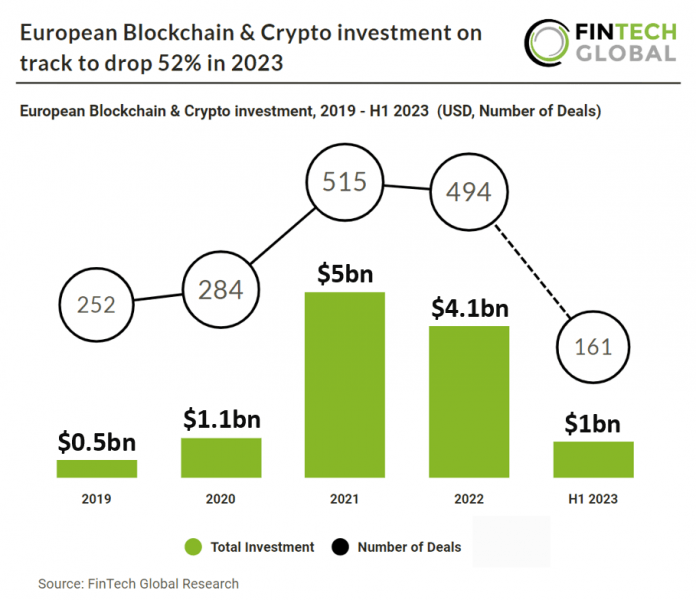

Key European Blockchain & Crypto investment stats from 2019 to H1 2023

• European Blockchain & Crypto investment from 2019 – 2022 has increased at a CAGR of 52%

• European Blockchain & Crypto deal activity is on track to reach 322 deals in 2023, a 35% drop YoY

• European Blockchain & Crypto deal activity reached 161 deals in H1 2023, a 49% drop from H1 2022

Europe’s Blockchain & Crypto sector within FinTech has experienced extreme growth in the past five years and has finally started to cool off in 2023 with deal activity and investment dropping significantly. This can be attributed to the drop in funding in general and the decrease in hype around Blockchain & Crypto. The investment in European Blockchain & Crypto sectors between 2019 and 2022 exhibited a Compound Annual Growth Rate (CAGR) of 52%. European Blockchain & Crypto deal activity is expected to reach 322 deals in 2023, a 35% drop from 2022. In the first half of 2023, the European Blockchain & Crypto deal activity amounted to 161 transactions, demonstrating a 49% decrease compared to the same period in 2022.

IslamicCoin, a native currency of Haqq that focuses on empowering the Muslim community with a financial instrument for the digital age, had the largest European Blockchain & Crypto deal in H1 2023, raising $200m in their latest private equity round, led by ABO Digital. Islamic Coin, a digital money platform catering to the global Muslim community, has secured a significant funding round of $400 million. This funding surpasses prominent players in the crypto industry such as Circle, BlockFi, and Solana, making it one of the largest funding rounds in crypto history. Islamic Coin has garnered international recognition, including accolades like the Most Promising ESG Crypto at the Abu Dhabi Blockchain Awards. The partnership with ABO Digital will enable Islamic Coin to introduce its Shariah-compliant financial products to the ABO network of investors and access up to $200 million for future growth. ABO Digital CEO Amine Nedjai expressed excitement about collaborating with Islamic Coin and praised their ambitious project as a revolutionary force in the Shariah-compliant market.

In May 2023 the European Council adopted new rules on markets in crypto-assets. MiCA, or the Markets in Crypto-Assets Regulation, is a regulatory framework introduced in the European Union. It aims to protect investors and promote transparency by establishing comprehensive rules for issuers and service providers in the crypto-asset sector. These rules encompass utility tokens, asset referenced tokens, stablecoins, trading venues, and crypto asset wallets. The framework also emphasizes compliance with anti-money laundering regulations. By harmonizing regulations across the EU, MiCA seeks to enhance financial stability, encourage innovation, and make the crypto-asset sector more appealing, addressing the limitations of national legislation in certain member states.