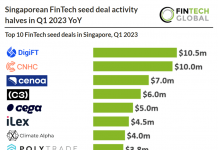

Cenoa, which stylises itself as a borderless super wallet, has raised $7m in its seed round to support market expansion.

The investment was led by San Francisco-based venture capital firm Quiet Capital and Boston-based investor Underscore VC.

Other commitments came from Human Capital, Ulu Ventures, Acrew Capital and Collective Spark.

This capital will allow Cenoa to expand its operations in existing and new markets across Latin America, Africa, Southeast Asia and Europe. Other plans are to add US Dollar-based debit cards and instant money transfer to its product suite within the next 18 months.

Finally, funds will be used to hire staff across various departments, including product development and engineering.

Based in Singapore, Cenoa is a borderless and non-bureaucratic way to access a digital dollar product without any fees and earn an inflation-resistant yield.

It added that as the US dollar is at its strongest in 20 years and emerging markets setting the highest USD saving demand, Cenoa’s non-custodial wallet can help users make their assets devaluation-proof and increase savings growth.

Cenoa founder and co-CEO Seçkin Çağlın said, “Cenoa offers easy access to digital dollar-based products, 100 percent designed for the everyday user. We believe in using modern technologies such as blockchain to provide one-click access to the digital dollar ecosystem to benefit the customers that need that access most – those in emerging economies lacking stable currencies like Argentina and Nigeria.

“People in these countries should be able to easily and affordably access US Dollars and beat inflation while saving, a function the traditional financial system has failed to provide.”

The platform, which is in its beta-testing phase with 1,000 private users, is available in 35 markets.

Its target for the next two years is to onboard millions of customers around the world and offer seamless local currency to dollar conversion services.

Another Singapore-based FinTech to recently raise funds was Pilon. The company, which allows suppliers and their corporate buyers to digitise their factoring processes, raised $5.2m in funding.

Copyright © 2023 FinTech Global