Out of the 29 FinTech funding rounds we reported on last week, cybersecurity companies, InsurTechs and challenger banks were among the clear winners.

Cybersecurity company FireEye, InsurTech venture Hippo and neobank startup Current raised the biggest rounds out of the 29 recorded last week in the FinTech sector. So let’s take a closer look at each of these segments of the industry.

FireEye’s raise came on the back of the cybersecurity sector having noted a big jump due to the pandemic. Covid-19 has motivated cyber criminals to increase their activities and trying to leverage the health crisis to launch more ransomware, phishing, financial frauds and other scams. Consequently, the cost of security breaches has also gone up since the coronavirus outbreak.

Given the rise in hack attacks and a huge number of employees still working from their kitchen tables, it’s hardly surprising that the pandemic has pushed companies and governments to rethink their cybersecurity strategies.

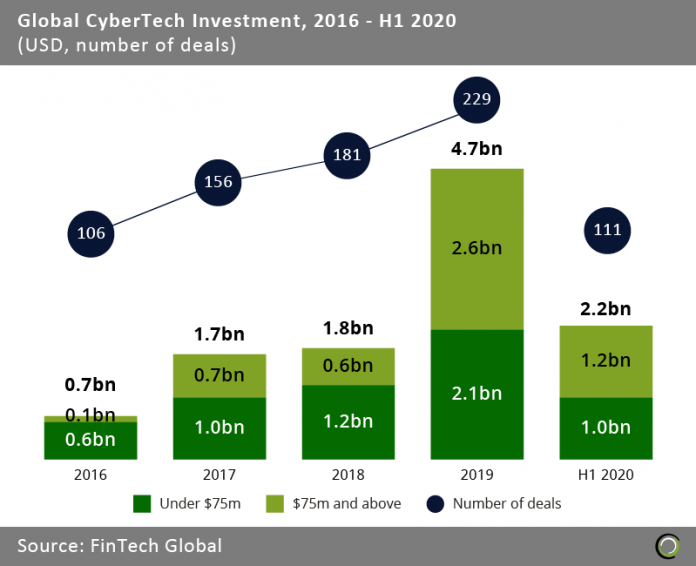

Interestingly though, investment into the CyberTech space has dropped over the last year. In the first half of 2020, only $2.2bn were injected into the sector, a far cry from the the $4.7bn invested in 2019, according to FinTech Global’s research.

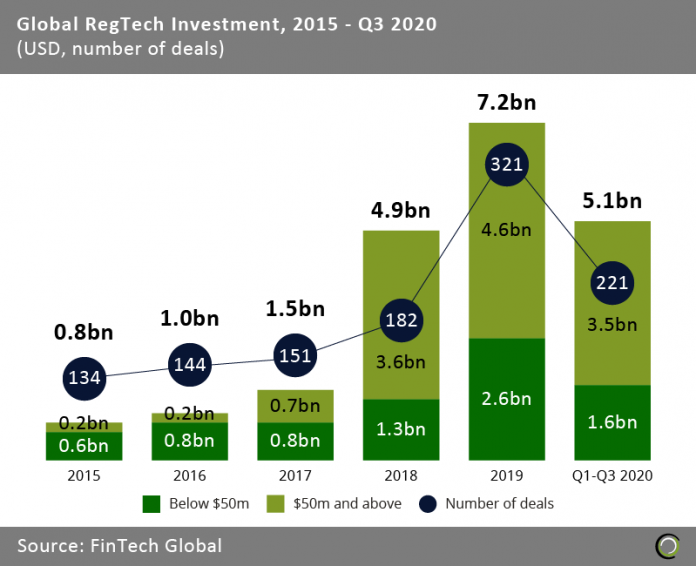

Looking at the RegTech industry as a whole, of which the cybersecurity segment is a part of, it looks like investment in the sector is set for its first investment decline since 2015, according to FinTech Global’s research. While deal activity recovered in the third quarter this year, Covid-19 has shrunk investors’ appetite to invest into the industry.

Looking at the RegTech industry as a whole, of which the cybersecurity segment is a part of, it looks like investment in the sector is set for its first investment decline since 2015, according to FinTech Global’s research. While deal activity recovered in the third quarter this year, Covid-19 has shrunk investors’ appetite to invest into the industry.

Now, let’s head over to the InsurTech industry where Hippo raised a £350m mega round last week. The raise came after interest in the InsurTech industry has seemingly spiked over the past few months with US-based InsurTech Lemonade that successfully went public in July and Root Insurance following with an initial public listing of its own in October.

Now, let’s head over to the InsurTech industry where Hippo raised a £350m mega round last week. The raise came after interest in the InsurTech industry has seemingly spiked over the past few months with US-based InsurTech Lemonade that successfully went public in July and Root Insurance following with an initial public listing of its own in October.

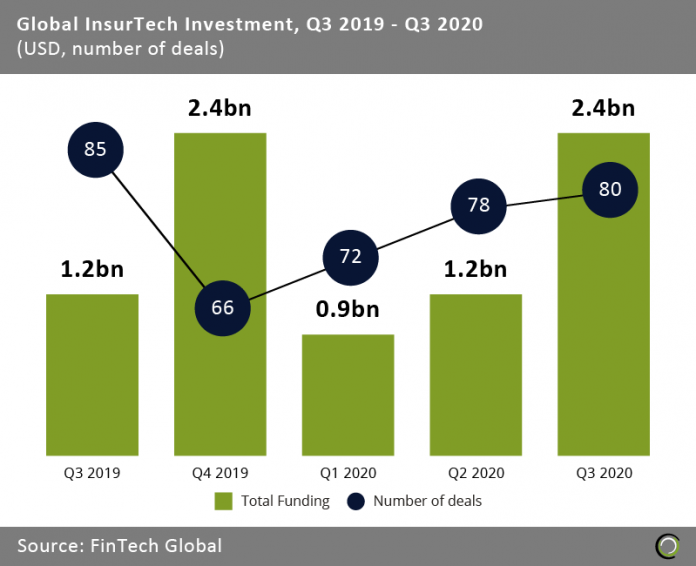

Looking at investment into the InsurTech industry as a whole, the sector had a reasonably slow start to 2020. The industry only raised about $900m between January and March, according to FinTech Global’s research. Just like for the RegTech space, investment was affected by the coronavirus, with investors becoming more conscious with their money in the face of the market uncertainty. Nevertheless, investment has picked up in the last two quarters. The sector raised $1.2bn in the second quarter and a whooping $2.4bn in the third, according to FinTech Global’s research.

This gives credence to the market experts we spoke to at the beginning of the pandemic who argued that the industry could prove to be one of the big winners to come out of the global health crisis. Their argument is that the pandemic has demonstrated, with almost painful clarity, how much the insurance industry is in dire need of innovation.

This gives credence to the market experts we spoke to at the beginning of the pandemic who argued that the industry could prove to be one of the big winners to come out of the global health crisis. Their argument is that the pandemic has demonstrated, with almost painful clarity, how much the insurance industry is in dire need of innovation.

Recent Scanbot research backs that up, suggesting that only 42% of health insurers in Europe have a consumer facing app, despite the rising importance of digitalisation.

No matter how you cut it, the last few weeks have been huge for challenger banks. First, Revolut’s CEO and co-founder Nik Storonsky was named the UK’s first tech billionaire, having a calculated networth of £1.06bn. Then Starling Bank became the second challenger bank in the UK to have reached profitability. The first was business-focused neobank OakNorth, which became profitable within six months of its launch in 2015.

And the rise of the neobanks is still happening, with Current, HMBradley and OakNorth all having been in the news over the past week for having raised big investment rounds.

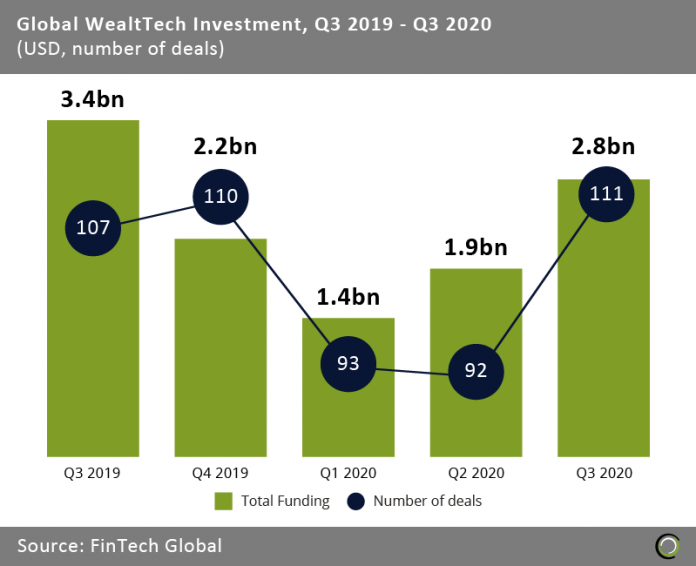

The news about those raises came as the global WealthTech is set to snap back after only raising $3.3bn in the first half of 2020, a 41% decline compared to the capital raised in the preceding two quarters, according to FinTech Global’s research.

However, the sector recovered with a five-quarter high between July and September, raising $2.8bn in total. The extra influx was led by US-based challenger bank Chime’s $485m Series F round, which saw the company become the US’ most valuable consumer-focused FinTech with a valuation of $14.5bn.

The sector rebounding was also fuelled by seven large deals over $100m, including three rounds totalling $980m raised by Robinhood, a commission-free investing platform.

Wit all that taken care of, let’s look at the 29 FinTech rounds from last week that you cannot afford to miss out on.

FireEye secures $400m in a strategic investment

Intelligence-led security platform FireEye has received a $400m strategic investment led by Blackstone Tactical Opportunities. Cybersecurity-focused investment firm ClearSky also contributed to the round. FireEye will use the new fund to fuel further development of its cloud platform and managed services. Cybersecurity-focused investment firm ClearSky also contributed to the round. This money will also support FireEye’s recent acquisition of Respond Software, a digital security investigation automation company.

Hippo secures $350m investment

Hot on the heels of securing its unicorn status this summer, Hippo has now bagged $350m in a new investment round. The Palo Alto-based InsurTech received the capital raise from Mitsui Sumitomo Insurance Company, which is a subsidiary of MS&AD Insurance Group Holdings. Hippo will use the money in order to achieve its goal of covering 95% of American households.

Current bags $131m as it eyes further growth

Last week we reported that the US-based neobank Current had secured $131m in a Series C funding round. Tiger Global Management led the raise, which was also supported by, Sapphire Ventures, Avenir, Foundation Capital, Wellington Management Company and QED Investors. With the new money, Current has raised over $180m in total. The neobank now has a valuation of $750m.

Kredivo receives $100m debt facility

Indonesian digital credit platform for retail borrowers Kredivo reportedly bagged $100m in a debt facility to facilitate more consumer loans. The capital was supplied by Victory Park Capital Advisors, a Chicago-based credit specialist, marking its first deal in Southeast Asia.

Paddle secures $68m in its Series C

B2B SaaS platform Paddle has enjoyed a $68m Series C raise to continue to scale. FTV Capital, Kindred Capital, Notion Capital and 83 North were behind the venture adding additional cash to its coffers.

IceKredit secures $33m Series C1 round

Anti-fraud and risk management tech startup IceKredit has raised $33m in a Series C1 round. Guoxin Venture Investment led the raise. Guohe Capital, Yunqi Partners, and China Creation Ventures also participated.

IceKredit will use the cash injection fund further expansion of its development team, investments and acquisitions, and improving its business ecosystem.

OakNorth closes $30m investment

OakNorth stands apart among its UK neobank peers for one particular reason: it was profitable within six months of its launch in 2015. The company has continued to scale since and has famously been able to reasonably weather the Covid-19 crisis and has now received a $30m investment from Japan-based bank Sumitomo Mitsui Banking Corporation (SMBC).

Through the deal, OakNorth will provide its credit software to SMBC with insights into its commercial loan book and borrowers in the US and Asia. It will also supply it with process automation and portfolio monitoring capabilities.

True Balance said to raise $28m in its Series D round

South Korea-based True Balance has reportedly collected $28m in its Series D round, as it expects to reach profitability next year. SoftBank Ventures Asia, Naver, BonAngels, Daesung Private Equity and Shinhan Capital supported the round. True Balance will use the funds to help it break even and then pursue profitability. It also hopes to reach more unbanked consumers in India.

CyberTech DefenseStorm locks down $19m in new capital

Cybersecurity and cyber compliance company DefenseStorm has added $19m to its coffers to support its growth. The investment was divided in two parts. The first consisted of a Series B round worth $12m led by Georgian and supported by TTV Capital. The second was made up of $7m in growth capital financing from CIBC Innovation Banking. DefenseStrom will use the cash injection to accelerate the further development of DefenseStorm’s capabilities.

Sofia closes $19m Series A round led by Index Ventures

Sofia, a telemedicine and insurance startup, has reportedly received $19m in its Series A investment round. Index Ventures led the raise, marking the investor’s first investment into a Latin American company. Kaszek Ventures and Ribbit Capital also backed the round. By working with the new investors, Sofia is looking to increase its footprint and user activity.

HMBradley picks up $18.25m in Series A round

After officially launching earlier in 2020, US neobank HMBradley has secured a $18.25m Series A funding round last week. Acrew Capital, which was an early investor in US challenger bank Chime, led the raise. The challenger bank will use the new cash injection to fuel the growth of its credit programme and continue expanding offerings built around consumer needs.

PureFacts secures $15.39m in new round

WealthTech venture PureFacts Financial Solutions has picked up a $15.39m investment from Scotiabank and Round 13 Capital. The company is a provider of fees, reporting and AI-powered predictive analytics solutions. PureFacts will use the money to fuel its global growth plans and fund potential acquisitions, including the recently announced acquisition of Quartal Financial Solutions.

Novidea secures $15m Series B

Insurance software developer Novidea has closes its Series B round on $15m, as it looks to capitalise on its strong growth. Technology investment firm JAL Ventures led the investment, with contributions also coming from previous Novidea backers KT Squared and 2B Angels. Novidea will use the money to scale its platform and to fund its international expansion plans.

WeGift secures an $8m Series A extension

Last week we reported that gift card company WeGift had closed a $8m Series A extension raise. The investment was led by AlbionVC, with previous WeGift backers Stride.vc, SAP.iO fund and Unilever Ventures also contributing. WeGift will use the money to invest into its supply chain via direct integrations with brands. It will also use the funds to increase its product development.

Ubiq Security secures $6.4m

Developer-focused security platform Ubiq Security has closed its seed round on $6.4m, as it looks to increase customer acquisition. The round was led by Okapi Venture Capital, with support also coming from TenOneTen Ventures, Cove Fund, DLA Piper Venture, Volta Global and Alexandria Venture Investments. Capital from the round will be used to accelerate platform development, increase customer acquisition and improve developer relations.

Paceline scores $5m in its seed round

Paceline, which offers financial benefits for health living, has scored $5m in its seed round. Montage Ventures and Propel Venture Partners co-led the raise. Northwestern Mutual Future Ventures, Courtside Ventures, GreatPoint Ventures, Lux Capital, Clocktower Technology Ventures and NextView Ventures also backed the raise as did a smattering of angel investors, including BlackRock senior managing director Mark McCombe.

TransferGo secures £4m credit facility

Money remittance platform TransferGo is said to have secured a £4m credit facility. The debt line was supplied by Silicon Valley Bank and will enable the FinTech to develop and expand its real-time payments services. Users of TransferGo can make low-cost international money transfers to 62 countries and their local currencies. The FinTech previously raised $10m in a funding round back in June from Seventure, Vostok Emerging finance, Hard Yaka, Revo Capital and Bootstrap Europe.

Weavr closes $4m in its seed funding round

Embedded banking software developer Weavr has closed its seed round on $4m, as it launches its first suite of tools aimed at the services sector. The investment was supported by Anthemis, QED Investors and Seedcamp.

Cashfree closes $35.3m Series B round

Digital payments app platform Cashfree has reportedly secured $35.3m in its Series B funding round. Apis Partners served as the lead investor to the Indian startup’s round, with contributions also coming from previous Cashfree backer Y Combinator.

Cashfree offers payment processing technology that enables companies in India to access digital transactions. Its tools also include auto collect, which automatically track customer payments with virtual bank accounts.

Qara secures $3m in new funding

South Korea-based Qara, which has built an AI-powered robo-advisor, has reportedly raised $3m in funding. Mirae Asset x Naver, Nexon’s NXC, and Kingsley Asset Management backed the raise. Qara will use the money to fiund the launch of its new trading service early in 2021 and to source more talent for its teams.

Globe reportedly bags $3m investment

There has been a lot happening in the cryptocurrency space recently. Not only has bitcoin climbed tremendously in value recently and even encouraged celebrities like the Game of Thrones star Maisie Williams to invest in it, but the digital exchange Coinbase has also been accused of harbouring a racist and discriminatory workplace culture. On top of that, the Faceook-led Libra Association is seemingly set to launch its cryptocurrency some time in 2021, after having dealt with a huge pushback from regulators, lawmakers and other critics over the last year.

Adding to the cacophony, we reported last week that cryptocurrency derivative exchange Globe had bagged a $3m investment to help it build a suite of new features. The capital was supplied by Pantera Capital, Y Combinator, Tim Draper and other unnamed investors. Once launched, the company hopes to provide everyone with access to invest into cryptocurrency.

EarlyBird secures $2.4m

EarlyBird, which enables parents and guardians to establish custodial investment accounts for children, has closed its funding round on $2.4m as it prepares for its launch.

Network Ventures served as the lead investor, with contributions also coming from Chingona Ventures, Bridge Investments, Kairos Angels, Takoma Ventures and Subconscious Ventures. A number of unnamed angel investors also contributed to the round.

Productfy said to close seed round on $2.35m

Productfy, which empowers companies to build secure financial applications, has reportedly raised $2.35m in its seed round. Point72 Ventures led the round, with contributions also coming from Envestnet Yodlee Incubator. With the close of the round, the company has raised a total of $2.4m in equity since it was founded in 2018.

Vennfi nets $2.3m to support the growth of its charity platform

Tax-exempt payments FinTech Vennfi has netted $2.3m in a seed round to support the development of its charity account services. Angel investor Tom Blaisdell served as the lead investor, with participation also coming from Teamworthy Ventures, Duro.vc, Sovereign’s Capital and Promus Ventures also contributed to the round. Vennfi’s flagship platform is Charityvest. It enables anyone to create a tax-deductible charitable giving account known as a donor-advised fund. These act as a personal charitable foundation.

Ibancar secures €1.65m round

Cloud-based consumer credit platform Ibancar has netted €1.65m in an equity round led by Knuru Capital. A syndicate of internet entrepreneurs and senior finance executives also backed the round. Funds will be used to help Ibancar to increase its lending capacity, increase product development, bolster marketing efforts and make key hires as well as expanding across Europe.

Detected bags £600,000 in seed capital

Business verification platform Detected has secured £600,000 in a funding round led by EmergeVest alongside a smattering of angel investors. Detected will use the new funds to fuel further product development, continued commercialisation and its global expansion plans. The round comes after it closed a pre-seed round worth £250,000 in September. Detected is planning on launching its AI-powered platform in early December.

Paysme secures £268,520 in oversubscribed crowdfunding round

Last week we reported that the SME-focused FinTech startup Paysme had secured £268,520 on its Seedrs campaign so far. Since then, it has further smashed its original £250,000 targer by raising £270,310 from 72 investors in total. Founded in 2010, the company claims to have £1.6m in revenue and to have been integrated into a network of 12,000 taxis across the UK.

Advice Analytics has secures $235,000 in investment

San-Diego-based Advice Analytics is a retirement plan compliance platform. Last week we reported that it had won $235,000 at the Seattle Angel Conference. The 28th annual competition was the first to accept companies from outside Seattle, due to being held virtually. The RegTech claims to have built their product in just two months, launching ahead of schedule and under budget.

TerraMagna has raised its seed round

TerraMagna, an agriculture FinTech company, has closed its seed round on an undisclosed amount. The investment was led by ONEVC, with contributions also coming from MAYA Capital, Accion Venture Lab and a series of angel investors.

Copyright © 2020 FinTech Global