Key Israeli FinTech investment stats in Q1 2023:

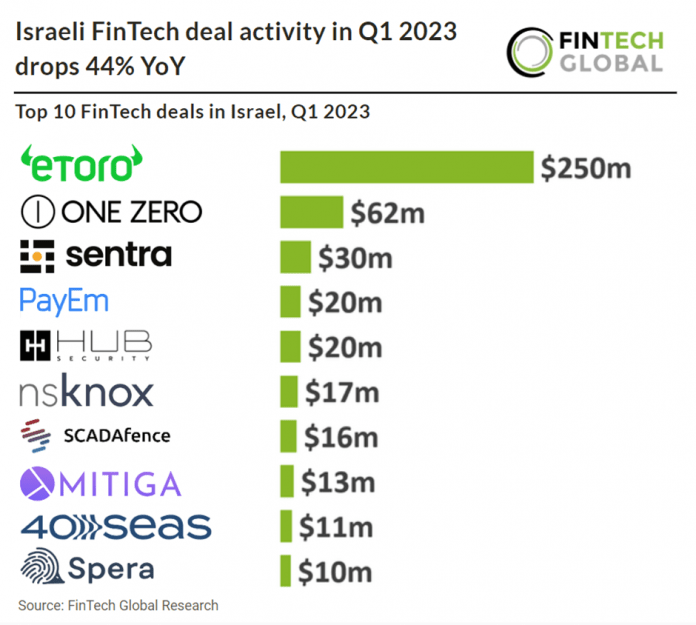

• Israeli FinTech deal activity reached 29 deals in Q1 2023, a 44% drop YoY

• Israeli FinTech companies raised a combined $512m during the opening quarter, a 48% drop from Q1 2022

• CyberTech was the most active FinTech subsector in Israel during Q1 2023

Israel’s FinTech sector saw a disappointing start to the year with both deal activity and investment reducing considerably compared to the previous year. Israeli FinTech deal activity in Q1 2023 experienced a significant decline of 44% compared to the previous year, with a total of 29 deals recorded. In Q1 2023, Israeli FinTech companies collectively raised $512m, marking a substantial decrease of 48% compared to the funding raised in Q1 2022.

eToro, a social investment and trading platform, had the largest Israeli FinTech deal in Q1 2023 after raising $250m in their latest corporate funding round. Investors include ION Group, Social Leverage, SoftBank and Spark Capital. This funding came from an Advance Investment Agreement (AIA) which eToro entered into in February 2021 as part of its proposed SPAC transaction. The company also acquired options trading app Gatsby to continue the diversification of eToro’s US offering after the launch of stocks and ETFs, and Bullsheet, a provider of portfolio management tools designed exclusively for eToro users. eToro is also expanding its global footprint by partnering with regulators around the world in the evolution of the digital assets ecosystem securing registrations in France, Italy, and most recently a licence in New York. It also secured an in principle approval to operate as a broker in Abu Dhabi.

During Q1 2023, CyberTech emerged as the most active subsector within the Israeli FinTech industry with 15 deals, a 52% share of total deals. WealthTech was the second most active sector with four deals and Blockchain & Crypto was the third most active with three deals.

The Israeli Ministry of Finance promoted a regulatory change for the regulation of the payment services industry, under which the supervision over payment services will be excluded from the authority of the Capital Market, Insurance and Savings Authority and will be moved to the Israeli Securities Authority. The legislation process is expected to be concluded during 2023.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global