eflow Global and GRSS enhance their partnership to provide managed surveillance solution

UK RegTech firm eflow Global has teamed with surveillance consultant GRRS to introduce a holistic market abuse surveillance solution to the market.

New Australian digital-only bank 86 400 taps Morgan Stanley for $100m funding round

Australia’s newest challenger bank 86 400 has just announced investment bank Morgan Stanley is going to help it kick of a private funding round worth more than $100m.

PayTechs blaze a trail in this week’s funding rounds

In the 25 FinTech funding rounds reported by FinTech Global this week, PayTech and Crypto firms led the way with high levels of funding.

Top two deals make up lion’s share of FinTech funding this week

Two large deals of $296 and $93m respectively stole the show in this weeks FinTech funding round up.

Sunlight and Finovox joins forces to prevent insurance fraud

Sunlight, a cloud-native provider of core administration technology and InsurTech services, has partnered with French software editor Finovox to help insurance organisations prevent fraud.

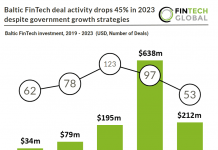

Baltic FinTech deal activity drops 45% in 2023 even with government growth strategies

Key Baltic FinTech investment stats in 2023

• Baltic FinTech investment totalled at $212m in 2023, a 67% drop YoY

• Baltic FinTech deal activity reached...

MAP FinTech launches AI-powered solution to boost anti-money laundering compliance

RegTech venture MAP FinTech has unveiled its latest solution to help financial services firms monitor and screen transactions in order to prevent money laundering.

ZignSec launches new anti-money laundering product as the RegTech company views global markets

The Swedish RegTech company ZignSec has rolled out a new anti-money laundering (AML) product as the Nordics are still with the fallout of a massive banking scandal.

Investment platform Koia snares $1.4m pre-seed funding

Alternative investment app Koia has raised $1.4m from a pre-seed funding round led by Seedcamp.

Boost Insurance nets $14m as it looks to launch various new services

Boost Insurance has netted $14m in its Series A round as it looks to release a selection of data-driven products.