China-based FinTech platform Lufax is reportedly eyeing a $2.4bn initial public offering in the US.

The online lending platform is hoping to sell 175 million shares at a price between $11.50 and $13.50 apiece, according to a report from the Wall Street Journal. Depending on the price they actually sell for, the FinTech could reach a market cap between $28.1bn and $32.9bn.

Lufax was previously valued at $39.4bn after it secured a $1.4bn investment from Ping An Insurance, the article said.

The FinTech company initially started off business as a peer-to-peer lender and has since expanded to offer a selection of services including insurance and currency exchange.

This report also claims this move to the US could be down to China’s restrictions that are being place on the peer-to-peer lending market. The government has placed limits on the amount of credit available to borrowers and the number of products a company can offer.

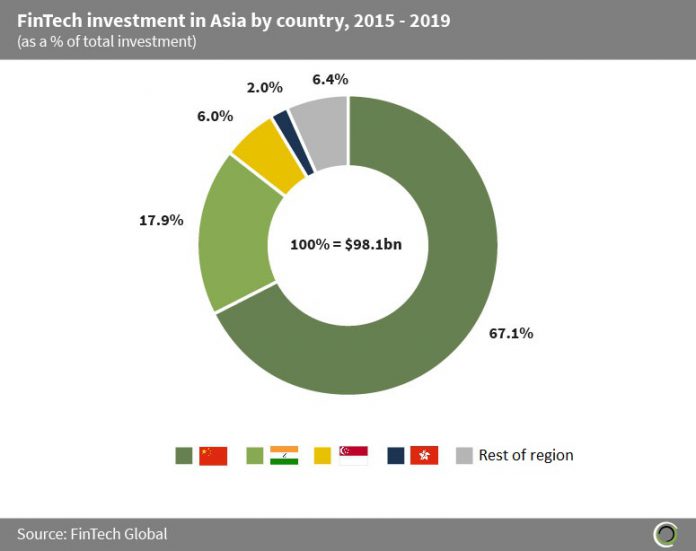

China’s FinTech sector has helped drive total investment volume in Asia to reach just under $100bn since 2015. The country is responsible for 67.1% of the total capital invested into FinTech companies on the continent, with India representing the second largest portion.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global