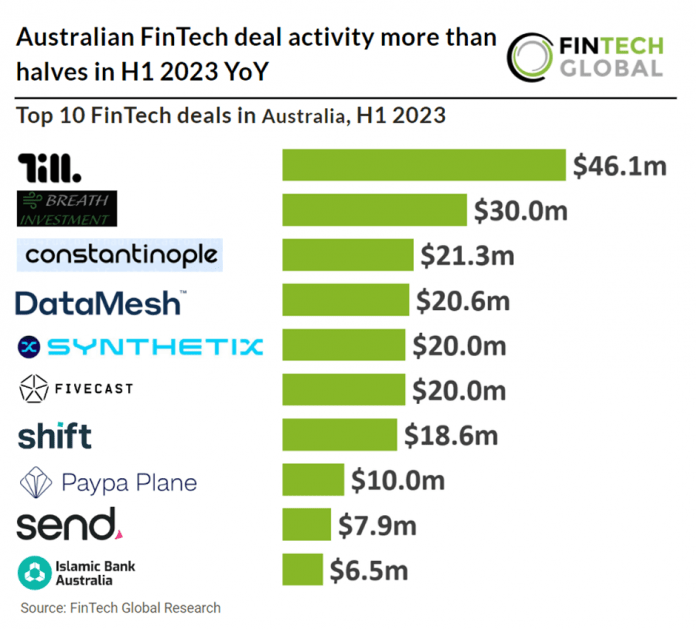

Key Australian FinTech investment stats in H1 2023:

• Australian FinTech deal activity reached 47 transactions in H1 2023, a 55% reduction from the same period last year

• Australian FinTech companies raised $239m in aggregate funding during the first six months of the year, a 69% drop compared to 2022

• PayTech and WealthTech were the two most active FinTech subsectors with nine deals each

Australian FinTech has seen a significant drop in investment activity in the first half of 2023 with both funding and deal activity dropping significantly and at a higher rate than the global average. In the first half of 2023, the number of Australian FinTech deals amounted to 47, reflecting a significant 55% decrease compared to the same period in 2022. This is eight percentage points more than the global average. During the first half of 2023, Australian FinTech firms collectively secured $239m in funding, marking a substantial 69% year-over-year decline.

Till, which provide intelligent payment and revenue assurance systems, had the largest Australian FinTech deal in H1 2023, raising $46.1m (A$70m) in their latest Series D funding round, led by Silva Fortune. The money was to be used for global expansion, but high inflation and tough economic conditions forced a retreat for the firm and the recent sacking of 120 staff in the UK, North America and Australia. The company has since revised its strategy with a fresh focus on sustainable growth and fast-tracking profitability. Till’s existing investors have demonstrated their confidence in our plans for the company and our renewed and prudent approach to governance,” says non-executive director, Matt Davey. “We look forward to delivering strong organic growth underwritten by a disciplined approach to operations. Over the past year, the company has witnessed a remarkable surge, with transaction volumes skyrocketing by 300% and its merchant base expanding by 200%. Additionally, they are on the verge of introducing a new Core Acquiring Platform, which will provide Till with direct access to Payment Networks on a global scale.

PayTech and WealthTech were the two most active FinTech subsectors with nine deals each, a 19.1% share of deals each. RegTech was the second most active FinTech subsector with seven deals, a 14.8% share of deals.

The ASX (Australian Securities Exchange) continues to progress its plans to adopt a blockchain-based technology for its clearing and settlement system called CHESS. A likely update will occur in H1 2023. CHESS stands for Clearing House Electronic Subregister System and is the computer system used by the ASX to manage the settlement of share transactions and to record shareholdings. In practical terms, it allows brokers and other market participants to settle trades via CHESS by themselves or on behalf of their clients.