Specialist research firm FinTech Global has launched an innovative ESG FinTech Market Map, that will serve as a vital guide for financial institutions looking for solutions to solve their ESG needs.

The Market Map has been released at a time where financial institutions are under increased pressure and regulatory scrutiny to adopt sustainability goals across their product and operations. In fact, 76% of banks are implementing digital transformation initiatives for driving sustainable outcomes, according to a report from Hexaware.

Banks, investment firms and other financial services organisations will be able to use the Market Map to discover the technology companies that could aid with their ESG objectives. Detailed information about each company is provided, such as the sectors and regions they operate in. Navigation tools also provide users dynamic search abilities so they can explore the market and find the companies that are the most relevant for their needs.

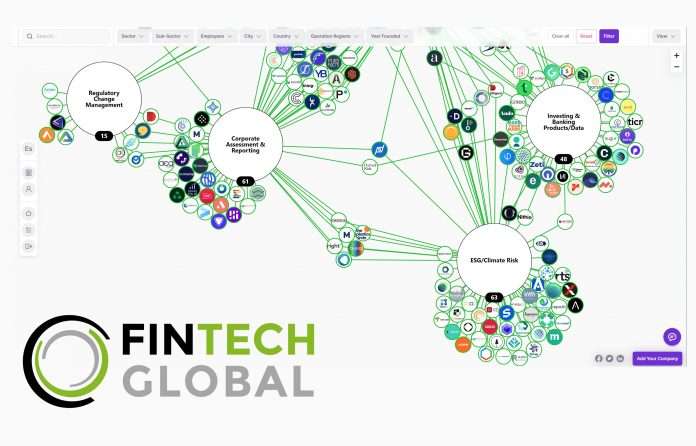

The map covers companies serving financial services with solutions for climate risk, ESG assessment & reporting, ESG Intelligence & Data Analytics, supply chain screening, banking products and regulatory change management.

On top of the ability to search through the list of companies, the Market Map has an interactive map that groups companies by the sectors they serve.

The Market Map currently boasts a database of 291 ESG FinTech companies, but more are always being added to the list to ensure it is up to date with all the leading solutions. If an ESG FinTech company is not in the database, they can submit their information to be added as a profile.

Financial institutions are under increased pressure from regulators and consumers to adopt sustainability as a core business function. This is helping to build a bustling sector for startups. In fact, a report from Dun & Bradstreet found that 29 of 30 largest financial services firms in the world prioritise ESG initiatives.

Despite the troubled financial market, ESG FinTech companies have continued to attract the attention of investors. In 2022, there were 114 deals in the space, an increase of 46% on 2021. The US was the home to the largest share of these transactions, accounting for 25%.

FinTech Global director Richard Sachar said, “ESG is still only getting started within the FinTech world. Pressures for financial institutions to implement sustainable and climate friendly products will only increase, especially as wildfires and other natural disasters continue to disrupt the lives of many. However, it is also important to remember ESG is more than just climate, social and governance issues are also becoming more important, and banks will need to be ready.

“Our new Market Map ensures that financial services companies can quickly and easily identify the relevant ESG FinTech companies. As the ESG FinTech market continues to bloom, this map gives decision teams the ability to compare providers, saving them time and ensuring they find the best providers for their needs.”

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global