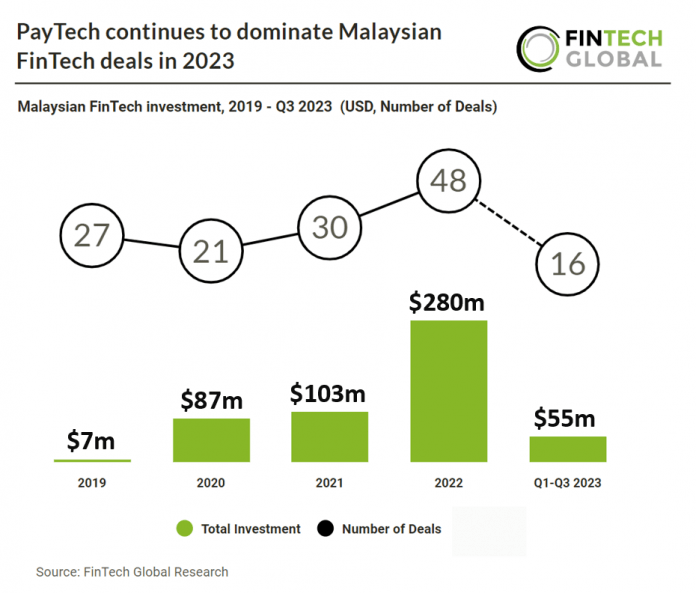

Key Malaysian FinTech investment stats in Q1-Q3 2023:

• Malaysian FinTech companies are on track to raise a combined $73m in 2023, a 74% reduction from 2022

• Malaysian FinTech deal activity is expected to reach 21 transactions in 2023, a 55% drop from the previous year

• PayTech was the most active Malaysian FinTech subsector with five deals in Q1-Q3 2023

Malaysian FinTech has seen a downturn in 2023 although this is in line with global averages. It is anticipated that there will be a 55% decrease in Malaysian FinTech deal activity in 2023, which is predicted to reach a total of 21 deals, compared to the previous year. In 2023, Malaysian FinTech firms are expected to secure a collective funding of $73m, reflecting a significant 74% decrease compared to the funding they raised in 2022.

SoftSpace, which offer a payment platform solution for financial institutions, had the largest FinTech deal in Malaysia during Q1-Q3 2023 after raising $31.5m in their latest Series B funding round, led by Southern Capital Group. The funds will be utilized to support the company’s ongoing growth and expansion. Soft Space has demonstrated robust growth in recent years, with its revenue nearly doubling in the last 2 years. Currently, Soft Space’s full-stack payment services are employed by over 70 financial institutions and partners across Japan, Europe, Oceania, and the Americas. Joel Tay, Chief Executive Officer of Soft Space, said “Building on our strong momentum, the new funds will help expand our global footprint and widen our customer base by accelerating the innovation of our full-stack payments platform while expanding into next generation technological solutions.”

PayTech was the most active Malaysian FinTech subsector with five deals in Q1-Q3 2023, a 31% share of deals. Lending Technology was the second most active FinTech subsector with three deals. The Malaysian payments market size was estimated at $183bn in 2023. The market is expected to reach $313bn in the next five years, registering a CAGR of 11.4% during the forecast period.