Key Nordic FinTech investment stats in Q1 2023:

• Investment in Nordic FinTech companies reached $137m in Q1 2023, a 77% drop from Q1 2022

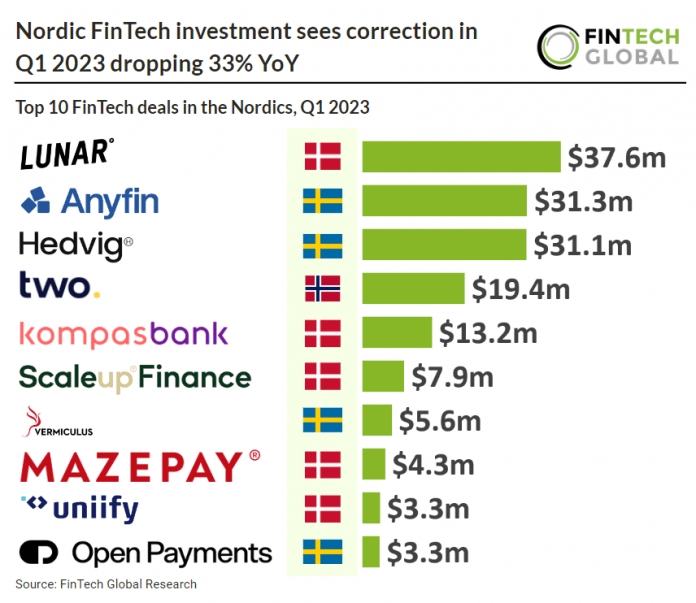

• FinTech deal activity in the Nordics totalled at 23 deals in Q1 2023, a 33% drop YoY

• Sweden was the most active Nordic FinTech country with 10 deals, a 43% share of total deals in the region

FinTech in the Nordics saw a troubling start to the year with both investment and activity recording double-digit drops. Investment in Nordic FinTech companies raised eyebrows after a significant 77% drop YoY to $137m in Q1 2023. Deal activity in the region also declined, although less dramatic to 23 deals in Q1 2023, a 33% reduction from Q1 2022.

Lunar, a digital bank, had the largest Nordic FinTech deal Q1 2023 raising $37.6m to extend their Series D funding round from eight investors. Lunar previously closed a Series D-2 extension round of $77m back in November last year, alongside the launch of a new cryptocurrency service. This funding round was raised at a $2bn valuation, according to a report from TechCrunch. Operating throughout the Nordic countries, Lunar currently has 500,000 retail customers and 15,000 business customers. Lunar CEO Ken Villum Klausen said, “The capital markets that we and other similar companies raise money in have changed completely, with earnings now becoming the key focus. Last year we improved our product, attracted more customers, and increased our revenue streams significantly. “We will continue to do so in 2023 and the years to come because the market needs a serious challenger in the industry.”

Sweden was the most active FinTech country in the Nordics during Q1 2023 with 10 deals announced, a 43% share of total deals in the region. Denmark was close behind with eight deals, a 35% share and Norway was third with three deals, a 10% share.

Central bank digital currency (CBDC) is an area of development that has garnered interest from central banks in the Nordics. Sweden has made significant progress in its CBDC efforts through the e-krona project, conducting investigations and testing the technical solution. Denmark, on the other hand, remains sceptical about CBDCs due to perceived challenges and unclear benefits. Norway has initiated tests for CBDC and is exploring its use for international retail and remittance payments. Finland, being part of the Eurozone, has the advantage of relying on investigations into the Digital Euro conducted by the European Central Bank (ECB). Iceland conducted an early investigation into the advantages and disadvantages of a CBDC but has not announced any public developments in this area since then.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global