From challenger banks to stock trading apps, the last week has seen a smattering of both massive funding rounds and smaller seed investments.

FinTechs continue to attract a lot of investment. The last week is a testament to that fact, with 22 rounds having caught our eyes in the past seven days. But across the regular rounds raised by application program interface ventures, cybersecurity startups and savings companies, there were a few capital injections that highlighted bigger trends in the industry.

The clearest message from the last week is that challenger banks are not going anywhere. The last week saw Judo Bank, N26 and new startup Alpian all close new rounds. This comes on the back of Revolut, Chime, Empower, One, NorthOne, Lunar, indó and all having raised money this year.

Digital banks have also attracted more investment than any other WealthTech sector, according to FinTech Global’s research. For instance, seven of the ten biggest WealthTech investment deals in the first quarter of 2020 were raised by challenger banks. Although, not all challenger banks have been successful through venture capital. For instance, neither British OakNorth nor Dutch bunq have raised any outside capital. Both have been funded by the winnings from the founders’ previous startups. Although, as our interview with the bunq founder and CEO Ali Niknam revealed, bunq could soon raise its first round.

Although, not all challenger banks have been successful through venture capital. For instance, neither British OakNorth nor Dutch bunq have raised any outside capital. Both have been funded by the winnings from the founders’ previous startups. Although, as our interview with the bunq founder and CEO Ali Niknam revealed, bunq could soon raise its first round.

That being said, the closure of Bó is also a testament to how fierce the competition in this segment has become. Although, the app that was once hailed as NatWest’s Monzo killer also struggled with multiple setbacks, including fraudulent accounts, fake reviews and having to resend 6,000 cards when it was revealed that they weren’t compliant with the EU’s strong customer authentication legislation, all of which definitely contributed to its eventual demise.

Elsewhere, this week also saw more companies raise rounds to help them stay afloat through the COVID-19 crisis, which is something we expect will continue for some time yet as will the trend of startups motivating their raise with the need for their services in these chaotic times we’re living through.

So, let’s take a closer look at the companies that raised money last week.

Free2 collected $305m in debt funding

Financial services platform Free2 was set up by founder and CEO Paul Lindsay who had noticed that the financial services industry had failed to keep up with “the changing demands of modern retirement.”

“Our mission is to change that,” Lindsay said. “By catering specifically for these customers, we’re seeking to create products that promote freedom and choice and that provide opportunity rather than limitations for those assessing what they want to achieve in retirement. We call it financial freethinking, and today’s announcement is an important milestone as we begin that journey.”

To help it work towards this goal, Free2 has now has received a £200m securitisation facility from NatWest Markets to help the FinTech issue customer loans.

In addition to this, an unnamed European special situations fund is deploying a further £105m in debt funding to give Free2 working capital and make new customer loans. The FinTech also plans to use the capital to support the launch of its first product in early June.

Robinhood bagged $280m after a tumultuous year

The US-based stock trading app Robinhood led the pack in terms of investment rounds last week after collecting $280m in a Series F round. The investment saw the FinTech unicorn achieve a valuation of $8.3bn. Robinhood said it would use the cash to scale the platform, develop new products and expand its operations by boosting its recruitment efforts.

Existing investor Sequoia Capital led the round, which also saw participation from existing and new backers, including NEA, Ribbit Capital, 9Yards Capital and Unusual Ventures.

The investment round was announced after a year where Robinhood had suffered multiple service outages that caused speculation about a class action lawsuit against Robinhood, data security snafus and a widely publicised bug, the so called “infinite money cheat code”, that enabled traders to borrow money through the Robinhood Gold service, which was then added to their capital. That essentially meant that they could borrow money to be able to borrow more money. Robinhood has since said it has amended the bug.

Judo Bank becomes a unicorn after raising $230m in new funding round

Australian challenger banks are on the rise. Over the past two years, several challenger banks that have launched across the country. Judo Bank is one of them.

The Australian neobank has now pushed past the $1bn valuation mark and officially became a FinTech unicorn thanks to it collecting $230m in the venture’s third funding round to date. It has raised $750m in total since the launch in 2018. It plans to use the money to boost its national footprint and to further develop its services.

Judo Bank relied on the support of existing backers Bain Capital Credit, Myer Family Investments, Ironbridge and the Abu Dhabi Capital Group for the new raise.

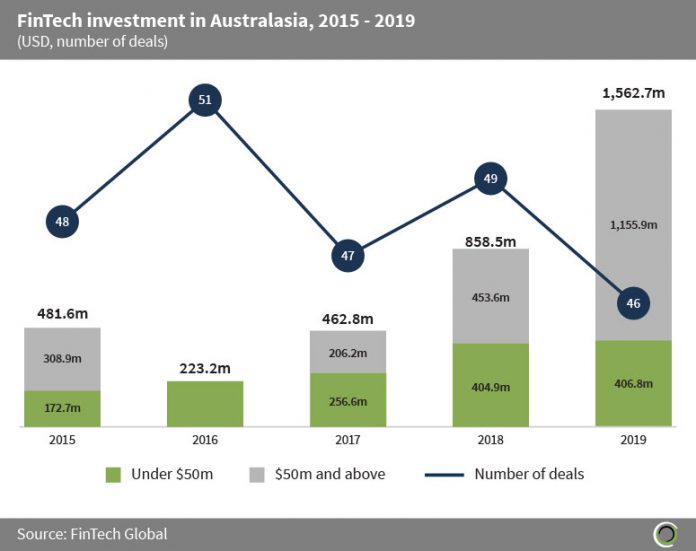

The raise came after a period where FinTech companies in Australasia has collected massive rounds recently. Companies in the region raised $3.6bn across 241 transactions between 2015 and 2019, with Australian companies capturing 91.1% of the investment on the continent, according to FinTech Global’s research.

Last week the German challenger bank N26 extended its Series D round again. This time it topped up its coffers with an additional $100m investment to strengthen its position in the days of COVID-19.

The neobank first announced the close of its Series D round in January 2019 at a $2.7bn valuation. That initial raise saw it add $300m to its war chest. The company then extended the investment round in July, putting an additional $170m into its coffers. That extra influx of capital also saw the company’s valuation jump to $3.5bn.

The valuation remained the same through this latest extension of the Series D round, which pushed the grand total raised in the Series D round to $570m.

Bought By Many bagged £78m in new equity raise

Bought By Many, the pet insurance platform, has closed a £78m investment from private equity firm FTV Capital. Mike Vostrizansky, partner at FTV Capital, will join the Bought By Many board of directors as part of the deal.

Having closed the round, Bought By Many will look to hire more staff and deepen its product suite, the article claims.

Dtex Systems secured $17.5m in a funding round

Northgate Capital has led cybersecurity startup Dtex Systems’ latest $17.5m funding round. Norwest Venture Partners and Four Rivers Group also participated in the raise.

Alpian bagged $12.5m as it pursues 2021 launch

Alpian is setting out to become Europe’s latest challenger bank. The Swiss startup has now bagged $12.5m in its efforts to launch as a fully licensed digital affluent bank in 2021. To this effect, it is also pursuing a banking licence from the Swiss Financial Market Supervisory Authority (FINMA).

Agicap collected €15m round

Lyon-based Agicap has raised €15m in a round led by Partech that also saw participation from existing investors BlackFin Capital Partners and Kima Ventures. Agicap will use the money to fund its product development and to grow its team from 30 to 100 employees within the next year. It said it would help SMEs better manage their cash flows.

Flagstone raised $15m round

Flagstone, which offers a marketplace of cash deposit accounts, has reportedly raised $15m in funding to help it extend its footprint in the UK. The round was led by OMERS Ventures, with additional commitments coming from Kindred Capital and Moneysupermarket Group.

Treasury Prime netted $9m in raise

Banking API startup Treasury Prime has closed a Series A investment round that saw it add $9m to its war chest. QED Investors partner Amias Gerety led the round that also saw participation from angel investors Jason Lemkin and Hans Morris. With the close of the round, the FinTech has raised a total of $11.5m in equity, having previously closed a $2.5m seed round.

LUXHUB netted €7.4m in funding round

Open banking API platform LUXHUB is looking to bolster its European expansion on the back of an internal €7.4m funding round. The investment was supplied by its founder banks Banque Raiffeisen, BGL BNP Paribas, POST Luxembourg and SPUERKEESS.

Hub Security bagged $5m in a round led by AXA Venture Partners

Cybersecurity startup Hub Security has raised in a $5m Series A round led by AXA Venture Partners. The investment also saw participation from Jerusalem-based OurCrowd.

Hub Security will use the money to strengthen its team, expand its technology and offer enhanced products to FinTech companies.

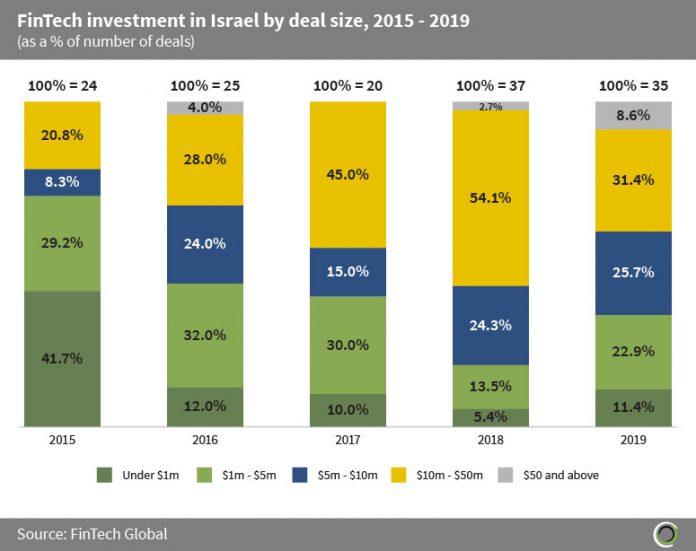

The raise marked the continuation of the important role cybersecurity plays in the Israeli FinTech sector. The segment of the industry has long driven the growth of FinTech activity in Israel. Over the years, the Israeli cybersecurity industry has only been second to the US in terms of funding, according to FinTech Global’s research.

Overall, Israeli FinTech companies raised more than $1.7bn across 142 transactions between 2015 and 2019. The same period saw the money raked in from backers jump from $118m in 2015 to $555.5m in 2019.

Clear Skye bagged $4.95m in Series A round

Clear Skye bagged $4.95m in Series A round

Identity solution provider Clear Skye has secured $4.95m in its Series led by Toba Capital. Inner Loop Capital and previous Clear Skye backer ServiceNow Ventures also participated in the raise.

Countingup bagged £4m

Countingup, an automated accounting platform, has closed a £4m bridge round. ING Ventures led the round with the additional support of Triple Point, CVentures and BiG Start Ventures.

Snoop raised £3.2m ahead of its upcoming Series A

Savings platform Snoop has collected £3.2m in a new funding round led by British angel investor Sir Lloyd Dorfman, with additional contributions coming from Havisham Group and Salesforce Ventures. But the company is not stopping there, having already announced that it is planning to raise more money later in 2020 in an upcoming Series A round.

Banked has secured $2.35m in a seed round

Banked, which support real-time payments, has reportedly secured $2.35m in a seed funding round led by Force Over Mass. Previous Banked backers Backed and Acrew Capital as well as a number of angel investors also supported the raise. The investment brings the FinTech’s total equity funding to £5.35m.

AskRobin collected $1.7m in new round

Loan comparison company AskRobin has reportedly raised $1.7m in funding.

The capital injection was supported by Change Ventures, Vereeni Early Stage Fund, BENE Asia Capital and Lemonade Stand as well as a number of angel investors from AskRobin’s native Estonia.

Doorr raised $1.26m in seed round

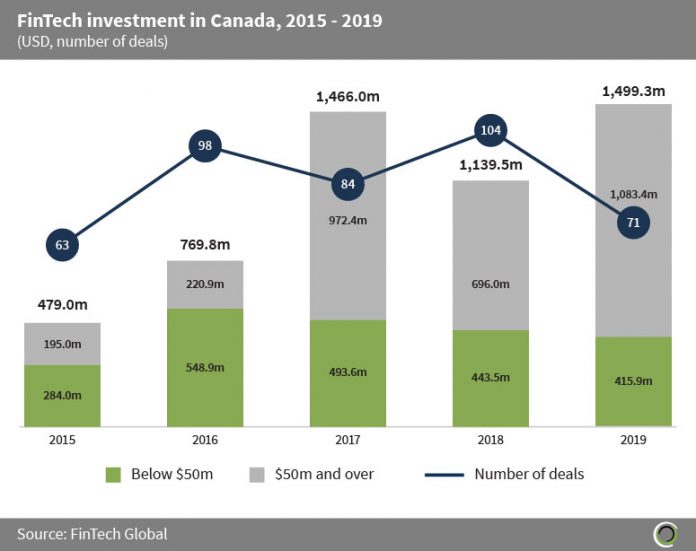

Canada is growing its FinTech industry. The sector raised $1.49bn in 2019, $33.3m more than the previous record year of 2017, according to FinTech Global’s research. It also marked a significant increase from 2015 when the industry raised $479m. Between 2015 and 2019, Canadian FinTech companies raised more than $5.2bn across 420 deals.

The latest company to join this trend is the PropTech startup Doorr. It has announced that it has raised $1.26m in a new seed round co-led by Celtic House Venture Partners and MaRS Investment Accelerator Fund. Techstars and several angel investors also participated in the round.

MetaMorphoSys has closaed a pre-Series A funding round.

MetaMorphoSys has closaed a pre-Series A funding round.

Indian InsurTech platform MetaMorphoSys Technologies has reportedly raised a pre-Series A funding round, which was led by Good Capital. Contributions to the round also came from HNI.

White Ops netted cash in a new round

White Ops, a developer of bot mitigation and fraud protection technology, has collected an investment from Goldman Sachs Merchant Banking Division and ClearSky Security. The company said it would use the money to support the next phase of its growth, including its ambition to expand across the global. White Ops will will also use the money to fund product development and move into new verticals.

LoanAdda has raised an undisclosed funding round

LoanAdda, which offers small-ticket loans, has collected a funding round through the fundraising platform ah! Ventures High Tables. Contributions came from investors including PRAAK Investments and Ratnaafin Group. The amount of capital raised in the round was not disclosed.

Accenture acquired NIKE Group

Leading professional services firm Accenture has bought NIKE Group, an Italian consulting firm that provides regulatory technology services and solutions to financial services firms. The financial terms of the deal were not disclosed. Accenture will use NIKE Group’s data-driven approach and compliance platform to help its financial clients better monitor new regulatory requirements and assist with compliance.

Copyright © 2020 FinTech Global