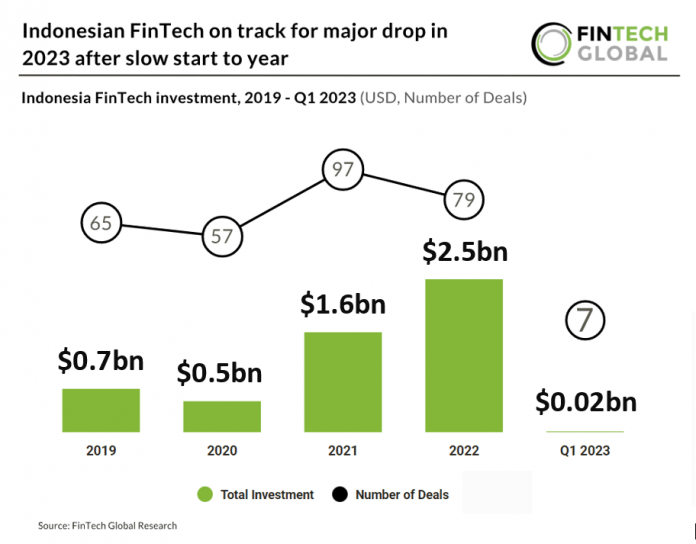

Key Indonesian FinTech investment stats in Q1 2023

• Indonesia’s FinTech sector recorded its lowest investment quarter in past five years with only $17m raised in Q1 2023

• Indonesian FinTech deal activity on track to reach 28 deals in 2023 based on Q1 levels, a 65% drop from the previous year

• InsurTech was the most active Indonesian FinTech subsector in Q1 2023 with two deals

Indonesia saw a very rocky start to their year with investment and deal activity dropping considerably.

Indonesian FinTech companies raised a combined $17m in funding during Q1 2023,a 97% drop from Q1 2022. FinTech deal activity also faltered in the country during Q1 2023, dropping 65% YoY. Charles Wong, the co-founder and managing partner of Southeast Asia-focused venture capital firm TNB Aura, sees the drop in deal value as a reflection of higher standards in the region’s startup ecosystem. “Gone are the years of unsustainable ‘value-transfer’ from one stakeholder to the next via extreme discounts and promotions. If companies are not generating a step-change in terms of value for their ecosystems, they do not deserve to extract any of said value from it,” he said.

Komunal, a peer-to-peer lending platform, was the largest Indonesian FinTech deal in Q1 2023, raising $8.5m in their Series B funding round, led by East Ventures. This fresh fund will be used towards the company’s mission, which is to accelerate financial inclusion and strengthen the neo-rural bank ecosystem in Indonesia, especially outside the Greater Jakarta area. Hendry Lieviant, CEO of Komunal, said, “We are humbled by the overwhelming support from our investors, rural bank partners, and loyal users. It was very fulfilling to see how digitalization has helped our rural bank partners to thrive during the pandemic recovery period and enabled our loyal users to access attractive deposit and loan products digitally. In 2023, we hope to reach a wider market, particularly BPR users and partners outside of Java and Bali.” In 2022, Komunal has channelled $230m (equivalent to IDR 3.6 billion) worth of deposits and loans to local BPRs and MSMEs. This represents 350% YoY growth compared to 2021, where the number of deposits and loans disbursed was 50m (IDR 781 billion). Transaction volume is expected to exceed $500m by 2023. In addition, Komunal has also recorded positive EBITDA since October 2022, experiencing growth and profitability at the same time.

InsurTech was the most active FinTech subsector in Q1 2023 with two deals, a 29% share of total deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global