Swiss FinTech investment stats in Q1 2023:

• Swiss FinTech reported its lowest quarter for deal activity in five years with 20 transactions completed in Q1 2023

• Swiss FinTech funding reached $130m in Q1 2023, a 76% drop YoY

• Blockchain & Crypto was the most active FinTech sector in Q1 2023 with a 60% share of deals

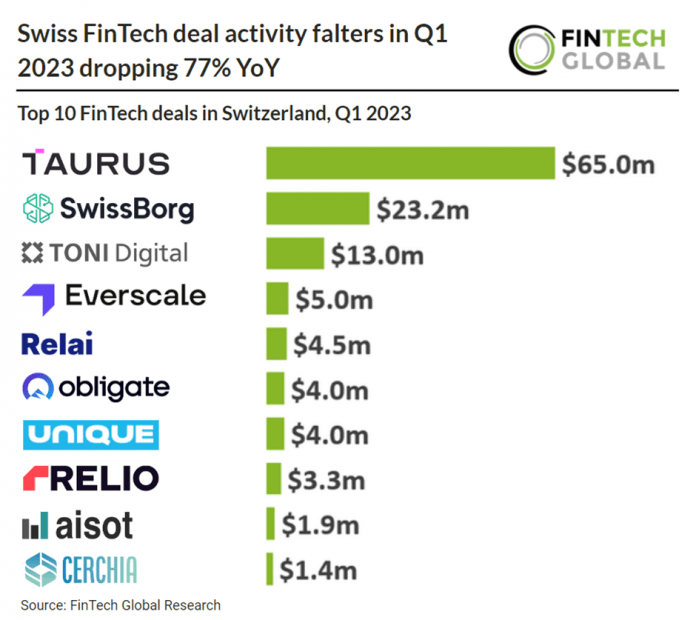

Swiss FinTech saw a worrying drop in deal activity and investment during Q1 2023, considerably lower than 2022 levels. FinTech deal activity in the country reached 20 deals in Q1 2023, a 77% drop from Q1 2022. Swiss FinTech investment also saw a dramatic drop in Q1 2023, reducing 76% to $130m YoY.

Taurus, a digital assets trading and investment platform, was the largest Swiss FinTech deal in Q1 2023, raising $65m in their latest Series B funding round led by Credit Suisse. The funds will be used to support Taurus’ growth strategy across three main priorities: hiring top engineering talent to further develop its platform; expanding its sales and customer success organization with new offices in Europe, UAE, North America, South America and Southeast Asia; and maintaining stringent security, risk and compliance requirements across product lines, processes and organizations. “We are proud to welcome such high-profile investors and benefit from their expertise to further develop one of the richest platforms in the industry, covering any type of digital assets, way beyond cryptocurrencies,” said Lamine Brahimi, co-founder and managing partner of Taurus.

Blockchain & Crypto was the most active Swiss FinTech subsector in Q1 2023, with 14 deals, a 60% share of total transactions during the quarter. RegTech was the second most active subsector with four deals announced, a 20% share of deals.

In April 2023 the Swiss National Bank (SNB) revealed its Swiss payments vision, which includes plans to issue a real wholesale Central Bank Digital Currency (CBDC) on the SIX Digital Exchange (SDX) for a limited time. The SNB has been conducting tests on wholesale CBDCs and is also considering a private token backed by central bank reserves for settling financial transactions. While similar to a stablecoin, the SNB did not use that term. The pilot project, known as Project Helvetia, involves SDX and five participating banks. Initially, the integration with the Swiss real-time gross settlement (RTGS) system was explored, but the trials expanded to include a wholesale CBDC on SDX for settlement purposes.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global