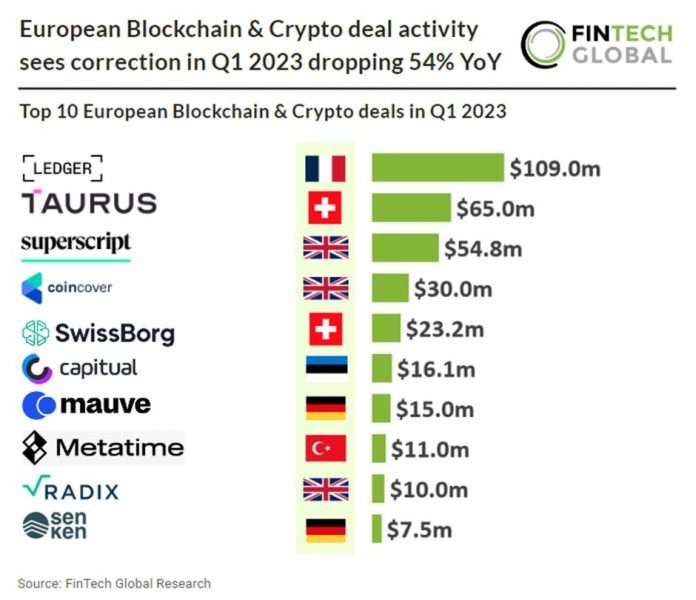

Key European Blockchain & Crypto investment stats in Q1 2023:

• European Blockchain & Crypto companies raised a combined 72 deals in Q1 2023, a 54% reduction from Q1 2022

• The UK was the most active Blockchain & Crypto country in Europe with 16 deals, 22% share of total deals

• European Blockchain & Crypto companies raised a combined $413m in Q1 2023, a 79% drop from Q1 2022

During the opening quarter of 2023, European Blockchain & Crypto companies secured a total of 72 funding rounds, representing a significant decrease of 54% compared to the same period in Q1 2022. During Q1 2023, European Blockchain & Crypto companies collectively raised $413m, in funding, indicating a substantial decline of 79% compared to Q1 2022. Based on the investment in Q1 2023 Blockchain & Crypto is on track to raise $1.6bn, a 70% drop from 2022.

Ledger, which provides security and infrastructure solutions to critical digital assets, was the largest Blockchain & Crypto deal in Q1 2023 raising $108m to extend their Series C funding round. The extension round maintained the company’s valuation at €1.3 Billion. The company intends to use the funds to further its global ambitions and accelerate its drive to support blockchain innovation. Led by Pascal Gauthier, Chairman and CEO, Ledger is a global platform for digital assets and Web3. With more than 6M devices sold to consumers in 200 countries and 10+ languages, 100+ financial institutions and brands as customers, 20 % of the world’s crypto assets are secured, plus services supporting trading, buying, spending, earning, and NFTs.

The UK was the most active blockchain & Crypto country in Europe with 16 deals, 22% share of total deals. Switzerland was a close second with 11 deals, a 15% share of total deals and France was third with nine deals.

In May 2023 the European Council adopted new rules on markets in crypto-assets. MiCA, or the Markets in Crypto-Assets Regulation, is a regulatory framework introduced in the European Union. It aims to protect investors and promote transparency by establishing comprehensive rules for issuers and service providers in the crypto-asset sector. These rules encompass utility tokens, asset referenced tokens, stablecoins, trading venues, and crypto asset wallets. The framework also emphasizes compliance with anti-money laundering regulations. By harmonizing regulations across the EU, MiCA seeks to enhance financial stability, encourage innovation, and make the crypto-asset sector more appealing, addressing the limitations of national legislation in certain member states.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global