Texan FinTech StellarFi nets $15m to improve credit scores

Texan FinTech company StellarFi, which helps users build credit scores by paying bills, has reportedly collected $15m in its Series A funding round.

Self Lender raises $10m in Altos-led Series B round

US FinTech Self Lender has raised $10m in an Series B found round led by Altos Ventures. Altos has been joined fellow VCs Silverton Partners,...

ESMA calls for evidence on credit rating information availability

The European Securities and Markets Authority (ESMA) has called for evidence on the availability and use of credit rating information and data.

Petal continues its ambition of helping people build credit scores after closing Series C...

Petal, a credit card company helping people to build credit, has closed its Series C on $55m so it can help more people in these tough times.

Virgin Money teams with 9Spokes to aid business banking development

Virgin Money has partnered with New Zealand-based FinTech company 9Spokes to help support the development of the former’s business banking proposition.

Credit risk platform James bags $2.7m funding

Credit Risk platform James has reportedly up picked $2.7m in a funding round led by angel investor Ga?l de Boissard.

Credit decisions platform Flowcast secures €3m in Series A funding

Flowcast, which leverages AI technology to make smart credit decisions, has secured $3m in Series A funding. ING Ventures and BitRock Capital led the round,...

Codat eyes US expansion after bagging $10m and looks to help banks process coronavirus...

London-based Codat has raised $10m in new funding from Robinhood backer Index Ventures, an investment that it says could benefit banks busy bashing out...

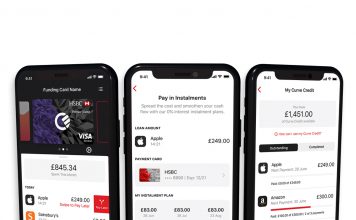

Lending, credit and financial planning app Updraft seals £16m equity and debt investment

Lending, credit monitoring and financial planning app Updraft has scored a £16m equity and debt funding round.

Creditworthiness rating startup Agrograph collects seed funding

Agrograph, which helps agriculture companies get better access to finance, has closed its seed round, which was led by Mucker Capital.