Key Italian FinTech investment stats in H1 2023

• Italian FinTech deal activity reached 33 deals in H1 2023, a 6% drop YoY

• Italian FinTech companies raised $113m in H1 2023, 60% decrease from H1 2022

• RegTech was the most active Italian FinTech subsector in H1 2023 with seven deals

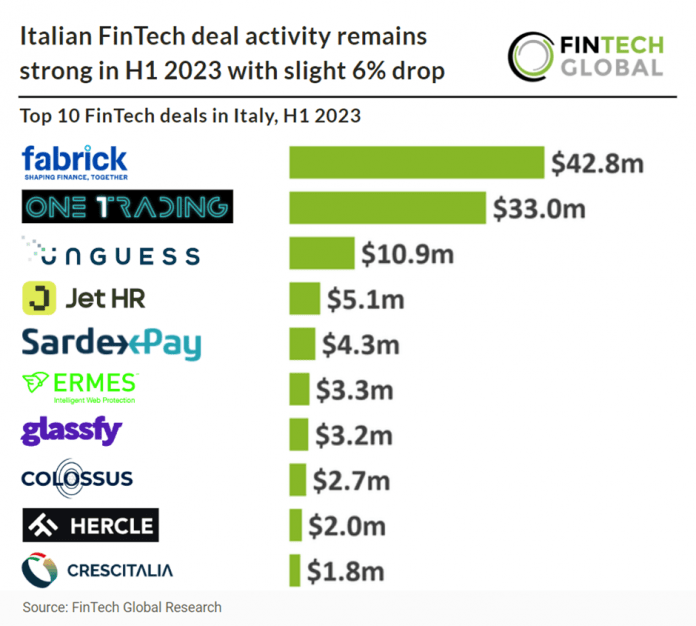

Italian FinTech has remained strong in H1 2023 with only a slight decrease in deal activity compared to the rest of Europe. The number of Italian FinTech deals in H1 2023 amounted to 33, indicating a 6% decrease compared to the previous year. This is 36 percentage points better than France. In the first half of 2023, Italian FinTech companies raised a combined $113m in funding, reflecting a significant 60% decrease compared to the funding raised in H1 2022.

Fabrick, an open finance company, had the largest Italian FinTech deal in H1 2023 after raising $42.8m in their latest corporate round, led by Mastercard. Fabrick says the funding will go towards supporting its consolidation process in Italy, invest in products and services, scale up infrastructure, and expand into new European markets, following its recent acquisition of UK PayTech Judopay. Fabrick have extended their partnership with Mastercard, with whom they have been collaborating since 2019, to develop embedded finance solutions aimed at enhancing digitalization for businesses, financial institutions, and FinTechs throughout Europe. With operations in Italy, France, Spain, Portugal, and the UK, Fabrick employs over 400 people and reported a consolidated net revenue of €50 million in 2022, a 14% increase year-on-year, including its subsidiaries.

The latest FinTech related regulation in Italy was announced in May 2023. The Bank of Italy launched a consultation on supervisory guidance for specialized crowdfunding service providers The Bank of Italy launched a public consultation relating to the draft “Supervisory Guidance for specialized crowdfunding service providers for businesses,” providing the expectations of the Bank of Italy on how such service providers should comply with Regulation (EU) 2020/1503 (Crowdfunding Regulation) and its implementing regulation.

RegTech was the most active Italian FinTech subsector in H1 2023 with seven deals, a 21% share. PayTech and Blockchain & Crypto were the joint second most active with six deals each.

Italian FinTech deal activity remains strong in H1 2023 with slight 6% drop

Investors

The following investor(s) were tagged in this article.