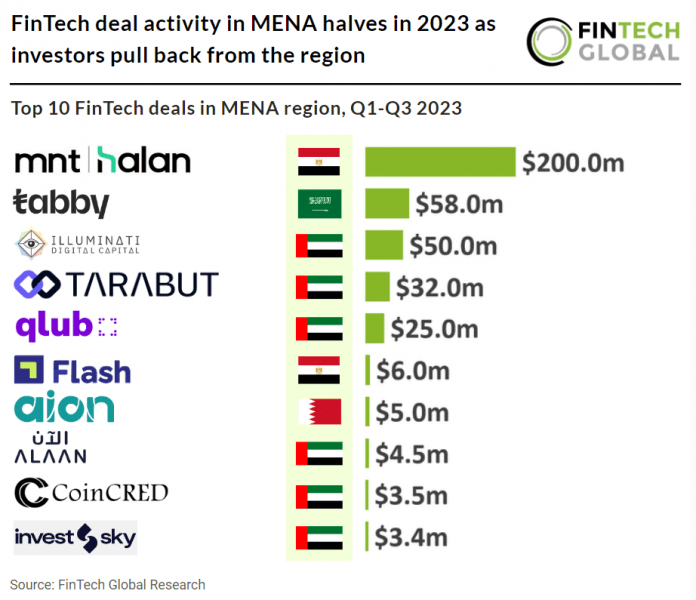

Key MENA FinTech investment stats in Q1-Q3 2023:

• FinTech companies in the MENA region raised $428m in Q1-Q3 2023, a 75% drop from the same period in 2022

• FinTech deal activity in the MENA region reached 89 deals in Q1-Q3 2023, a 50% reduction from the same period last year

• The United Arab Emirates (UAE) was the most active FinTech country in the MENA region with a 51% share of deals.

FinTech activity in Middle East and North Africa (MENA) region has seen a considerable drop in Q1-Q3 2023 YoY. FinTech transaction volume in MENA area amounted to 89 transactions from Q1 to Q3 in 2023, marking a 50% decrease compared to the same timeframe in the previous year. This is similar to other regions such as Europe which saw a 56% decrease over the same period. In the first three quarters of 2023, FinTech companies operating in the MENA region secured $428m in funding, marking a significant 90% decrease compared to the same period in 2022.

MNT-Halan, an Egyptian digital lender, was the largest FinTech deal in the MENA region during Q1-Q3 2023 after their latest $200m private equity round, led by Chimera Investment. The round propelled them to unicorn status with a post-money valuation above $1bn. Chimera Investment has invested more than $200m in equity in exchange for over 20% of the company. MNT-Halan plans to expand internationally after its growth in Egypt and progress on the swap agreement between Halan and Netherlands-based microlending platform MNT Investments. The offerings aim to “reflect the high quality, diversity, and granularity of the combined securitized loan books, consisting of 246,000 contracts and a robust cash pay-back ability.”

The United Arab Emirates (UAE) was the most active FinTech country in the MENA region with a 51% share of deals. Egypt was second most active with 12 deals, a 13% share of deals and Saudi Arabia was the third most active FinTech country with 10 deals, a 11% share of deals.

The UAE government is actively encouraging sustainability through attractive tax incentives for green FinTech ventures, promoting innovation, financial expansion, and environmental responsibility. Aligned with the UAE Vision 2030, which underscores the reduction of carbon emissions, resource conservation, and economic diversification, the UAE offers several tax incentives. These include exemptions from corporate income tax for FinTech companies in designated free zones that meet sustainability criteria, Value Added Tax (VAT) benefits for green FinTech firms, investment and innovation incentives such as R&D grants and support for sustainable projects, customs duty waivers for eco-friendly technology imports and exports, reduced tariffs to bolster sustainable FinTech growth, and specialized funds and programs to finance and uplift green projects in the FinTech sector with favourable terms and conditions.