Oikocredit, a social impact investor, has deployed a $5m loan into Yellow, a pay-as-you-go off-grid solar solutions and appliances provider.

With the funds, Yellow hopes to increase access to electricity to around 89,000 households in Sub-Saharan Africa. The funds will allow it to support low-income people in Malawi, Rwanda, Uganda and Zambia to access clean energy and move towards the ownership of off-grid solar products.

Yellow stated that access to renewable electricity will help households improve their living standards and increase their earning potential.

Based in South Africa, Yellow offers smart finance and solar and digital technology solutions.

Since its inception in 2018, Yellow has sold over 300,000 energy devices and helped improve the lives of over 1.5 million people, it said. Furthermore, renewable energy generated through its solar home systems has avoided approximately 442,671 metric tonnes of CO2 equivalent by replacing kerosene lanterns and diesel generators.

Oikocredit investment officer Siebren Wilschut said, “We’re very pleased to support Yellow, one of the fastest growing companies in the industry, in its expansion to provide greater access to energy across Africa.

“With this investment, we continue our commitment to achieving higher social impact in sub-Saharan Africa through investments in renewable energy. Our partnership with Yellow will enable the company to increase its social impact by helping low-income people become healthier, improve their livelihoods and be better connected.”

Yellow previously raised $20m in debt funding. This included a $5m equivalent senior secured debt facility from Facility of Energy Inclusion’s Off-Grid Energy Access Fund.

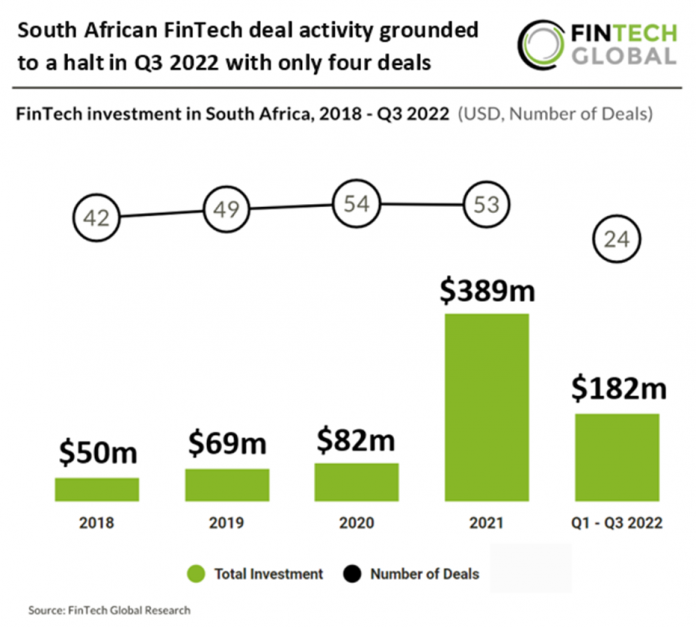

In the first three quarters of 2022 a total of $182m was raised through 24 deals in South Africa. In the third quarter just four deals were completed, a 55% reduction on Q2.

A total of $389m was raised in South Africa’s FinTech sector during 2021 through 53 transactions.

Copyright © 2023 FinTech Global