African FinTech investment stats in Q1 2023:

• African FinTech deal activity in Q1 2023 reached 37 deals, a 69% drop YoY

• African FinTech funding ended the quarter at $331m, a 17% reduction from Q1 2022

• Nigeria was the most active country for FinTech dealmaking in Africa during Q1 with 12 deals, a 32% share of total deals

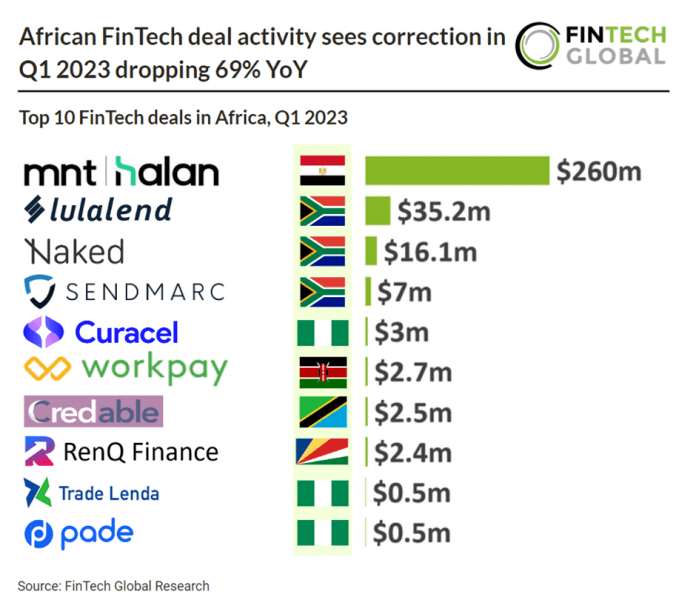

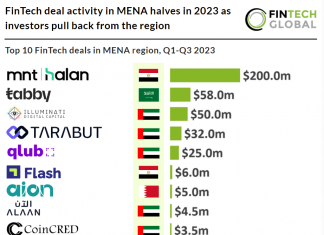

African FinTech deal activity and investment took a substantial hit in Q1 2023 compared to last year. African FinTech deal activity reached 37 deals in Q1 2023, a 69% drop from the same period in 2022. African FinTech investment saw a less dramatic 17% drop to $331m in Q1 2023 YoY. Removing MNT-Halan’s deal, African FinTech companies only raised $71m in Q1 2023. The largest deal in Q1 2022 was from m-kopa ($75m), which provides connected asset financing solutions. When removing these two large deals from the figures, African FinTech investment in Q1 2023 dropped 78%.

MNT-Halan, an Egyptian digital lender, was the largest African FinTech deal in Q1 2023 after their latest $260m private equity round, led by Chimera Investment. The round propelled them to unicorn status with a post-money valuation above $1bn. Chimera Investment has invested more than $200 million in equity in exchange for over 20% of the company. MNT-Halan plans to expand internationally after its growth in Egypt and progress on the swap agreement between Halan and Netherlands-based microlending platform MNT Investments. The offerings aim to “reflect the high quality, diversity, and granularity of the combined securitized loan books, consisting of 246,000 contracts and a robust cash pay-back ability.”

The most active FinTech subsector in Africa during Q1 2023 was PayTech with nine deals, a 24% share of total deals. The second most active was Lending Technology with seven deals, a 19% share of deals and InsurTech and RegTech were joint third with four deals each.

Africa is set to have the highest growth for digital payments (total transaction value) of any region globally at a CAGR of 16.1% from 2023 – 2027. In total Africa is on track to have a total transaction value of $146bn, a 1.5% share of global transaction value in 2023.

The most active FinTech country during Q1 2023 in Africa was Nigeria with 12 deals, a 32% share of total deals. South Africa was the second most active FinTech country with six deals, a 16% share of deals and Kenya was third with five deals, a 14% share of deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global