Tag: Challenger Banks

Revolut launches its new financial super app to make it easier...

The European neobank app updates are coming fast right now with Revolut unveiling the latest version of its app just days after Dutch rival bunq did the same.

Challenger bank bunq releases third version of its app as it...

Neobank bunq has updated its platform with new features aimed at changing the way people think about banking, including new charity functions that allow them to help businesses struggling because of the coronavirus.

New digital habits will force every fourth European bank branch to...

Challenger banks had already started a revolution in digital banking, but with the coronavirus pushing these changes to become permanent it could mean that one in four European bank branches will be forced to close by 2023.

Presenting Europe’s next neobank: Intruder

A former Sberbank Technologies employee has set out to launch a challenger bank for self-employed Europeans.

The coronavirus represents a “return to chaos” that could benefit FinTech...

COVID-19 has plunged financial markets into chaos, but the pandemic also represents both challenges and opportunities for FinTech companies as they adjust to a whole new reality.

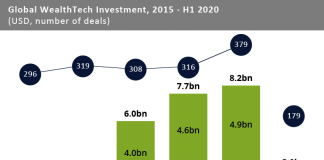

Global WealthTech investment on track for its worst year since 2017

Investment in the sector is expected to slow down for the remainder of the year as the momentum from record H2 2019 wears off

Judo Bank has become a unicorn after raising $230m in a...

Australian challenger bank Judo Bank has pushed past the $1bn valuation mark and officially become a FinTech unicorn on the back of its latest raise.

Bó is shutting down just months after launching its criticised app

Months of setbacks seemed to have been too much for the banking app that was once hailed as NatWest’s Monzo killer, with Bó now announcing that it is closing down.

Revolut launches a bank in Lithuania and plans to use its...

UK challenger bank Revolut has launched a bank in Lithuania after having achieved a European banking licence in the tail end of 2018, but says it might just be the beginning of further expansion across the continent.

The challenger bank revolution could come to the Asia-Pacific by 2025

Despite being slow to join the party, the Asia-Pacific challenger bank sector could be up for a massive growth in the next five years.