RegTech proved popular this week in the dealmaking world, accounting for seven of the total 28 deals completed.

Across the 28 FinTech funding rounds, a total of $832m was raised, of which, $747m was secured by the ten biggest deals of the week. As mentioned, the RegTech sector secured the most number of deals, raising a combined total of $223m. OneTrust, a data governance firm, recorded the largest RegTech funding round of the week ($150m) and was the second biggest deal, falling just behind credit card provider Mercury Financial’s $200m debt facility.

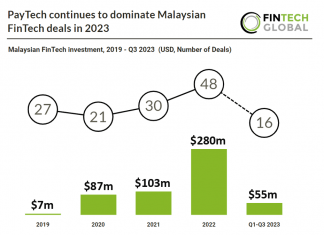

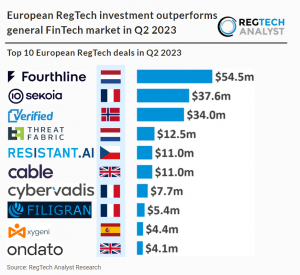

This strong week for RegTech matches an overall shift in the market. European RegTech investment outperformed the general FinTech market in Q2 2023, according to research by FinTech Global. However, while it is doing better than the rest of the market, there are still signs of struggle during a tough financial market. There were 58 deals in Q2, a 6% decline compared to the same period in 2022 and the companies raised $208m in aggregate during Q2 2023, a 77% reduction YoY.

Just behind RegTech this week was PayTech, which recorded 5 funding rounds, including this week’s biggest deal. The other PayTech deals of the week were raised by GlossGenius, Croissant, SquadTrip and Sunrate. Collectively, these five companies raised $253.5m.

Marketplace lending and WealthTech companies both accounted for four deals apiece, and raised $217.9m and $86m, respectively. Settle, Auxilo Finserve, Lumi and SuperFi were the marketplace lending companies, and bunq, GIMO, Immediate and AgenaTrader were the WealthTechs.

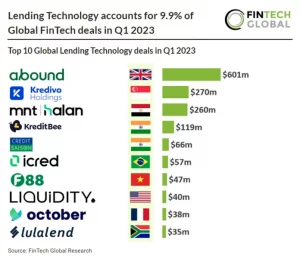

Marketplace lending has proved to be a very popular sector this year. In. fact, there were 134 Lending Technology deals globally in Q1 2023, a 9.9% share of total FinTech deals, according to research from FinTech Global.A combined $2.2bn was raised by Lending Technology companies in Q1 2023 and the US was the most activity country in the sector, with 44 deals completed.

With marketplace lending becoming a highly competitive market, firms are looking at how they can stand out. FinTech Global recently spoke to several industry players about how automation can transform the customer experience and improve the market appeal. The general consensus was that failing to adopt new ways of engaging with customers quickly could see a firm fail to keep clients.

Karen Oakland, VP of Industry Marketing for Financial Services at Smart Communications, explained, “Too many lenders still lean on traditional print and mail correspondence to provide updates. The explosion in the number of communications channels and the increasing number of customer decisioning touch points across the credit lifecycle make it critical that lenders have the tools to facilitate these real-time, anytime conversations with customers.”

Back to this week’s funding rounds, there were three CyberTech deals this week (Trustmi, Cyclops and Data443 Risk Mitigation), pulling in a total of $24.9m. Finally, BankLabs was the only infrastructure and enterprise software company to secure capital this week.

The USA accounting for the lion share of the FinTech deals has become a regular sight, apart from a couple of weeks ago when Europe took the reins. This week, the US was home to 15 deals, including five of the top ten. On top of this, it was responsible for the three biggest deals, Mercury Financial, OneTrust and Settle. The other US companies to secure funds were GlossGenius, Croissant, Immediate, Ennabl, Effectiv, Modives, Data443 Risk Mitigation, SquadTrip, BankLabs, ASA, Aembit and Data Safeguard.

There is a huge drop for the country with the second most deals, which was the UK with just three (eflow Global, Percayso Inform and SuperFi). Canada and Israel each secured two deals. These were MindBridge and Foxquilt in Canada and Trustmi and Cyclops in Israel.

The other countries represented this week were, Australia (Lumi), Austria (AgenaTrader), India (Auxilo Finserve), the Netherlands (bunq), Singapore (Sunrate) and Vietnam (GIMO).

Here are this week’s 28 FinTech funding rounds.

Mercury Financial secures $200m for its credit card business expansion

The credit card provider for middle-class Americans, Mercury Financial, has announced the successful closure of a $200m debt facility.

Aiming to drive growth in their business, the debt facility comes courtesy of funds managed by Neuberger Berman.

The newly acquired funding of $200m was sourced from client funds managed by Neuberger Berman. This significant financial boost is aimed at furthering the expansion of Mercury’s credit card business, targeting middle-class Americans who are often overlooked by conventional banks.

In providing financial services, Mercury utilises an innovative business model. Leveraging proprietary data and over 100 million data points, the company is able to better identify and underwrite their customers, aiming to provide a prime credit card experience. The usage of its patent-pending digital toolset, notably its oculus mobile app, allows Mercury to engage effectively with its customers while promoting healthy credit use.

With the new injection of funds, Mercury plans to initiate additional credit card accounts and expand its existing cardmember relationships. Furthermore, it intends to innovate new capabilities to enhance customer experience, thereby fulfilling its mission of improving the financial lives of middle-class Americans.

Mercury’s current reach extends to 36 million middle-class Americans, a demographic largely ignored by traditional banks and non-bank lenders alike. The company’s CFO, Jason Whiting, pointed out the regulatory limitations faced by banks and high fee products of subprime lenders that often lead to continued financial stress.

Data governance provider OneTrust secures $150m in new funding

At the heart of the ever-evolving world of data governance is OneTrust, a company known for its innovative approach to data privacy and transparency.

Founded in Atlanta in 2016, the firm has quickly become a global name in the realm of data privacy and governance.

OneTrust’s latest stride comes in the form of a $150m funding round, which has now elevated the firm’s valuation to a whopping $4.5bn. This financial milestone has been achieved with the backing of leading investors including Generation Investment Management and Sands Capital, a previous investor in the company.

Diving into the essence of OneTrust, it offers a unique trust intelligence platform. This platform is designed to empower organisations with the ability to visualise, manage, and meet compliance requirements for the data that enters their sphere. With its suite of privacy and security compliance tools, OneTrust caters to organisations of all sizes, embedding a holistic approach to trust in their operations.

The fresh infusion of funds is set to support the company’s growth plans, meeting the escalating demand for its trust intelligence software. The firm is unyielding in its commitment to advancing data governance, security, privacy, and compliance.

Despite a valuation dip from last year’s $5.1bn and a reduction in workforce by 950 employees, OneTrust has managed to maintain an active customer base of over 14,000 – a number that has more than doubled since 2020. The firm currently has more than 2,000 employees and continues to influence the data governance landscape with its advanced solutions.

Cash-flow FinTech champion Settle secures colossal $145m credit facility

Leading cash-flow management platform, Settle, has recently secured an impressive $145m credit facility.

The hefty investment comes from Silicon Valley Bank, a division of First Citizens Bank, and significantly boosts Settle’s potential to support high-growth e-commerce, consumer brands, and small businesses.

Settle has strategically positioned itself as a cash-flow management platform dedicated to e-commerce and consumer brands with challenging inventory and cash conversion cycles. The platform centralises key operations, including vendor payments, payment status tracking, invoice management, and application for flexible financing solutions. Currently, hundreds of consumer brands, such as Branch, Starface, and Lalo, rely on Settle to manage their cash-flow and secure their inventory needs with Settle Working Capital.

The new financing will be utilised to expand the firm’s customer base and further develop its suite of lending products for larger e-commerce and consumer brands. The credit facility will support business owners’ needs by providing the tools necessary to adapt to changing market conditions. Amidst the inherent volatility of the capital markets, the secured funding gives Settle the power to assist growing brands in changing their business trajectories.

PSG Equity propels MindBridge’s global growth with hefty $60m investment

Indian Auxilo Finserve secures ₹470cr to boost financial education sector

Auxilo Finserve, an Indian non-banking finance company (NBFC) specialising in education finance, has recently declared the successful procurement of ₹470 crores ($57m) in primary equity capital.

The substantial capital injection comes from several reputable investors including Tata Capital Growth Fund II, Trifecta Leaders Fund – I, and Xponentia Opportunities Fund – II, along with the existing shareholder, ICICI Bank Limited. The closure of this transaction awaits the necessary regulatory greenlights.

In operation since 2017, Auxilo Finserve grants loans to students for education both domestically and internationally, and supports educational institutions with infrastructure and working capital needs. With a reach extending to over 900 universities in over 25 countries, the company has fulfilled the dreams of over 7,500 students and assisted more than 150 educational institutions with their financial requirements.

The newly acquired capital is set to be utilised for fuelling Auxilo’s growth ambitions. The company plans to expand its loan base, diversify product offerings, and pioneer innovative financial solutions for its clientele.

Additional information reveals Auxilo’s impressive growth. The company’s Assets under Management (AUM) grew at a rate of 51% CAGR from FY20 to FY23, totalling ₹ 1,691 crores as of March 31, 2023. With over 250 employees, the company operates from seven key cities in India.

Dutch FinTech leader bunq nets additional €44.5m ($49.1m) in thriving growth year

Netherlands-based digital banking platform, bunq, continues to make financial headlines with its remarkable progress.

The company recently secured an additional €44.5m in a funding round, which further bolstered its market valuation to a formidable €1.65bn. The investment was led by current investors Pollen Street Capital and included participation from bunq’s Chief Information Officer, Raymond Kasiman, and the bank’s founder and CEO, Ali Niknam.

A household name in the burgeoning FinTech industry, bunq is renowned for its innovative digital banking solutions. It delivers seamless banking experiences for its steadily growing user base, which recently crossed the 9 million mark, accounting for over €4.5bn in deposits. The firm’s consumer-centric approach and user-friendly technology have made it a standout player in the digital banking sphere.

The fresh capital injection will fuel bunq’s forward momentum. Plans are already underway to leverage the funding to facilitate further expansion and sustain the company’s impressive deposit growth. Bunq is committed to establishing its dominance in the digital banking market, with a strong focus on continued innovation and customer satisfaction.

This funding round is not the first significant investment for bunq this year. Despite a challenging market, the neobank has demonstrated commendable financial resilience, securing nearly €100m this year alone.

The company, founded in 2012, was bootstrapped until 2021. It then hit a landmark milestone, recording the largest series-A ever raised by a European FinTech at €193m, which included €168m from London-based private equity firm Pollen Street Capital and a €25m reinvestment by Niknam.

GlossGenius lands $28m in series C funding

GlossGenius, a ‘business-in-a-box’ platform catering to small businesses within the beauty and wellness industry, has recently announced a funding success.

The firm has secured $28m in a series C funding round, with the primary investment contributed by the Growth Fund of L Catterton, a well-regarded global consumer-focused investment firm. Additional participants in this round included Bessemer Venture Partners and Imaginary Ventures, further bolstering GlossGenius’ financial backing.

GlossGenius, with its innovative platform, is instrumental in empowering small business owners across the US to manage their operations seamlessly, construct a cohesive client experience, and foster the growth of their businesses. With billions of dollars transacted annually on the platform and a triple-digit business growth percentage over the last year, GlossGenius has established itself as one of the quickest growing companies in the industry.

The new funding is earmarked for the acceleration of GlossGenius’ platform development. The funds will primarily be used to enhance the existing suite of consumer experience, payment, and automation products, in line with its recent series of releases.

This is the second time in the last 12 months that GlossGenius has seen an up-round in funding, bringing the total funding amount to an impressive $70m to date. The additional capital will not only aid GlossGenius’ ongoing innovation but also enable the company to offer more sophisticated products and services to the beauty and wellness industry.

Croissant’s revolutionary FinTech platform kicks off with $24m seed funding

In a significant leap towards transforming the future of commerce, Croissant, a mission-driven FinTech platform, recently unveiled itself with a robust $24m seed funding from prominent investors.

The distinguished investors in the seed round included Portage, and KKR co-founders George Roberts and Henry Kravis. The funds were instrumental in propelling the MVP launch of Croissant, helmed by an elite founding team. The team comprised Co-Founder and CEO John Howard (ex-KKR), Co-Founder and CTO John Klose (formerly Amazon, PayPal), and Head of Product Vrishti Mongia (ex-Meta, Moda Operandi).

Croissant’s platform revolutionises merchants’ existing shopping experiences, by guaranteeing a buyback value to customers at checkout, thereby enhancing conversion and the average order value. The FinTech startup employs data science and AI to generate the guaranteed buyback values for customers, and fulfils these guarantees. After purchase, items become liquid assets within customers’ Croissant accounts, which can be sold easily. This recycling of funds and goods enhances customer retention rates and lifetime value.

John Howard, CEO of Croissant, shed light on the changing landscape of e-commerce. He emphasised that conventional seamless payment options are no longer sufficient. For a merchant to truly excel, they need to trigger consumer psychology around the purchase decision in empowering and effortless ways. He added, “Croissant contributes to a richer, more vibrant commerce experience for everybody.”

Partially developed as a counter to consumer debt-focused offerings, Croissant shifts the shopping paradigm from a credit-driven consumption to an asset ownership model. This innovative approach boosts purchasing power and financial empowerment for users, resulting in increased conversions, average order value, and customer retention.

Vietnamese FinTech GIMO’s $17.1m funding fuels mission to bridge financial inclusion gap

Vietnamese social impact FinTech startup, GIMO, which focuses on delivering flexible pay and financial well-being solutions for underbanked workers, has announced the successful completion of a $17.1m Series A funding round.

This funding round, a blend of equity and debt financing, comes only five months after GIMO secured an initial $5.1m. Leading the round was TNB Aura, with significant participation from existing backers including Integra Partners, Resolution Ventures, Blauwpark Partners, ThinkZone Ventures, and Y Combinator. Global corporate ventures such as Genting Ventures, TKG Taekwang, George Kent, and AlteriQ Global, an Asia-focused private credit financier, joined as new investors.

GIMO strives to empower underbanked employees in Vietnam by providing them with access to earned wages on demand. By offering mobile-enabled financial solutions, GIMO assists these workers in bettering their financial lives and increasing financial inclusion. Despite the economic slowdown in 2023, GIMO has demonstrated a solid 15% growth rate, currently serving 500,000 employees from medium to large-sized multinational manufacturing companies across Vietnam.

The new funds will propel GIMO’s expansion and innovation across its product portfolio. The company plans to allocate a significant portion of the funding to enhance research and development efforts, accelerating product development and introducing more social impact initiatives. These initiatives aim to assist underbanked workers in evading debt traps and improving their financial well-being.

Moreover, a segment of the funding will be utilised to augment GIMO’s customer success and support initiatives, ensuring top-tier services for its users. Additionally, GIMO aims to use the funding to forge strategic alliances with key partners and industry leaders to foster collaboration and launch new social impact initiatives.

Cybersecurity firm Trustmi bolsters payment security with $17m funding

Trustmi, a cybersecurity-focused FinTech firm, today celebrated its global launch, aiming to revolutionise business payment security.

Founded in Israel in 2021, Trustmi provides businesses with a comprehensive, end-to-end solution that aims to protect their bottom line from losses arising from cyberattacks, internal collusion, and human error.

The firm has successfully raised $17m in a Series A funding round, bringing the total funding to $21m. The round was led by Zeev Ventures, a venture capital firm recognised for its notable investments in technology firms such as Audible, Chegg, and Uber Freight. Cyberstarts, a venture capital company primarily funded by successful cybersecurity founders, also invested in the round.

Trustmi has developed an innovative platform to combat the fragmentation of payment processes, integrating seamlessly into existing organisational workflows. The solution connects all data across the payment process, aiming to detect and eliminate future fraud and errors. Trustmi’s unique Trust Network utilises crowd-sourced data from thousands of vendors and businesses to maximise protection for business payments by detecting suspicious signals and vulnerabilities.

With the newly secured funds, Trustmi plans to expand its enterprise customer portfolio and protect business payments on a larger scale. The cybersecurity FinTech firm has quickly become the preferred solution for Fortune 500 companies such as CNA Insurance and Colgate-Palmolive, as it aids in mitigating losses and driving bottom-line growth.

Earned wage access FinTech Immediate bags $16m in a growth round

Based in Birmingham, Alabama, Immediate, an innovative FinTech company specialising in earned wage access, announced a successful round of growth funding.

The company raised a remarkable $16m in this latest round. Leading the investors was Castle Creek Launchpad, a joint fund managed by Castle Creek Capital and Launchpad Capital that dedicates its resources to investing in transformative FinTech companies.

Alongside them, strategic investors also made contributions, including Georgia’s community bank, BankSouth, and Birmingham executives Bryan Statham and Cynthia Johnson. A significant portion of the capital was also provided by SouthPoint Bank.

At the heart of Immediate’s operation is an aim to address liquidity issues faced by employees in times of sudden financial needs.

By giving workers access to their earned wages without having to wait for the next pay cycle, Immediate is creating a robust solution to a growing problem. With this approach, employers can gain significant advantages in staff recruitment and retention, with Immediate providing a structure that promotes financial stability for employees.

With this freshly acquired $16m, Immediate plans to propel its growth in the workplace financial health sector. The focus is to accelerate the momentum the company has been building over the past five years, especially considering the rising financial challenges faced by employees in the current economic climate.

The round of funding was not just about capital; it was about strategic partnerships. The involvement of SouthPoint Bank was a crucial factor in Immediate’s decision-making process. The bank’s exceptional products, services, and mission to propel businesses forward resonated with Immediate’s own mission and vision.

Lumi, the Australian SME lender, secures $15m from Harel in a capital raise

Lumi, an Australian company specialised in lending to small and medium-sized enterprises (SMEs), has successfully concluded a capital raise of $15m.

This fundraise, aimed at boosting the firm’s growth, saw participation from both new and existing investors, according to a report from Australian FinTech. New to the roster was Harel Insurance and Finance Group (Harel), marking the firm’s maiden investment on Australian shores. Other contributors included the Josh Liberman Investment Group, Arbel, Perennial, and Stellan Capital.

Lumi, a brainchild of Yanir Yakutiel, established in 2018, provides SMEs in Australia with business loans and lines of credit. Ranging from $5,000 to $500,000, these offerings come with flexible terms, quick application processes, and a maximum loan term of 48 months. Lumi’s proprietary technology simplifies access to working and growth capital for SMEs.

The $15m raised will be channelised towards further bolstering Lumi’s balance sheet and enriching its product portfolio. Lumi stays dedicated to the broker distribution model, and expects business originated through brokers to increase. The newly raised capital will also enable Lumi to present brokers with an expanded range of products, thereby augmenting their ability to serve their clients in a more comprehensive manner.

Overall, this capital raise and Harel’s investment uniquely position Lumi to extend its services and continue aiding SMEs throughout Australia.

InsurTech player Foxquilt lands $12m

Foxquilt, a prominent North American insurance technology (InsurTech) firm, specialising in catering to small businesses and micro-enterprise markets, has made a thrilling announcement of securing $12m in a funding round.

The robust fundraise of $12m was carried out across two distinct rounds. The initial round closed towards the end of 2022 and was led by ICM. The subsequent round witnessed participation from both new and existing investors, marking a vote of confidence in Foxquilt’s innovative approach to insurance, and its potential to reshape the industry.

Born in 2016, Foxquilt’s winning formula is a fusion of unique proprietary technology and insurance products. This winning blend propels its large-scale growth through B2B enterprise and Broker/Agent distribution channels.

As the only cross-border platform of its kind, Foxquilt leverages data analytics and dynamic underwriting logic to deliver fully automated, multi-operational coverage that satisfies both affinity partners’ insurance necessities and their associated small businesses.

Embedded insurance technology lies at the heart of Foxquilt’s game-changing strategy. It deftly integrates insurance products into multiple platforms and services, facilitating businesses and communities to offer customised coverage solutions to their clients and networks effortlessly.

This strategy empowers consumers to access insurance products seamlessly by dismantling traditional barriers and providing a superior user experience.

The $12m Series B funding will power Foxquilt’s expansion plans across North America. The company aims to scale its embedded enterprise capabilities, advance its technology infrastructure, and expand its product offerings.

Additionally, the fresh investment will aid the development of cutting-edge data analytics capabilities, enabling Foxquilt to better understand customer needs and finetune its insurance solutions for diverse markets. By harnessing advanced technology, data analytics, and a customer-centric approach, Foxquilt is poised to bring about a paradigm shift in the InsurTech sector, driving profitability by the end of 2023.

eflow Global rides RegTech wave with £7m ($9m) Series A financing

eflow Global, a UK-based RegTech scaleup, has successfully secured a hefty £7m in a Series A funding round.

As a renowned figure in the global RegTech landscape, the firm brings to the table a suite of acclaimed software solutions specifically designed to streamline compliance for financial firms.

The £7m capital injection was led by Finch Capital, with considerable backing from Atempo and ScaleUp Group partners. The significant influx of funding earmarked for eflow Global signifies the investor consortium’s confidence in the firm’s ambitious growth trajectory.

Established in 2004, eflow Global’s raison d’être is to empower financial firms with comprehensive software solutions that simplify regulatory compliance. The firm’s award-winning services range from market abuse surveillance and transaction-cost analysis to transaction reporting and eComms surveillance. Its reputation as a world-leading RegTech provider is well earned, with over 100 global financial institutions including Aegon Asset Management and Plus500 benefiting from its innovative solutions.

The freshly secured funding is targeted towards accelerating eflow Global’s growth, with a particular focus on expanding its influence in North America and Asia-Pacific. As part of its aggressive growth strategy, the company is committed to launching an array of new products and enhanced solutions in the next two years.

Other notable milestones in eflow’s history include its shift to a completely cloud-based SaaS model in 2021 and a successful management buyout (MBO) led by the executive team in 2022. These pivotal moments have catalysed the company’s current expansion phase.

InsurTech game changer Ennabl secures $8m in Series A funding

Ennabl, an innovator in the InsurTech industry, with a data analytics platform that empowers insurance brokers and agencies, has announced a successful Series A fundraising round.

The platform succeeded in raising $8m in the round, led by Brewer Lane Ventures. Altai Ventures, along with a host of private investors, also joined the round, contributing to the platform’s ambitious expansion plans.

The central pillar of Ennabl’s operation is a Software-as-a-Service (SaaS) platform, using machine learning to drive growth in the insurance brokerage sector. The platform cleans, enriches, and extracts data from a variety of broker systems and processes, providing actionable intelligence for brokers. This intelligence enables brokers to increase their commissions, identify new customers, manage carrier strategy, and grow their book of business.

Ennabl will channel the newly secured funds towards product development, expanding the sales and marketing team, and overall company growth. This investment serves to accelerate the company’s growth trajectory and expand its market reach.

Ennabl has had a remarkable journey since its launch in 2021. It boasts a significant customer base that includes many of the world’s largest insurance brokers. The company has also formed partnerships with key technology and service providers like Reagan Consulting, NeuralMetrics, HazardHub, and Fenris Digital. These collaborations enable it to provide brokers with external data that can be used to stimulate top-line growth.

Contextual cybersecurity platform Cyclops secures $6.4m seed

Cyclops, a FinTech firm in the cybersecurity sector, recently announced its successful emergence from stealth.

The company boasts an innovative cybersecurity search platform that utilises artificial intelligence (AI) to revolutionise the sector.

The company successfully raised $6.4m in seed funding, attracting investments from Merlin Ventures, Insight Partners, Tal Ventures, and toDay Ventures. In addition, CrowdStrike’s strategic investment vehicle, CrowdStrike Falcon Fund, and cybersecurity veterans such as Mike Fey, CEO of Island.io; Dan Amiga, CTO of Island.io; Ofer Smadari, CEO of Torq; and Eyal Gruner, CEO of Cynet, also participated in the round.

Cyclops offers an intuitive, user-friendly search engine which utilises generative AI to answer critical and timely questions about an organisation’s security posture. This platform eliminates the need for complex forensics or Security Information and Event Management (SIEM) expertise, making cybersecurity much more accessible for companies.

With the fresh funding, Cyclops intends to increase its scale to meet the demands from its growing customer base. They plan to recruit additional developers to maintain product innovation and broaden capabilities. Also, the funds will be utilised to enhance its go-to-market strategy.

Cyclops operates on a cybersecurity mesh architecture (CSMA) and employs generative AI to offer an easy-to-navigate experience. Security teams can use natural language queries to gain vital insights about their environment and address vulnerabilities, security incidents, and governance, risk and compliance scenarios.

Effectiv, the real-time fraud combatant, secures $4.5m in seed funding

Effectiv, a real-time fraud and risk management platform servicing financial institutions and FinTech companies, has announced a fresh round of funding.

An additional $4.5m in seed funding has been pumped into Effectiv, elevating its total raise to over $9m. The financing round was spearheaded by Better Tomorrow Ventures, with substantial participation from Accel and various angel investors.

Effectiv’s core function revolves around its innovative AI-driven solutions. These include payment fraud detection, customer and business onboarding verification, as well as compliance management. Since its inception in 2022, the company has exhibited stellar growth, helping organisations manage more than $27bn in financial products and currently processing over $100m daily.

The freshly procured funding will be directed towards bolstering Effectiv’s growth and equipping organisations to better fight financial fraud, a problem that has escalated since the advent of the pandemic.

In the preceding year, the company has recorded a surge in fraud with real-time payments. In response to this, as banks gear up to adopt FedNow, an instant payment service launched by the Federal Reserve, Effectiv is readying to launch DeviceAI. This new feature, which scrutinises and flags dubious user behaviour on devices, is expected to substantially enhance Effectiv’s payment fraud solutions.

€3.5m ($3.8m) funding boost for AgenaTrader and TradersYard in fresh expansion bid

Galaxy Ventures GmbH, the Vienna-based parent company of Austrian FinTechs AgenaTrader and TradersYard, has announced its €3.5m investment.

Galaxy Ventures, the innovative holding company behind these two trailblazing entities, represents a significant cog in the FinTech wheel.

The robust investment of €3.5m has been generously contributed by Andromeda Capital Partners, a Swiss-based private equity firm. This monetary injection bolsters the ambitions of AgenaTrader and TradersYard, showcasing the investors’ confidence in their transformative plans for the trading landscape.

AgenaTrader is a Bloomberg certified integration partner with a decade-long presence in the market, delivering a suite of potent trading and market-scanning tools to clients around the globe. On the other hand, TradersYard is an emerging social network catering specifically to traders and investors, poised for significant developments later this year. Together, they aspire to revamp the trading landscape through advanced platforms and an interactive social trading network.

This fresh influx of capital will be employed to expand the firm’s engineering, marketing, sales, and business development teams, thereby broadening their collective capabilities. By doing so, AgenaTrader and TradersYard aim to make their platforms among the most popular worldwide, with a strategic focus on simplifying product offerings and reducing platform fees, including the introduction of a free version.

Furthermore, AgenaTrader’s founder, Gilbert Kreuzthaler, announced plans for a competitive fee structure and product enhancements while expanding partnerships with banks, brokers, and technology firms. Gilbert Kreuzthaler, the founder of AgenaTrader, commented, “As a trading platform that supports all asset classes and offers access to more than 350 thousand trading instruments, we are open to working with any bank, broker, or hedge fund in providing the best-of-its-kind trading technology and market access.”

Insurance intelligence firm Percayso Inform nets £2.7m ($3.4m)

Percayso Inform, a groundbreaking UK-based company that turns insurance data into insights, has successfully closed a £2.7m funding round. The company, known for its smart solutions which have been adopted by insurers, brokers, and MGAs, continues to expand rapidly.

The investment round was led by insurance industry veteran Neil Utley, alongside existing venture capital backer Praetura Ventures. This marks a second major investment into the company, reflecting its growing influence within the InsurTech sector.

Percayso Inform operates by aggregating data from a multitude of sources to deliver a comprehensive quote intelligence suite. The technology enables insurers to access vast volumes of intelligence via a simple API call. Its robust platform allows insurance providers to customise their strategies and deployment by employing rules and models in their own environments through a SaaS model.

The company has grand plans for the recently raised funds. The objective is to enhance its existing portfolio of services and further establish its footprint in the UK motor insurance market. Following the acquisition of Cazana, now rebranded as Percayso Vehicle Intelligence, the company is better equipped than ever to achieve this goal.

Neil Utley, whose impressive career includes key roles with Privilege Insurance, Cox Insurance Group, and leading Hastings’ management buyout in 2009, has been welcomed as an investor. His extensive experience and knowledge of the motor insurance market is expected to be instrumental in realising Percayso Inform’s ambitions for its Vehicle Intelligence division.

InsurTech disruptor Modives secures $3m in seed round

Modives, an InsurTech start-up, is aiming to improve the arduous process of insurance verification for property managers and auto dealers.

The company successfully secured a seed funding of $3m, although the investors involved in the round were not disclosed.

Modives has been conceived to alleviate the traditionally laborious process of insurance verification in the property and auto industries. As a crucial and legally necessary step before any vehicle leaves a dealership or tenant moves into a property, insurance verification has long been a source of frustration due to its cumbersome nature and time-consuming process.

The newly acquired funding will be utilised to enhance Modives’ innovative platform, designed to streamline this tedious process and significantly improve the customer experience.

In addition to its seed funding, Modives boasts a rich pedigree with its founder and CEO, Frederick Waite, a veteran entrepreneur with an impressive track record in the insurance industry. His previous ventures include BCF, a software platform acquired by Vertafore in 2006, Yodil, Inc., an analytics platform purchased by Duck Creek in 2016, and most recently the IntelliBACE platform and BACE, both acquired by ONCAP in 2021.

CEO Frederick Waite said, “One of the pain points for both selling cars and renting properties is that verifying insurance takes too long and is cumbersome, which negatively impacts the customer experience.” His ambitious goal with Modives is to modernise this verification process which has remained stagnant for decades.

Data443 lands $1.5m boost and amends debt conditions

Data443 Risk Mitigation, an industry leader in data security and privacy software solutions, has today announced the completion of a series of transactions that have netted the company an additional $1.5m in growth capital while simultaneously retiring specific outstanding debt obligations.

The newly injected $1.5m came as a direct investment in the company. Alongside this, a notable element of the transactions involved the exchange of an existing note for a new one under enhanced terms and the relinquishing of specific security interests on a portion of the company’s assets. The sole placement agent for this transaction was Dawson James Securities Inc.

At its core, Data443 is a company dedicated to “All Things Data Security”. Offering software and services that ensure the security of data across devices and databases, both locally and in the cloud, Data443 serves over 10,000 customers across 100 countries.

Whether data is at rest or in transit, Data443’s modern approach to data governance and security helps customers identify and protect all sensitive data, regardless of its location, platform or format.

With this newly acquired funding, Data443 plans to increase its operational flexibility, allowing it to close outstanding technology acquisitions and position itself for a planned listing on a major stock exchange. The transactions also support the company’s objectives to reduce its outstanding debt under more favourable terms.

Automated payment solution SquadTrip welcomes $1.5m funding boost

SquadTrip, an automated payment solution for both large and small group trips, has successfully secured $1.5m in funding.

The investment will serve to bolster SquadTrip’s ambitious expansion plans. Leading the company through this exciting growth phase are CEO Darrien Watson and Co-founder Stevon Judd.

At the heart of SquadTrip’s operations is a passion to revolutionise the travel industry by offering enhanced experiences to both travel enthusiasts and industry professionals. By providing a comprehensive suite of professional tools, the platform facilitates travel organisers to boost sales and streamline their operations.

In terms of leadership, the company is in strong hands with Darrien Watson and Stevon Judd. They have already demonstrated their successful entrepreneurial spirit by generating $7m in travel sales and achieving 6,000 bookings. These founders and college best friends took their first entrepreneurial steps by setting up an event ticketing platform for Black entrepreneurs, ultimately founding SquadTrip last year.

Other noteworthy information about the duo includes their impressive achievement as one of the few Black-owned travel software companies to secure an investment deal surpassing $1m. Their investment deal includes support from lead investor Atento Capital and additional investor Forum Ventures. As a testament to their success, SquadTrip was part of the Build in Tulsa Techstars Accelerator 2022 and has raised nearly $2m within one year.

Debt prevention platform SuperFi snags €900k ($993k) for living cost crisis support

SuperFi, a FinTech company focused on preventing debt, recently announced a successful pre-seed funding round where it raised €900k.

The company, based in London, is designed to support individuals grappling with the current cost of living crisis.

The funding round was orchestrated by UK seed fund Ascension and its impact fund, Fair By Design, with additional investments from Force Over Mass, among other notable investors.

SuperFi was established in 2021 and has since been transforming the debt management sector by offering users a comprehensive overview of their debts, analysing their financial and personal circumstances, and suggesting the most appropriate debt prevention tools and services.

With the new injection of funds, SuperFi intends to secure authorisation through the FCA’s innovation sandbox and initiate collaborations with London boroughs. These initiatives will allow SuperFi to refine and test its platform, offering debt prevention tools to Londoners for the first time before a broader UK rollout.

SuperFi co-founder Tom Barltrop remarked, “We believe that debt management should be proactive, not reactive. Our goal is to help millions of people struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis. In doing so, we believe we can help British people during the cost of living crisis – saving businesses and society billions associated with problem debt.”

Interestingly, according to a study from StepChange, 18 million British adults are struggling with monthly bills and credit commitments, collectively owing more than £70bn in unsecured debts. However, SuperFi’s platform could potentially save users £130m in debt repayment costs by 2028.

SuperFi has previously received grant funding from the Greater London Authority, part of the Mayor of London’s Challenge LDN scheme to combat poverty. This backing enabled SuperFi to prototype and test its platform with Councils and Housing Associations across London.

Sunrate secures series D-2 funding to fuel global expansion in FinTech

Sunrate, an “intelligent global payment and treasury management platform,” has confirmed the successful closure of its extended series D (series D-2) funding round. This round was spearheaded by Sequoia Capital Southeast Asia, now known as Peak XV Partners.

The funding round welcomed participation from a range of investors, including Softbank Ventures Asia and Prosperity7 Ventures. The actual amount raised, however, has not been specified.

Sunrate specialises in offering global payment products and services for businesses across the globe. The platform provides a plethora of services like international payments, global collection, commercial card issuance, and treasury management.

Businesses can utilise the platform to transact in over 100 currencies and make payments to more than 150 countries. Sunrate also provides effective treasury management tools such as TreasuryOS and RiskOS, which enable businesses to manage and oversee their financial assets, liabilities, and liquidity.

The new funding will propel Sunrate’s global expansion plans, driving the innovative development of its technologies, deepening its range of products and services, and recruiting top industry talent. It also provides the flexibility for Sunrate to explore additional strategic opportunities.

Paul Meng, Co-Founder at Sunrate, shared his vision for the company. He said, “We started Sunrate with the modest goal of bettering the payments experience of small to medium-sized businesses (‘SMBs’).

“Having prestigious investors like Peak XV Partners come onboard this journey with us is testament to our efforts and performance – in cementing ourselves as the go-to leading global cross-border B2B payment platform in emerging markets. By removing business payments friction and helping businesses to digitalise, Sunrate empowers businesses — helping them to scale across borders seamlessly and effectively.”

Sunrate has significantly scaled its business over the past year, gaining considerable momentum across emerging markets. The new funding will be utilised to accelerate growth in these markets, particularly in Southeast Asia and India. The company plans to continue onboarding new customers globally and match its talent acquisition with its global growth trajectory.

Investment secured by BankLabs’ loan platform, new spin-out ‘Participate’ introduced

ASA clinches strategic investment from Travis Oliphant’s Quansight Initiate

Keep up with all the latest FinTech news here

Copyright © 2023 FinTech Global