Digital insurer iptiQ and Emily Frey Group enter Swiss alliance

iptiQ, Swiss Re's B2B2C digital insurer has partnered with fellow Swiss company Emil Frey Group.

Green Shield opts for INSTANDA to bolster insurance offering

Chicago-based Green Shield Risk Solutions has partnered with INSTANDA to enhance Green Shield’s product and service offerings.

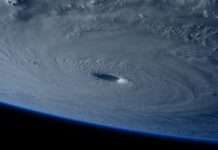

Swiss Re, Britam and Oxfam to protect small-scale farmers in Kenya with parametric flood...

Global reinsurer Swiss Re has teamed up with Britam and Oxfam to launch an index-based flood insurance solution in Kenya to protect small-scale farmers.

Synchrono Group Partners with KCC for Advanced Risk Modelling in Insurance Underwriting

Karen Clark & Company (KCC), a pioneer in providing advanced models and innovative software for deeper insights into catastrophe risk, has announced that the Synchrono Group, trading as SynchronoSure, has licensed KCC's comprehensive suite of US catastrophe models.

Qorbis and Mbanq unite: Tailoring FinTech solutions for US brands

Qorbis and Mbanq, two pioneering entities in the world of FinTech, have announced a new partnership. Qorbis, renowned for its end-to-end embedded finance and FinTech personalisation solutions, has joined hands with Mbanq, a top-tier Banking-as-a-Service (BaaS) provider.

Capital Union Bank unveils cutting-edge eBanking platform with Avaloq

Capital Union Bank, a Bahamas-based pioneering financial institution, has announced the launch of its new online banking platform (eBanking) in collaboration with leading WealthTech provider, Avaloq.

ESG Bay seals £135,000 investment to propel green business assessments

ESG Bay, an environmental, social, and governance (ESG) self-assessment platform, has recently secured a pre-seed investment. The UK-based company assists organisations in gauging their climate and societal impact by applying universal metrics, and generates lucid ESG assessments for customers, community, stakeholders, and the broader public.

Handlesbanken Norway partners with Tietoevry to modernise wealth platform

Handelsbanken Norway has partnered with Tietoevry in a bid to modernise its IT landscape and enhancing the customer experience.

Arendt Services partners with Fenergo to elevate investor onboarding experience

Arendt Services, a prominent investor and corporate services provider based in Luxembourg, has announced a strategic partnership with Fenergo, a leading Client Lifecycle Management (CLM) solution provider.

Mastercard and Saxo Bank team up for open banking account feature

Mastercard and Saxo Bank have announced a partnership to facilitate open banking payments into customer’s investment accounts.