Starling Bank is “really sorry” if customers are unhappy with its new fees, introduced just weeks after the neobank revealed its losses had doubled in the last year.

The challenger bank announced that it will from now on force customers who misplace their cards to fork out another £5 for replacing them, Crowdfund Insider reported.

Additionally, Starling Bank added a £2 monthly charge for new children’s cards and for vulnerable users, although the FinTech noted that this initiative would not affect existing users.

That being said, existing users who open an additional British account will also have to pay the new monthly fee.

Moreover, customers who make payments through the clearing system Chaps will from now have to pay £20 per payment.

“If you’re not happy, we’re really sorry to hear that,” Starling Bank said in a letter to customer. “Unfortunately we can’t change any of the terms, but you have the right to close your account at any time by getting in touch with us through the app.”

The announcement comes almost a month after Starling Bank published its annual report, revealing that its losses had skyrocketed to reach £53.6m in the last year, up from £26.9m in 2018.

Still, the challenger bank was bullish about its prospects since the lending segment of its services had grown thanks to the government’s Covid-19 financing schemes. By the end of July, it had £1bn in lending on its balance sheet.

However, Starling Bank is not alone among UK challenger banks to have introduced new fees.

Last week we reported that competitor Monzo had introduced a 3% fee for any UK and European Economic Area customers withdrawing more than £250 in cash within 30 days. The digital lender also introduced a £5 fee for replacing cards.

Like Starling Bank, Monzo have recently reported massive losses due to the fallout of Covid-19. Its post-tax loss for 2020 had jumped to £113.8m, up from the £47.1m recorded in 2019.

Their rival Revolut also reported that its losses had grown in the past year. Its losses trebled from £32.8m in 2018 to £107.4m in 2019.

The losses recorded by the British leading neobanks have raised concerns about the sector’s viability, especially given that the WealthTech sector as a whole could be heading towards its worst year in years.

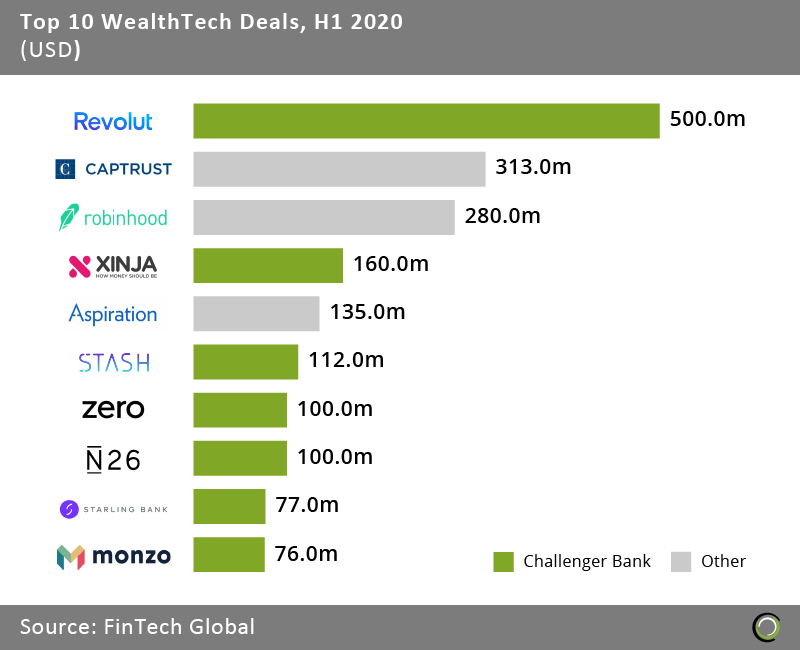

For some context, it is worth remembering that challenger banks account for a big part of the investment going in the WealthTech sector. If we look at the first six months of 2020, then seven of the biggest deals in the sector in the digital banking sector, according to FinTech Global’s research. Those deals were Revolut, Xinja, Stash, Zero, N26, Starling Bank and Monzo.

But Covid-19 has certainly had an impact on the WealthTech sector by eradicating many potential users’ disposable income, meaning they would be less inclined to use the services of the sector.

But Covid-19 has certainly had an impact on the WealthTech sector by eradicating many potential users’ disposable income, meaning they would be less inclined to use the services of the sector.

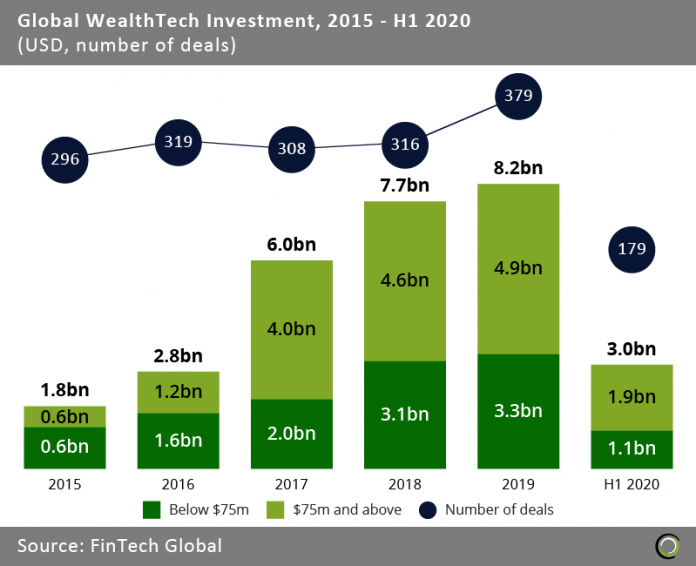

And the slowdown is noticeable, with the sector as a whole only completing 179 rounds and having $3bn injected into the sector between January and June, meaning it could be en route towards having one of the worst years of investment since 2017 when the industry raised $6bn.

That would mean the end of a long winning streak for the sector. Back in 2015, the global WealthTech sector attracted $1.8bn across 296 rounds. Over the next four years the number of deals and the amount injected into the industry grew expectationally until the record year of 2019 when investors invested $8.2bn across 379 deals into WealthTech companies.

Another potential cause for concern is that UK challenger bank Tandem has been revealed to having instigated a pivot away from its credit card business and moving towards homeowner financing instead.

Another potential cause for concern is that UK challenger bank Tandem has been revealed to having instigated a pivot away from its credit card business and moving towards homeowner financing instead.

The company has reportedly also suffered a 40% down round in August that saw its valuation drop from £150m to £90m.

Copyright © 2020 FinTech Global