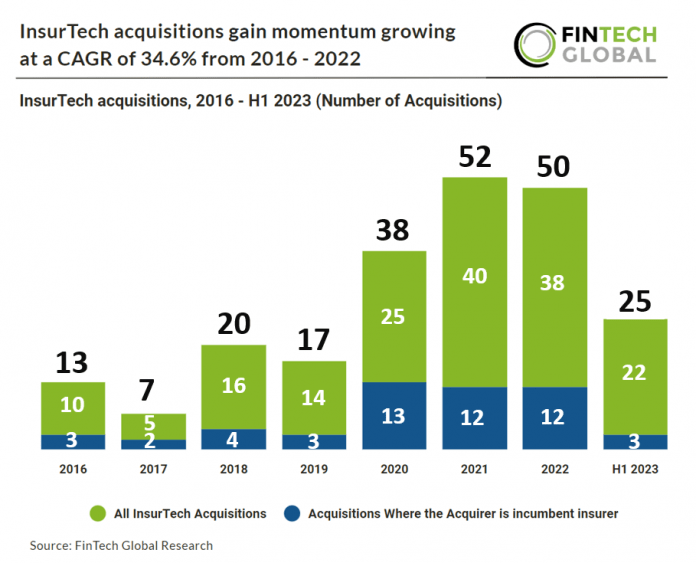

InsurTech acquisitions have increased in popularity from 2016 to 2022 although incumbent insurers haven’t kept up with the market’s speed. David Wechsler, a principal at OMERS Ventures says, incumbent insurers seem to stay away from InsurTech M&As so far, but lower valuations might be an opportunity to acquire portfolio and, most of all, digital customer journeys for reasonable prices. InsurTech acquisitions have seen significant growth with a CAGR of 34.59% from 2016 – 2022. InsurTech acquisition activity is expected to reach 50 acquisitions, based on acquisition activity in H1 2023.

InsurTech firms have faced significant setbacks in the recent market downturn market, starting in Q3 2022, particularly those that went public in 2021. A noteworthy example is Metromile, which witnessed a staggering drop of over 85% in its valuation. Consequently, it was acquired by its counterpart Lemonade. Metromile’s experience isn’t unique, as several other companies have also suffered considerable value losses and garnered attention from both competitors and established players. This drop in public markets is also trickling down to the private sector. It’s evident that certain private InsurTechs might encounter challenges when seeking their next round of funding. However, the downturn isn’t as dire as pessimists portray it to be. David Wechsler said “We are simply seeing a reality check happen,”. “If the last round was done at too high of a valuation, the market will force it back in line. Unfortunately, there are many companies that should not have raised as much as they did, or perhaps don’t have sustainable business models. These companies will struggle to survive.” In the absence of easy funding, the InsurTech private market seems ripe for M&A, several investors pointed out. “As InsurTech valuations have become more realistic, many companies are probing, looking for M&A opportunities,” Wechsler said. “I believe the next 12 to 18 months will have lots of interesting deals really invigorating the ecosystem and creating a lot more excitement for investors to come back in and at the correct prices.”

Broker Buddha, which provide software to streamline insurance applications and renewals, was the latest InsurTech acquisition, acquired by Acturis, a saas insurance provider, to accelerate Acturis’ growth and reach new heights. In a press release Acturis said Broker Buddha and Acturis are a natural fit. Both companies are committed to providing innovative insurance technology solutions that help insurance agencies to improve their efficiency and profitability. We believe that the combination of our two companies will create a powerful force in the insurance technology space. We are excited about the future of Broker Buddha, and we believe that this acquisition will allow us to achieve our full potential. We look forward to working with Acturis to create new and innovative solutions that will transform the insurance agency industry.