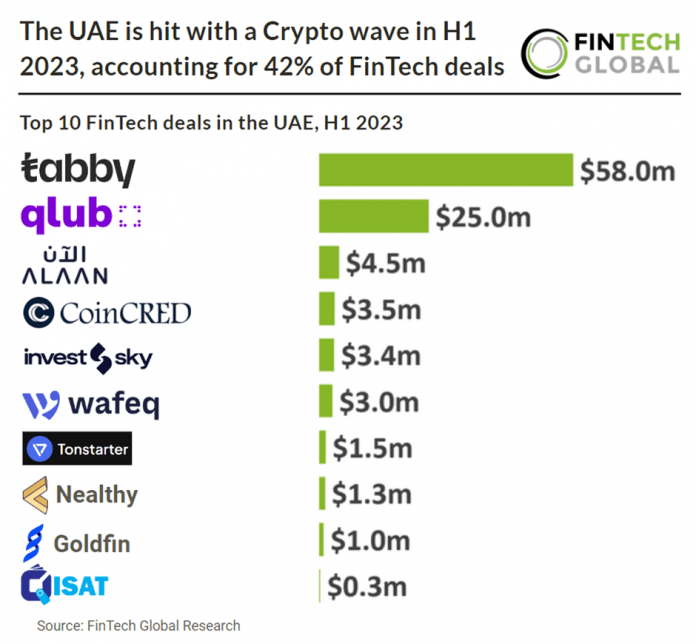

Key UAE FinTech investment stats in H1 2023

• UAE FinTech deal activity reached 24 deals in H1 2023, a 54% drop YoY

• UAE FinTech companies raised a combined $101m in investment during H1 2023, a 72% reduction from H1 2022

• Blockchain & Crypto companies accounted for 42% of FinTech deals in H1 2023

The UAE has seen a significant drop in both FinTech deal activity and investment during the first half of 2023. In the first half of 2023, the number of FinTech deals in the UAE declined 54% compared to the previous year, totalling 24 deals. During the first half of 2023, FinTech companies in the UAE raised a combined investment of $101m, reflecting a substantial decrease of 72% compared to the same period in 2022.

Tabby, a buy now pay later provider, had the largest FinTech deal in the UAE during H1 2023, raising $58m in their latest Series C funding round, led by Peak XV Partners and STV. The company intends to use the funds to expand its product line into next-gen consumer financial services and support its growing operations. Led by Hosam Arab, CEO, Tabby provided an app that aims to create financial freedom in the way people shop, earn and save. Over 10,000 global brands and small businesses, including H&M, Adidas, IKEA, SHEIN, noon, and Bloomingdale’s, use its technology to accelerate growth and gain loyal customers by offering flexible payments online and in stores. Tabby is active in Saudi Arabia, UAE, Egypt and Kuwait and crossed 3 million active shoppers last year. Hosam Arab said: “With rising interest rates and growing inflation, it has never been more important for people to have access to payment flexibility to stay in control of their finances. Despite downward pressure on FinTech valuations, our business continues to sustainably scale as we lead the generational shift towards fair and transparent financial products in MENA.”

Blockchain & Crypto was the most active FinTech subsector in the UAE during H1 2023 with 10 deals, 42% share of total deals. The government-owned licensing firm, KIKLABB, based in Dubai’s Mina Rashid, now accepts digital currency payments, including Bitcoin, Ethereum, and Tether, on behalf of the Dubai Financial Services Authority (DFSA) for trade licenses and visas. The DFSA has also announced plans to establish a comprehensive regulatory framework for cryptocurrencies. In line with its Emirates Blockchain Strategy 2021, the UAE aims to utilize blockchain technology to digitize at least 50% of its government transactions by the end of 2021. The Central Bank of UAE and the Saudi Arabia Central Bank collaborated on “Project Aber,” exploring the potential of a dual-issue digital currency for domestic and cross-border settlements. Dubai’s commitment to crypto assets is evident through the establishment of the Dubai Multi Commodities Centre (DMCC), which provides support and infrastructure for companies involved in blockchain and crypto asset development. The crypto-friendly policies of the UAE have attracted numerous companies, including Ripple, which recently moved its headquarters to the country. The UAE’s Securities and Commodities Authority (SCA) has actively sought input from the industry and the public regarding crypto asset regulations, further encouraging the growth of the cryptocurrency sector in the country.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global