Another German FinTech giant bites the dust with Monedo filing for bankruptcy after the pressures of Covid-19 became too much for the once celebrated company backed by investors like Peter Thiel and Naspers.

Founded in 2012 and known for most of its existence as Kreditech, the venture rebranded earlier this year with both a new name and a new business strategy. The pivot saw the company move away from microcredit loans to using algorithms to grant loans.

The pivot followed from a €20m funding round completed in September 2019 supported by investors Runa Capital, HPE Growth and Amadeus Capital Partners as well as German private investors.

While the new strategy saw the company enjoy a brief period of good press in the business papers, it seems that the pivot was not enough to tackle the strain put upon it by the coronavirus pandemic.

A lawyer at law firm Brinkmann & Partner in Hamburg has confirmed to Sifted that the scaleup filed for insolvency last week in a German court.

The lawyer, Christoph Morgen, said he has been appointed to manage the proceedings, adding that he hoped to find an investor to keep the company going.

“I plan to continue operations and have already started talks with possible financiers,” said Morgen in a statement seen by Sifted. “It is my goal to bring the investor process, which was started before the insolvency application and which according to the Monedo management looks promising, to a successful conclusion.”

The news comes after Monedo CEO David Chan argued back in March that digital credit providers could be worse of because of the pandemic due to it making lenders more risk averse.

Sifted reported that Monedo was close to going bust in 2018 when the value of the company, once celebrated as one of Germany’s largest FinTech startups, saw its valuation plummet from a $200m high to be worth almost zilch after several loans to private individuals in India and Russia defaulted.

Of course, Monedo is not the only German FinTech company to have filed for bankruptcy this year.

Although, Wirecard’s implosion in June happened under completely different circumstances, with it reporting that $2.1bn of its finances had gone missing and being suspected to be part of a global billion-dollar fraud.

Since it going bust, several members of Wirecard’s leadership have either been arrested suspected of fraud or are being sought after by the authorities.

In the aftermath of Wirecard’s collapse, regulators and lawmakers have called for more intense scrutiny of the FinTech sector.

That being said, it is not as if the FinTech industry are not feeling the strain from the global pandemic.

In July, Monzo reported that its losses had doubled from £47.1m to £113.8m, adding that the pandemic had put the UK challenger bank’s ability to continue as a business in “significant doubt”. It has also suffered a 40% down round that saw its valuation shrink from $2bn to $1.24bn.

And Monzo struggles are not an isolated event – its native rivals Revolut and Starling Bank have tripled and doubled their losses respectively in the last year. Additionally, Tandem has also reportedly suffered a 40% down round.

All these companies’ struggles have made some people wonder how strong the challenger bank industry’s ability to survive the pandemic is.

FinTech Global noted early on during the pandemic that the global health crisis could make investors less inclined to invest in new startups due to the uncertainties of the markets.

Indeed, over the past few months, FinTech Global has seen notable drops in investments in the global WealthTech, PropTech and CyberTech sectors, to mention a few.

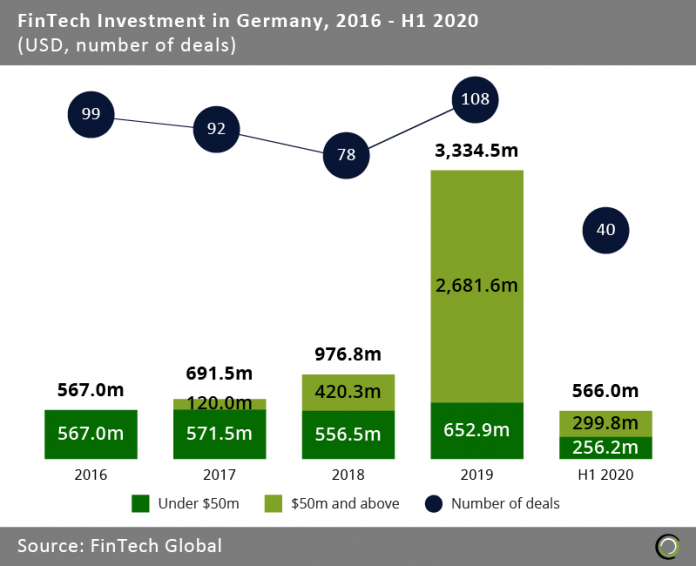

This trend has also reached Germany where investment dropped by 73.3% in the first six months of 2020 compared to the same period in 2019, according to FinTech Global’s research. The German FinTech industry only completed 40 deals worth $566m between January and June this year.

That is a far cry compared to record year of 2019 when the sector completed 108 deals to the tune of $3.33bn.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global