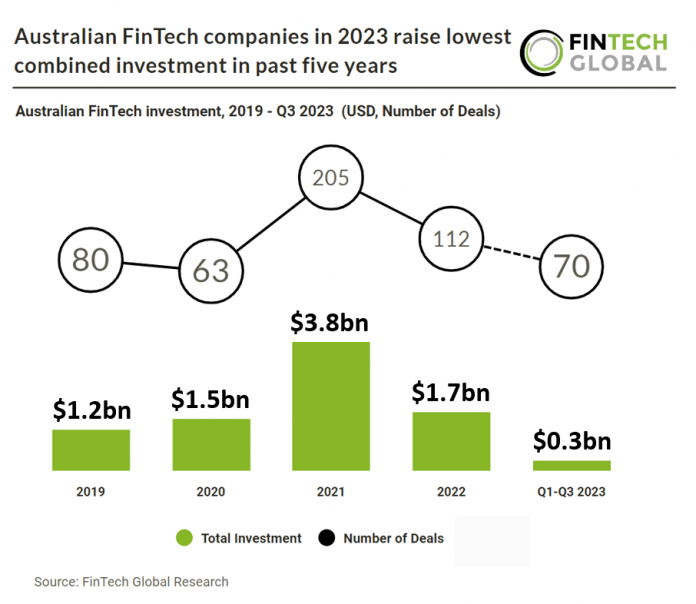

Key Australia FinTech investment stats in Q3 2023:

· Australian FinTech deal activity reached 70 deals in Q1-Q3 2023, a 24% reduction from Q1-Q3 2022

· Australian FinTech investment totalled at $299m in Q1-Q3 2023, a 66% drop YoY

· RegTech, Lending Tech and PropTech were the join most active FinTech subsectors with four deals each

Australian FinTech has seen a sizable drop in investment during 2023 but deal activity is on track to drop by a less significant 17%. This is much better than the global expected drop in FinTech deal activity of 40%. In the first three quarters of 2023, the number of FinTech deals in Australia totalled 70, marking a 24% decrease compared to the same period in 2022. Investments in Australian FinTech companies amounted to $299m during the first three quarters of 2023, reflecting a 66% YoY decline. Australian FinTech companies are on track to raise $299m in 2023 based on investment in the first three quarters of 2023.

Till, which provides intelligent payment and revenue assurance systems, had the largest Australian FinTech deal in Q1-Q3 2023, raising $46.1m (A$70m) in their latest Series D funding round, led by Silva Fortune. The money was to be used for global expansion, but high inflation and tough economic conditions forced a retreat for the firm and the recent sacking of 120 staff in the UK, North America and Australia. The company has since revised its strategy with a fresh focus on sustainable growth and fast-tracking profitability. Till’s existing investors have demonstrated their confidence in our plans for the company and our renewed and prudent approach to governance,” says non-executive director, Matt Davey. “We look forward to delivering strong organic growth underwritten by a disciplined approach to operations. Over the past year, the company has witnessed a remarkable surge, with transaction volumes skyrocketing by 300% and its merchant base expanding by 200%. Additionally, they are on the verge of introducing a new Core Acquiring Platform, which will provide Till with direct access to Payment Networks on a global scale.

RegTech, Lending Tech and PropTech were the join most active FinTech subsectors with four deals each, a combined 72% share of total deals

Australia’s financial services regulatory landscape is primarily shaped by the outcomes of the 2017–2019. As part of the government’s response to the Royal Commission, the Australian Law Reform Commission (ALRC) conducted an inquiry to streamline Australia’s financial services regulatory framework, making it more adaptable, efficient, and understandable for both consumers and regulated entities. The ALRC has issued interim reports on three key areas: the use of definitions in corporations and financial services legislation, the regulatory structure and hierarchy of laws, and the potential restructuring of Chapter 7 of the Corporations Act 2001 (Cth), which covers overarching financial services laws. The first three interim reports have been released and a consolidated final report is due by November 30, 2023.