Key global FinTech investment stats in April 2023:

• Global FinTech deal activity reached 475 transactions in April 2023, a 12% decrease from April 2022

• Global FinTech investment totalled at $406m in April a 47% drop from the same month last year

• The USA was the most active FinTech country in April with a 49% share of deals

FinTech deal activity and investment in April both dropped from the level’s recorded over the same month last year. In April 2023, there were 475 FinTech deals globally, indicating a 12% decline from the number of deals recorded in April 2022. Global FinTech investment in April amounted to $406m, indicating a YoY decrease of 47%. Average deal size dropped from $2.1m in April 2022 to $0.85m in April 2023.

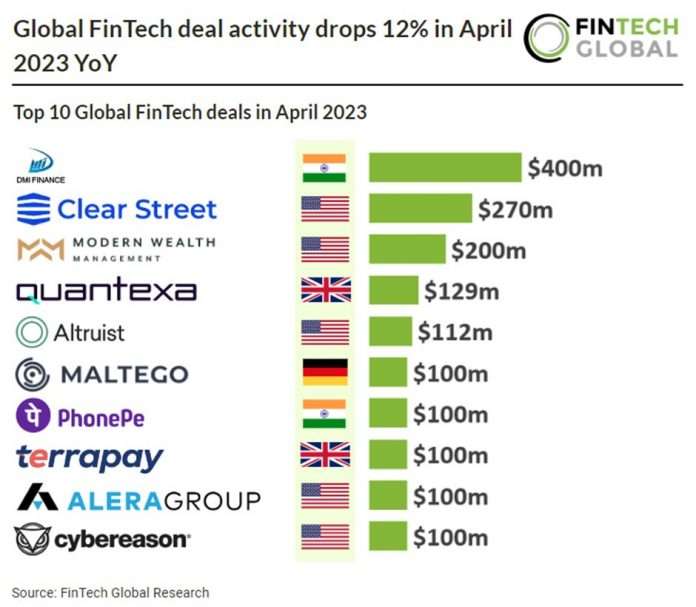

DMI Finance, a digital lending provider, was the largest FinTech deal in April 2023, raising $400m in their latest private equity funding round, led by MUFG Bank. According to a release by DMI Finance, it sources and services customers through multiple digital channels and is an embedded digital finance partner of choice for leading businesses including Samsung, Google Pay and Airtel. DMI Finance claims to cover 95% of India’s pin codes and has an accessible customer base of 25m, which is expected to grow to over 40m in FY24. It is expecting to disburse over $2.5bn in FY24.

The USA dominated FinTech deal activity in April 2023 with 235 deals announced, a 49.4% share of total deals. The UK was the second most active FinTech country with 35 deals, a 7.3% share of deals. India was the third most active FinTech country in April 2023 with 18 deals, a 3.7% share of total transactions.

Looking forward in 2023, trending sectors such as Blockchain & Crypto will likely see a drop in deal activity. Blockchain & Crypto was the most active FinTech sector in April 2022 and 2022 as a whole but has fallen to the third most active in April 2023 with 70 deals, a 14.7% share of total deals. RegTech is the only FinTech sector which has grown from 2022 with 91 deals in April 2023, a 66% increase YoY. This can be attributed to the continued disruptiveness of the CyberTech subsector. RegTech deal size has still dropped overall by 51% in April 2023 YoY.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global