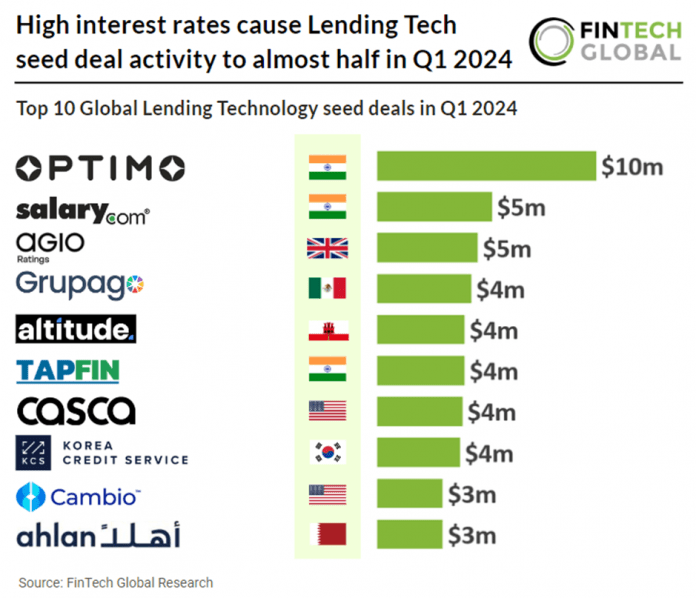

Key Global Lending Tech seed investment stats in Q1 2024:

• Lending Tech seed deal activity reached 46 funding rounds in Q1 2024, a 49% reduction from Q1 2023

• Lending Tech seed companies raised a combined $65m in the first quarter, a 62% drop from Q1 2023

• The USA was the most active Lending Tech country with 14 deals, a 30% share of total deals

In the first quarter of 2024, seed deal activity within the Lending Tech sector saw a significant decline, with only 46 funding rounds completed, marking a 49% reduction compared to the same period in 2023. The total funding secured by Lending Tech seed companies amounted to $65m, indicating a notable 62% decrease from the funding raised in Q1 2023. Rising interest rates are a risk for banks, even though many benefit by collecting higher interest rates from borrowers while keeping deposit rates low. Loan losses may also increase as both consumers and businesses now face higher borrowing costs—especially if they lose jobs or business revenues.

Optimo Loan, which is committed to promoting financial inclusion in the small business community, had the largest Lending Tech seed deal, globally in Q1 2024 after raising $10m, led by Blume Ventures and Omnivore. By the end of this year, the startup plans to broaden its presence to 20 locations in rural India by enhancing its operations, hiring new staff, and deploying new technology, according to a press release. The startup is also developing a co-lending platform with a distinct underwriting process for MSMEs. Optimo can make more informed lending decisions and stimulate economic growth and entrepreneurship in rural communities thanks to this approach, which also gives Optimo deeper insights into the financial health of MSMEs.

The USA was the most active Lending Tech country with 14 transactions, a 30% share of total deals. This was followed by India with five deals, a 11% share of deals and the UK was third with four deals, a 9% share of total deals.

RBI (Reserve Bank of India) have signalled a clampdown on lenders to moderate credit growth in 2024-25. S&P Global Ratings stated in March that a series of stringent regulatory measures by the Reserve Bank of India aimed at curbing lenders’ excessive risk-taking, fostering a culture of compliance, and ensuring customer protection, will likely elevate the cost of capital. Consequently, loan growth is forecasted to moderate to 14% in the fiscal year 2024-25, down from 16% recorded this year. Although the regulator’s initiatives underscore a “serious commitment” to enhancing governance and transparency within finance companies and banks, the rating agency highlighted that a potential drawback of this effort would be increased capital expenses for these institutions.