Envestnet, a developer of technology and systems for wealth management and financial wellness, has priced an offering of $500m in convertible notes.

These convertible notes have an aggregate principal amount of 2.625%. They will be sold in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933.

The aggregate principal amount of the offering was increased from the previously announced offering size of $350 million.

Envestnet has also granted initial purchasers of the notes an option to purchase for settlement within a 13-day period solely to cover over-allotments, up to an additional $75m aggregate principal amount of notes.

These notes will mature on December 1, 2027, unless earlier purchased, redeemed or converted. Additionally, notes at a rate of 2.625% per year and will be payable semi-annually in arrears on June 1 and December 1 of each year, beginning on June 1, 2023.

Envestnet claims to be transforming how financial advice and wellness is delivered. Its technology, solutions and intelligence are used by around 106,000 advisors and 6,900 companies.

Its offerings include trading and reporting, financial planning, investment solutions, annuity solutions, credit solutions, data aggregation, analytics, financial wellness and more.

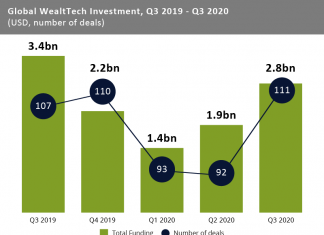

In other WealthTech news, Singapore private market investing app ADDX raised an additional $20m for its pre-Series B funding round. The company gives individual investors greater access to private market deals.

Another development in the sector came from Kidbrooke. It recently released a report that explored how wealth managers can help clients with their wealth transfer and ensure assets are not lost after someone’s passing.

Copyright © 2022 Fintech Global