Tag: Compliance

FileCloud acquires Signority to enhance e-Signature and document workflow solutions

FileCloud, a leader in content governance and collaboration for unstructured data, has announced the acquisition of Signority, a Canadian-based e-Signature and document workflow platform.

How machine learning is transforming AML controls in payments

The future of anti-money laundering (AML) controls in the payments industry is increasingly being shaped by machine learning technology. Paysafe’s Giacomo Austin recently spoke with Napier AI to offer valuable insights into this transformation.

The intersection of KYB and AML: A guide to business identity...

Know Your Business (KYB) and Anti-Money Laundering (AML) are critical parts of the compliance ecosystem, but how aligned are they? FullCircl, a SaaS platform...

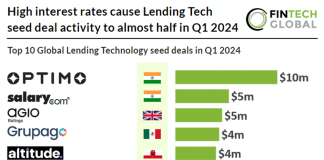

High interest rates cause Lending Tech seed deal activity to almost...

Key Global Lending Tech seed investment stats in Q1 2024:

• Lending Tech seed deal activity reached 46 funding rounds in Q1 2024, a 49%...

Revolutionising Salesforce data protection with IntellectAI’s iDataMasker

In the era of digital transformation, data privacy and security have become paramount for organisations worldwide. With the increasing reliance on cloud-based platforms like Salesforce, having robust solutions to safeguard sensitive information is crucial.

Revolutionising client lifecycle management with embedded customer outreach

In the age of enhanced due diligence, knowing your customer has evolved from a simple onboarding task to the lifeblood of a compliant, modern...

Reducing compliance costs with WealthArc’s advanced wealth app

WealthArc is revolutionising the way External Asset Managers handle compliance, making the arduous tasks associated with meeting FinSA/FinIA regulations more manageable and cost-effective.

Navigating the future with KYC Portal CLM: Transforming risk management in...

KYC Portal CLM, Risk Orchestration, FinTech, compliance, customer trust, data security, regulatory standards, customer due diligence, identity verification, financial services, digital transformation, operational efficiency, customer lifecycle management, risk management, technological innovation,

A comprehensive guide to Know Your Customer procedures

Know Your Customer (KYC) procedures are fundamental policies and processes implemented by businesses to mitigate risks and authenticate the identities of customers throughout their entire lifecycle. These protocols are especially critical in regulated industries, serving as a safeguard against money laundering, terrorism financing, fraud, and other illicit activities. FullCircl has put together a comprehensive guide to KYC procedures.

Trulioo and Nium elevate UK payment experience with rapid compliance enhancements

Trulioo, an industry-leading identity platform known for its global coverage and comprehensive verification for individuals and businesses, has joined forces with Nium, a pioneer in real-time cross-border payment services.