.

PhonePe was founded in 2015 and was acquired by e-commerce firm Flipkart. PhonePe split from Flipkart at the end of 2022, with Flipkart not planning on re-entering the payments market.

PhonePe has established itself as a single app for all things finance. Through the platform, users can pay bills, send money, buy gold, invest and shop at online stores, as well as order food, book flights and purchase groceries. Users can also choose to pay from options like UPI, the PhonePe wallet or debit and credit cards.

LendInvest secures Lloyds Bank backing

LendInvest, a homeowner mortgage firm, has secured further backing from banking giant Lloyds Bank totalling £300m.

According to Business Cloud, LendInvest is a technology-driven asset manager for UK property finance which aims to simplify the mortgage experience.

LendInvest has increased its total funds under management to more than £3.6 billion, up from £3.4bn last year.

The company’s homeowner mortgage product – which beta launched in December 2022 to a select group of mortgage brokers – is anticipated to launch more widely in 2023.

The offering is aimed at borrowers with multiple sources of income, the self-employed and small-business owners.

In 2022, LendInvest struck a new £180m lending partnership with Lloyds and increased an existing deal with JP Morgan to £1bn.

The company also secured a partnership with banking giants HSBC and Barclays that will funnel £150m into the UK property space.

MENA BNPL services provider Tabby closes Series C on $58m

Tabby, a BNPL services company based in the MENA region, has closed its Series C round on $58m, which brings its valuation to $660m.

This new valuation puts Tabby’s as one of the most valuable startups in MENA and the first GCC to receive funding from PayPal Ventures.

Commitments to the Series C came from Sequoia Capital India, STV, PayPal Ventures, Mubadala Investment Capital, Arbor Ventures and Endeavor Catalyst.

This capital injection will allow Tabby to expand its product line with next-gen consumer financial services.

Tabby works with over 10,000 brands, including nine out of the ten largest retail groups in MENA.

The company offers BNPL services that allows consumers to pay for products over four interest-free payments.

Anyfin secures €30m ($32m) to help people refinance existing loans

Anyfin, which helps consumers refinance existing loans, has raised €30m for its Series C funding round.

The investment was led by existing investor Northzone, with commitments also coming from Accel, EQT Ventures, FinTech Collective, Quadrille Capital and Augmentum FinTech. Citi Ventures also joined the round, making its first investment into Anyfin.

With the funds, Anyfin plans to bolster its growth across Europe. As part of this, it plans to bolster its product suite in existing markets across Europe, build new technology and more.

Anyfin aims to help people improve their finances. Its platform simplifies the process of refinancing debt, ensuring users get fair interest rates on their existing credit. Clients can refinance existing instalments, credit cards and personal loans within seconds.

The company operates in Sweden, Norway, Finland and Germany. Since launching in Germany in 2021, it has experienced a 15% average monthly growth rate and fivefold growth in 2022.

Overall, its mobile app has been downloaded more than one million times, with over 500,000 downloads in 2022.

South Korean P2P lending platform PeopleFund scores extra $20m

PeopleFund, a South Korean P2P lending platform that connects borrowers and investors to facilitate lending, has added $20m to its $63.4m Series C fund.

According to a report from TechCrunch, Bain Capital led the extension, with participation from previous investors such as Access Ventures, CLSA Capital Partners Lending Ark Asia, D3 Jubilee Partners, 500 Global, Kakao Investment, TBT Partners and IBX Partners.

PeopleFund was founded by proven and successful serial entrepreneurs and is supplemented by an experienced support team.

The startup said it has a passion for taking great business visions at any stage and growing them into larger and more profitable enterprises. Since its founding, PeopleFund and its affiliated businesses have impacted a wide array of charitable, social impact and nonprofit organisations in communities around the world by contributing time, expertise and resources.

The additional capital brings the total raised by PeopleFund to around $100m in equity.

The P2P lending platform also secured $240m in debt financing in 2022 from Goldman Sachs, CLSA Lending Ark Asia and Bain Capital.

PeopleFund will reportedly use the funding to continue to advance its AI-powered risk management and credit scoring system for its users, which included borrowers and lenders.

The startup is also planning to launch a B2B service this year to provide AI-enabled customised credit scoring services to financial institutions.

nsKnow nets $17m for its bank account verification services

nsKnox, which offers bank account verification and B2B payment security, has scored $17m in its latest batch of funding.

First time nsKnox backers Link Ventures and Harel Insurance & Finance took a significant part in the round. Existing nsKnox investors M12, Viola Ventures, and Alon Cohen, nsKnox’s founder and CEO, also joined the round.

The equity injection has been earmarked to scale nsKnox’s go-to-market infrastructure and to expand its product suite to corporations and banks.

nsKnox’s solutions detect and prevent finance and ops infrastructure attacks, social engineering, business email compromise (BEC), insider fraud, and other Advanced Persistent Fraud attacks.

Its technology verifies the authenticity of bank account details and ownership. The account is then provided with a Bank Account Certificate, which is then verified across the entire nsKnox portal for any paying entity.

One of nsKnox’s core products is PaymentKnox Payment Security Platform. This helps organisations avoid significant financial losses, heavy fines and reputational damage by validating accounts anywhere on the globe. It verifies the identities of the sender and receiver to prevent manipulations of the transaction.

Cybersecurity solution provider SpiderOak snares $16.4m

Cybersecurity solution provider SpiderOak has collected $16.4m in its Series C funding round.

The investment was led by Empyrean Technology Solutions, a space technology platform backed by funds affiliated with private equity firm Madison Dearborn Partners. Method Capital and OCA Ventures also contributed capital to the Series C round.

Funds will enable the company to complete on-orbit testing and achieve flight heritage of OrbitSecure 2.0. The capital will also allow SpiderOak to establish its headquarters in Reston, Virginia and hire more for its Mission Systems’ program and engineering teams. Additionally.

Plans do not end there. The cybersecurity solution provider is also looking to build a space cybersecurity laboratory for hardware in the loop qualification testing for OrbitSecure and custom mission partner solutions.

SpiderOak’s flagship solution OrbitSecure leverages a decentralised key management system to allow for full availability and continued operations in space despite disconnected or highly contested networks.

This empowers decentralised space resiliency to multi-vendor, multi-network, mesh proliferated low-Earth orbit (LEO) networks by significantly reducing the attack surface and the ability of adversaries to jam, disrupt, modify, or contest space communications and satellite services.

The CyberTech company, which offers services to civil, military and commercial firms, boasts HIPAA compliance. It supports certain customers that are subject to the regulation. Its CrossClave tool allows them to share files and collaborate in real-time, whilst maintaining compliance.

Singapore-based cybersecurity startup Blackpanda nets $15m

Singapore-based cybersecurity company Blackpanda has raised $15m for its Series A, which was co-led by Primavera Venture Partners and Gaw Capital Partners.

With the capital, Blackpanda plans to expand its technology-enabled cybersecurity services, including digital forensics and incident response. The CyberTech will also continue the development of its AI and machine learning cybersecurity InsurTech platform.

Finally, Blackpanda is looking to deepen its presence in Asia. It currently has offices in Singapore, Hong Kong, Tokyo, Manila, and San Francisco.

WI Harper, a San Francisco-based venture capital firm, also joined the round.

The CyberTech offers a digital forensics and cyber incident response service. It will help identify, prioritise and contain attacks so companies can minimise damage and respond more effectively to future incidents.

Its features include cyber incident response, compromise assessment, loss adjusting and investigations, digital forensics, and incident response preparation.

Seek AI scores $7.5m in pre-seed and seed funding

Seek AI, a company seeking to automate critical processes and workflows so data stakeholders can get data fast, has landed $7.5m in funding.

The round was led by Conviction and Battery Ventures and saw participation from former Snowflake CEO Bob Muglia, co-founder of DeepMind Mustafa Suleyman and founder and CEO of dbt Labs Tristan Handy.

According to Seek AI, the funding came at a critical juncture in Seek AI’s growth as it continue to gain traction within the generative AI space, and work with more than a dozen pilots across industries ranging from startups to the Fortune 100.

Seek claims it is that also making data accessible to non-technical, business-facing roles. In doing so, the firm said it is unlocking billions of dollars of previously inaccessible ROI for our customers.

Liberate kickstarts launch of P&C platform with $7m raise

Liberate Innovations, software-as-a-service (SaaS) platform that enables P&C insurers to fully automate claims and underwriting journeys, has raised $7m in funding and launched its platform

The seed round was led by Eclipse.

The platform aims to empowers insurers to deliver digital self-serve experiences and orchestrate an ecosystem of solutions providers and core systems to automate complex business processes. Liberate said this leads to significant reductions in costs and an unmatched experience for both customers and employees.

Liberate’s end-to-end platform provides insurers a one-stop shop for building user-friendly front-end experiences for their end customers and seamlessly stitching together core systems and insurance solution vendors to automate complex business processes.

Through the use of low-code tools and pre-built templates, Liberate said claims handlers and underwriters can streamline and accelerate deployment of digital experience and process workflows, resulting in up to 30% reduction in processing costs.

The launch of Liberate’s platform comes at a time when the P&C industry is facing significant financial and talent challenges.

Liberate said that a downward pressure on rates, a rise in frequency and severity of claims, and a shortage of skilled claims adjusters and underwriters is directly impacting profitability and business operations. At the same time, customers are demanding a digital experience on par with human interaction.

accSenSe raises $5m seed to boost identity verification on Okta

accSenSe, which claims to be the first and only enterprise-ready business continuity platform for Okta, has raised $5m for its seed round.

Okta is an identity and access management company. It offers cloud software that helps companies manage and secure user authentication into applications and enables developers to build identity controls into applications.

The seed round was led by Joule Ventures, a US-based partner-only seed fund. Other commitments came from Gefen Capital, Fusion and independent investors.

accSenSe will spend the funds on expanding to other IAM vendors and accelerating its expansion and hiring efforts.

Founded in 2020 by Dell EMC veterans, accSenSe aims to combat the challenges of human error and insider threats that plague IAM systems. Its platform allows organisations to maintain secure access to critical SaaS applications following any cyberattack or misconfiguration.

Features include one-click full tenant recovery, fail-over access to a secondary tenant, identify and investigate changes between different PiTs, low RTO and RPO and more.

Union Credit lands $5m seed after stealth period

Union Credit, a marketplace for credit unions to deliver perpetual credit approval and one-click loan activation, has arisen from stealth with $5m in seed funding.

The round was led by CMFG Ventures, and supported by Marin Sonoma Impact Ventures (MSIV), Array and other strategic fintech influencers.

Union Credit provides credit unions with new, credit-worthy members from outside their ecosystem by aggregating consumer data, and matching it with credit union field of membership, product, decisioning and underwriting details.

For the 250 credit unions already using the CuneXus platform, these lenders will have the ability to easily opt-in to the firm’s marketplace, via an existing integration with CuneXus. Once the match is made, the consumer is in charge of the relationship and their data. If they choose to move forward with an offer, it only takes one-click to engage.

The company will use this investment to focus on building out its digital lending marketplace, SDK, and a direct-to-consumer app where consumers can manage perpetual offers of credit from local lenders that want to serve them.

Spend management startup Alaan bags $4.5m

Alaan, a spend management platform for MENA businesses, has reportedly collected $4.5m in its pre-Series A funding round.

Commitments to the round came from Presight Capital, Y Combinator and other unnamed angel investors, according to a report from Waya.

With the funds, the spend management startup hopes to expand across the GCC, as well as other international markets. Capital will also enable Alaan to enhance its product with new features, including automated invoice payments to domestic and international suppliers.

Founded in 2022 in the UAE, Alaan aims to help clients take control of their business spend. Its services include corporate cards, expense management, accounting automation, invoice payments and real-time insights and more.

Clients can issue unlimited corporate cards for their team. These cards are multi-currency and can either be physical or digital. The cards can be used for e-commerce, digital ads, SaaS subscriptions, government payments, fuel and more.

Tailored spend controls can be placed on each card and team members can easily submit receipts digitally via the web or mobile. These receipts are then auto-verified and available online for review by finance.

InsurTech iLife Technologies lands $4m for insurance agents

InsurTech iLife Technologies, a software platform that gives insurance agents and brokers the ability to create digital insurance agencies, has raised $4m.

According to a report from the Los Angeles Business Journal, the seed funding round was led by Foundation Capital, the Palo Alto-based venture capital firm that was an original investor in Netflix Inc.

The round also saw participation from Taipei, Taiwan-based Cherubic Ventures and AME Cloud Ventures, a Palo Alto-based firm founded by tech investor Jerry Yang, who founded and ran Yahoo until his departure in 2012.

iLife was founded with the mission to give life insurance agents the “greatest sales tool possible”. The company believes that a life insurance business is best served by a tool that allows everything to be in one place.

Since its founding in 2019, iLife has raised a total of $5m in venture capital.

The InsurTech said its software is designed to solve pain points in the life insurance sales process. Namely, helping prospects find suitable policies, streamlining communication and identifying strong qualified leads.

iLife operates “behind the scenes”; consumers don’t do directly to iLife’s website to obtain a quote for life insurance, rather, they use a broker or agent’s website that is powered by iLife to get a quote is as little as seven seconds.

Obligate nets $4m for its blockchain-based regulated debt securities marketplace

Obligate, which offers blockchain-based regulated debt securities, has reportedly raised $4m in a seed extension.

The round was backed by Blockchange Ventures and Circle Ventures, according to a report from CoinDesk. They joined existing seed investors Earlybird and SIX Fintech Ventures.

This extension brings the seed round total to $8.5m.

Based in Switzerland, Obligate offers blockchain-based bonds for regulated debt securities. It boasts a marketplace that allows investors to easily find open issuance programs and investment opportunities.

Angle Health bags $4m for tech-enabled health insurance plans

Angle Health, a Y Combinator-backed health insurance carrier, has raised $4m in seed funding to launch its tech-enabled health insurance plans for startups.

The round was led by Blumberg Capital with participation from Y Combinator, Correlation Ventures, TSVC, Liquid 2 Ventures and several smaller funds and angels.

Founded in 2019, Angle Health is launching comprehensive health insurance plans designed to help startups save on benefits costs by providing options that are easy to understand, affordable and deliver more relevant coverage to employees.

By combining research-backed digital and behavioural health programs with an integrated data infrastructure and machine-learning, Angle Health said it is able to provide a “first-class member experience”, reduce administrative overhead, and leverage data-driven insights to incentivise healthier lifestyles.

The funding will be used to complete Angle Health’s regulatory filing, launch its mobile application and integrate infrastructure to support greater accessibility to medical services, including primary and urgent care, mental health, chronic disease management and reproductive health.

zavvie bags $3.65m to support real estate brokerages

zavvie, a software technology company providing real estate brokerages customised marketplaces for buying and selling solutions, has raised $3.65m in funding.

The round was led by existing investors, including Second Century Ventures, the startup incubator backed by the National Association of Realtors.

The funds include $1.5m in cash and $2.15m in convertibles.

zavvie also announced that Tyler Thompson, Managing Partner at Second Century Ventures, is joining its board of directors. Thompson brings more than 15 years of strategic, startup and operational experience to the zavvie Board.

Lane Hornung, zavvie CEO and co-founder, said, “At zavvie, we believe 2023 will be a breakout year for Power Buying because cash offers will particularly help first-time buyers. Also poised for explosive growth are two more categories: Listing Concierge or presale renovations, which help consumers sell their homes faster and at a higher sales price, and Homeownership Accelerators.

“Most renters still want to buy a home, and with a Homeownership Accelerator program, they can rent their starter home today and own it tomorrow.”

Hornung also noted that the massive shift in buyer and seller behaviours in 2022 benefited zavvie’s business momentum and growth. zavvie increased its total number of brokerage-assisted transactions by more than 400 percent over 2021 transactions, and grew its revenue by more than three times, year-over-year.

Hornung also notes that the recent launch of zavvie 2.0 software with its updated dashboard is helping agents streamline assisting their clients, and driving new business because of increased efficiency. He adds, “zavvie 2.0 sets the stage for incredible new software we will launch in 2023.”

Video-first financial literacy firm Beurzbyte lands £2.2m ($2.7m)

Beurzbyte, a company focused on tackling issues around financial education, has scored £2.2m in a funding round.

The London-based company secured £2.2m in pre-seed funding from a range of undisclosed angel investors.

Beurzbyte aims to solve the problem of financial education and access to affordable, reliable, and simple investment tools for retail investors.

Beurzbyte is a mobile app that helps retail investors learn the ins-and-outs of investing and discover investment opportunities through video content.

The company’s platform, Beurzbyte Learn and Beurzbyte Discover, empowers users with reliable and actionable information through creative storytelling. The firm said it believes that investing is about more than just the well-known companies and digital assets and want retail investors to discover opportunities based on their interests.

By providing financial literacy and connecting users with tailored investment opportunities, Beurzbyte aims to support and improve wealth creation globally.

The company’s motto is ‘discover the investor in you’. The firm said it wanted to ensure that not only do investors understand how to value a specific stock, but they also understand how they can develop as an investor and be at one with their own investment style and philosophy.

The funding will be used to develop the Beurzbyte platform and to create in-house content across financial literacy and investment intelligence.

Sustainable investment startup Grünfin scores €2m ($2.1m)

Grünfin, a sustainable investment platform, has reportedly raised €2m in equity to expand its product suite.

The capital injection was led by existing investors Norrsken VC, Specialist VC and Lemonade Stand, according to a report from AIN Capital. Participation also came from other unnamed angel investors. Sie Ventures and HoneyBadger VC also deployed funds.

The equity will enable the FinTech sustainable investment platform to grow its product suite with a new investment plan that helps employers keep their talent by offering sustainable financial independence to employees.

Based in Estonia, Grünfin allows individuals to build an investment portfolio of sustainable companies. The user selects their sustainability focus (climate change, gender equality and health) and their monthly contribution. The platform will then curate a portfolio.

The sustainable investment platform was founded by Karin Nemec, Triin Hertmann and Alvar Lumberg. As parents, Nemec and Hertmann were concerned about the future of the planet and wanted to help change its course.

Developer-first CyberTech Aikido Security scores €2m ($2.1m)

Aikido Security, which prevents security issues before they become threats, has reportedly collected €2m in a pre-seed round.

The investment was backed by several angel investors, according to a report from Tech.au. These include, Syndicate One, Pieterjan Bouten and Louis Jonckheere of Showpad, Christophe Morbee from Besox, Mathias Geeroms of OTA Insight and Teamleader’s Jeroen De Wit.

With the funds, Aikido Security hopes to enhance its features, as well as grow its team size and customer base.

Clients of Aikido get an overview of their security threats in one platform, as well as connect GitHub, GitLab, Bitbucket and AWS cloud.

The developer-first CyberTech software platform scans the client’s source code and cloud to show which vulnerabilities are actually important to solve. It accelerates triaging by reducing false-positives and making SVEs human-readable.

Cerchia nets funds to transform direct risk transfer with investors and reinsurers

Cerchia, which is on a mission to enable direct risk transfer between investors and reinsurers, has secured CHF 1.3m ($1.4m).

The investment was backed by High-Tech Gründerfonds (HTGF) and other unnamed investors.

The fresh funds will allow Cerchia to hire more staff and invest in technical advancements to provide a comprehensive, direct risk transfer experience.

Cerchia claims to have created the world’s first marketplace for direct risk transfer on the Zilliqa Blockchain. Its mission is to support a more resilient world by linking capital markets and digital asset markets.

Based in Switzerland, Cerchia is creating a novel capital markets platform that is efficient, transparent and compliant. This platform allows for direct risk transfer between reinsurers and investors.

It believes this platform will reduce the growing gap of over 1.8trn between insured and uninsured economic risks, according to data from Protection Gap.

The first of Cerchia’s products will be launched in the coming spring. Users will be able to execute if off-chain and on-chain depending on their needs

Australian FinTech Bloom nets seed to support climate impact investing app

Bloom Impact Investing, an Australian FinTech for investing into climate impact, has reportedly secured $525,000 in its seed round.

Euphemia, which is the family office of Up co-founder Dominic Pym, and Envato founders Collis and Cyan Ta’eed led the seed round, according to a report from FinTech Finance News.

With the capital, Bloom hopes to hire a full-time business development resource, improve operations and grow its community.

Bloom co-founder and CEO Camille Socquet-Clerc explained that the idea for Bloom came after wishing to invest in sustainable and climate positive investments, but finding most opportunities restricted to wholesale and institutional investors by buying into individual stocks.

After seeing this, Socquet-Clerc had the idea to build a platform for everyday individuals to invest into these types of companies.

Bloom is a mobile app that allows users to invest into a variety of climate-focused businesses, including solar and wind farms and energy storage. It also opens access to unlisted alternatives, such as green bonds, clean energy loans and infrastructure projects.

This seed round comes alongside Bloom’s latest milestone. It has surpassed $1.6m in funds under management and named FutureSuper founder Adam Verwey as its new executive director.

Verwey will lead Bloom’s community, partnerships and operations, with the aim of helping Bloom help more people have a positive impact on the planet.

India’s personal finance app SayF closes pre-seed

India-based SayF, which offers a personal finance app, has reportedly raised $240,000 in its pre-seed round, which will support its hiring efforts.

Titan Capital, Sunn91 Ventures and other angel investors led the round, according to a report from VCCirle.

With the funds, the company plans to bolster its product development efforts and hire more staff.

Founded in 2021 by Gandhi and Aman Singh, SayF has created a personal finance app that allows users to manage their savings, investing and spending.

The platform enables spending at a variety of online stores, including Amazon and Flipkart, and can earn the user up to 25% in rewards. Another feature of the app is automated savings.

SayF co-founder Aman Singh said, “At SayF, we are building a product made for India & that fits exactly to India’s ethos of saving & investing.”

Credit marketplace Percent collects debt investment

Percent, a modern credit marketplace, has received an investment from Nomura Strategic Ventures’ debt fund.

The size of the investment was not revealed.

As traditional investment lines are taking a hit during the current economic troubles, venture debt is expected to excel. Venture debt in the US totalled $17.1bn for H1 2022, up nearly 10% on the previous years, according to PitchBook Data.

This growth is only expected to continue. Preqin forecasts that the broader private credit market will more than double to $2.69trn by 2026. This will make it the second-largest private capital asset class.

Percent is positioned to meet this growth. It has modernised the industry by bringing public market efficiencies to private debt markets through its technology. By powering the sourcing, structuring, syndication, surveillance, and servicing of private credit transactions from beginning to end, it helps participants work more efficiently and transparently.

Founded in 2019, Percent has closed over 390 deals, to-date, and powered over $1bn in investments on its platform. The historical average APY for investments on Percent’s platform is 12.48%, but it is currently 14.91%.

Full-service 401(k) unicorn Human Interest sparks BlackRock interest

FinTech unicorn Human Interest, which provides a full-service 401(k), has received a minority investment from investment major BlackRock.

By working together, Human Interest hopes to expand access to retirement plans to small and medium-sized businesses across the US.

The size of the minority investment was not disclosed.

BlackRock’s capital injection will allow Human Interest to enhance its technology platform capabilities and mature its operational processes and infrastructure. BlackRock will also provide Human Interest with its experience and expertise.

Approximately 57 million people, nearly half of all employees aged between 18 and 64 in the private sector, do not have access to an employer-provided pension or retirement savings plan, according to the AARP. This lack of access is significantly larger in small and medium businesses that do not offer retirement plans due to high costs, complexity and administrative burdens.

Human Interest is combating this problem by helping companies implement an affordable retirement plan.

It claims to take all the hassle out of managing a 401(k) by syncing all payroll, processing contributions and handling all compliance testing and IRS paperwork. A dashboard also gives the company a 360-degree view of their company plan, including employee participation and contribution reports.

Copyright © 2023 FinTech Global