The coronavirus pandemic has forced insurers to review their pricing models, but adopting new tech solutions to do that could have many benefits.

Covid-19 has changed people’s behaviours. As countries around the world went into lockdown or enforced other social distancing measures, people have been less inclined to leave home, meaning the risk of them getting into accidents have dropped. The question is what this has meant for the way insurers price their policies.

This was the topic at a recent webinar hosted by FinTech Global and that drew insights from InsurTech100 company Akur8 as well as McKinsey & Company, and Prima.it.

Speaking at the webinar, Anne-Laure Klein, COO at Akur8, explained that the venture was particularly well placed to discuss this topic. “We are a solutions provider to the insurance industry dedicated to the pricing use case,” she said. “What we do is allowing insurers to automate their pricing processes with a transparent AI-based technology.”

In other words, Akur8 consists of experts in how insurers can reinvent themselves and boost their pricing capabilities.

During the pandemic, the French startup has noticed a growing need for its services. “The breadth and depth of insurers’ reaction to the Covid-19 context is unprecedented, as this is not a sector that is known for its real time reactivity,” she says.

Indeed, several industry stakeholders have previously noted that the insurance sector has been good at paying lip service to modernisation, but that few have really taken the time to fully embrace the digital revolution to the extent seen in other industries.

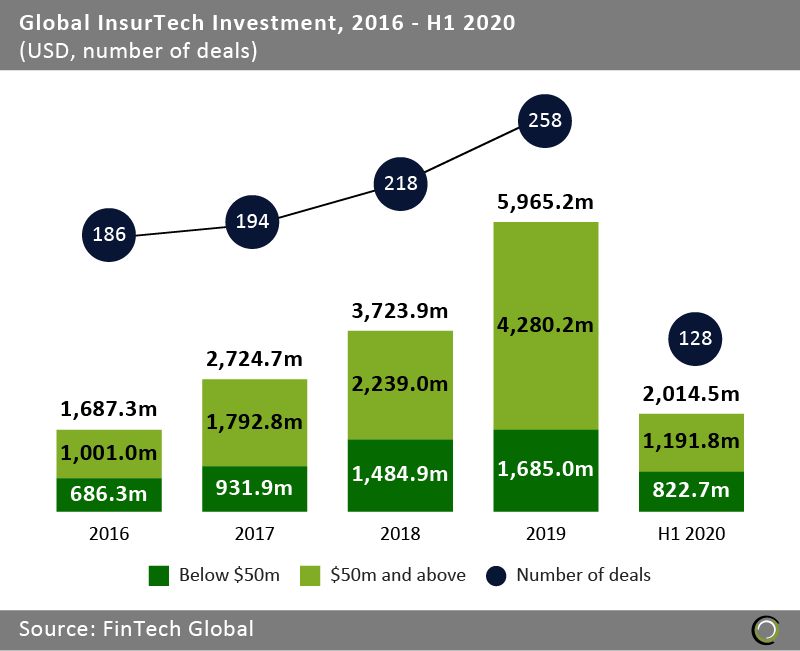

Although, over the past few years there have been signs that things are changing. For instance, investment into InsurTech ventures have grown tremendously since 2016. That year, $1.68bn were invested into the global industry, according to FinTech Global’s research. By 2019, that figure had skyrocketed to $5.96bn.

And then, despite the pandemic or thanks to it depending on your point of view, the InsurTech sector has raised $4.5bn in the first three quarters of 2020.

And then, despite the pandemic or thanks to it depending on your point of view, the InsurTech sector has raised $4.5bn in the first three quarters of 2020.

And now, several experts have argued that the coronavirus health crisis could be just the push needed for insurers to realise the need for more modern services.

Akur8 has noticed this trend too. “As a response to Covid-19, we’ve seen a lot of marketing campaigns from insurers to adapt to the new context, particularly on mature policies as customers were expecting immediate compensation and value redistribution in a context of falling miles driven, falling number of claims and overall decreasing customer purchasing power,” Klein said.

The Akur8 team has seen that insurers’ efforts to respond to the changing environment can be divided into two categories. “The first category is an overall value or distribution envelope that is spread evenly across customer segments of an existing customer portfolio with little or no specific targeting,” Klein explained.

“These redistribution efforts also serve communication purposes, to show policyholders that insurers were in solidarity with them. And the second category is premium discounts, targeting new customers or renewals, clearly addressing the challenge of retention or acquisition. And these efforts served the purpose of maintaining top line growth or at least stability despite the context. ”

She noted the pandemic has changed the risk profiles people. For instance, while age, gender and geography have been pretty stable factors in determining risk of individual drivers, the crisis has transformed how people use their cars. And not just during lockdown. “There is no back to normal but really a new normal that is different from the pre-Covid times,” Klein said.

And businesses are changing with the times. “[The] best in class [insurers] that we have seen have engaged in timely risk risk reassessment to adjust their commercial investment to this challenging context,” said Klein.

Those insurers who have been able to upgrade their pricing techniques have been able to be provide policies better prised to and able to change with the evolving demands of customers. “Being able to factor in the price elasticity or sensitivity of customers, whether for renewals or new customer acquisitions, allows them to maximise the impact of their marketing campaigns, not only for them, but also for the end customer,” she says.

“And being able to account for such effects in your pricing strategy in a real time context, like Covid shows an advanced maturity stage. speed to market is even more key when it comes to demand based pricing. Because when you take into account factors like price, elasticity and competitors prices and your pricing models, it is crucial to update your models very frequently, much more than risk models, as the cost of outdated models can be very high.”

You can find out more about the webinar and what else they talked about here as well as the entire InsurTech100 2021 list here.

Copyright © 2020 FinTech Global