Australia-based MoneyMe has reportedly snagged $50m as part of a strategic partnership with Pacific Equity Partners.

The capital has been earmarked to accelerate the growth of MoneyMy’s product suite and build car financing tools as well as other new features, according to a report from Sydney News Today.

It claims the funds will also help MoneyMe support the expansion of its securitisation warehousing program. It will also be able to repay its AUD 22m ($16.1m) secured note facility.

MoneyMe provides consumers in Australia with access to a variety of digital loans. Loans available include personal, cash, quick cash, cash advance, short-term, small loans and more. It also offers a selection of credit cards, including virtual credit cards and interest-free cards.

Pacific Equity Partners managing director Jake Haynes told Sydney News Today, “MoneyMe is considered to be the leading platform in consumer rental space with great talent, technology, products and constant efforts to provide our customers with great services and innovative solutions… We are impressed with our achievements and look forward to helping MoneyMe achieve its growth ambitions.”

Earlier this month, fellow Australian FinTech company Timello secured $270m in a debt facility from Goldman Sachs. The company has issued a total of $1.5bn in loans to customers and helping businesses improve cashflow.

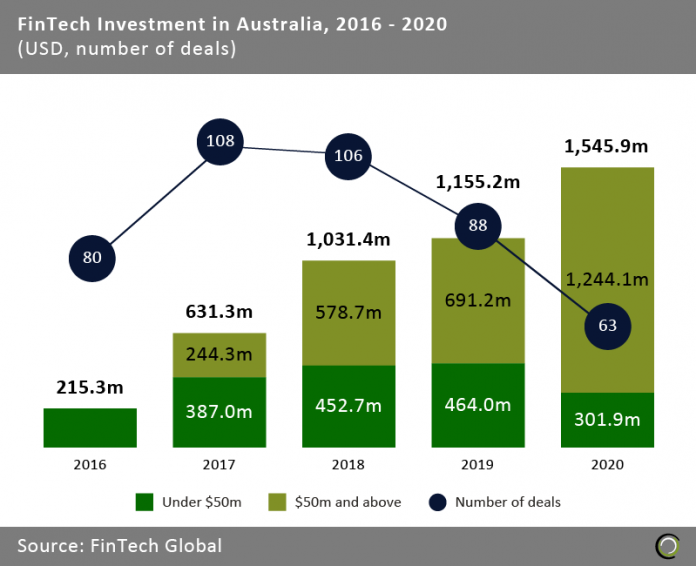

Australian FinTech hit a new record in 2020, according to FinTech Global data. A total of $1.5bn was invested through 63 deals, compared to 2019, where $1,1bn was distributed through 88 deals.

Copyright © 2021 FinTech Global

Copyright © 2021 FinTech Global