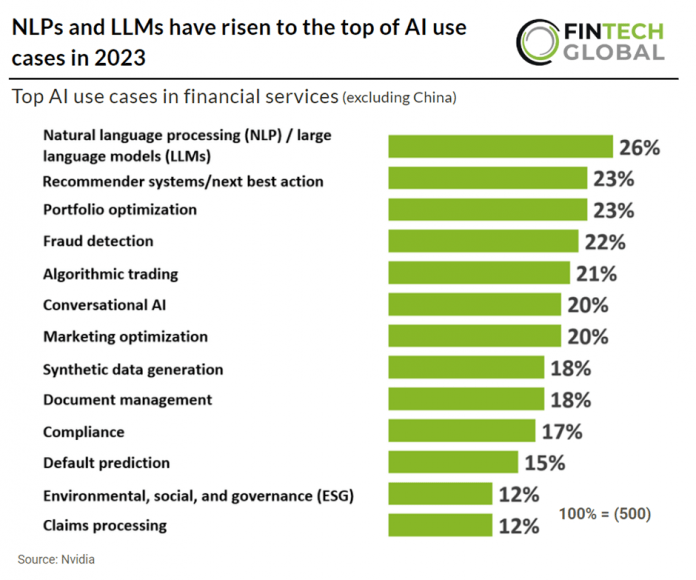

In a recent survey conducted by Nvidia it is clear the adoption of AI in the financial services sector is rapidly gaining momentum. From fraud detection to portfolio optimization and conversational AI, a wide array of AI-enabled applications are reshaping how financial companies operate. It’s noteworthy that out of the 21 different use cases examined in a recent survey, 10 are being utilized by over 20% of companies surveyed. A significant 35% of respondents reported that these applications have led to operational efficiencies, while 20% mentioned a reduction in the total cost of ownership. Moreover, 36% of companies indicated that they have achieved annual cost reductions of over 10%, potentially boosting their profit margins. AI has also enhanced customer experiences, created new business opportunities, and improved the accuracy of models, positively impacting both top and bottom lines. Remarkably, more than half of the surveyed companies have implemented three or more of the highlighted AI use cases, with a fifth of them having six or more in operation, showcasing the widespread adoption and effectiveness of AI in financial services.

Nvidia’s survey of approximately 500 global financial services professionals included C-suite leaders, managers, developers, and IT architects from FinTech’s, investment firms, and retail banks from around the world.

NLPs and LLMs have risen to the top of AI use cases in 2023

Investors

The following investor(s) were tagged in this article.